- Ethereum is intently mirroring Bitcoin’s actions, making it more and more inclined to a possible correction.

- With whales persevering with to dominate, maintaining a detailed eye on their day by day actions can be essential.

Bitcoin [BTC] has surged practically 3% prior to now 24 hours, reaching a contemporary all-time excessive of $106,488. Because the New 12 months kicks off, momentum is clearly constructing.

To not be outdone, Ethereum [ETH] is making its personal transfer, inching towards its yearly excessive of $4,000. Historically, ETH has mirrored BTC’s strikes, however with shaky fingers and overleveraged positions out there, some are questioning if Bitcoin’s newest surge indicators an approaching high.

If that’s the case, might this be the second when ETH breaks away from BTC’s shadow? With the market maturing, is a divergence between the 2 now extra doable than ever?

Bitcoin remains to be accountable for Ethereum

2024 is coming to a detailed, and looking out again, it’s been a yr of main milestones for Bitcoin. Within the first quarter alone, Bitcoin surged from $49,710 to an all-time excessive of $73,000 in simply 30 days.

Ethereum didn’t sit on the sidelines both. Throughout the identical interval, ETH additionally broke previous $4K, reaching ranges not seen since 2021. However right here’s the catch: Simply as Bitcoin hit its peak, ETH adopted.

In only one week, ETH plunged to round $3,100, with day by day drops reaching as much as 10%.

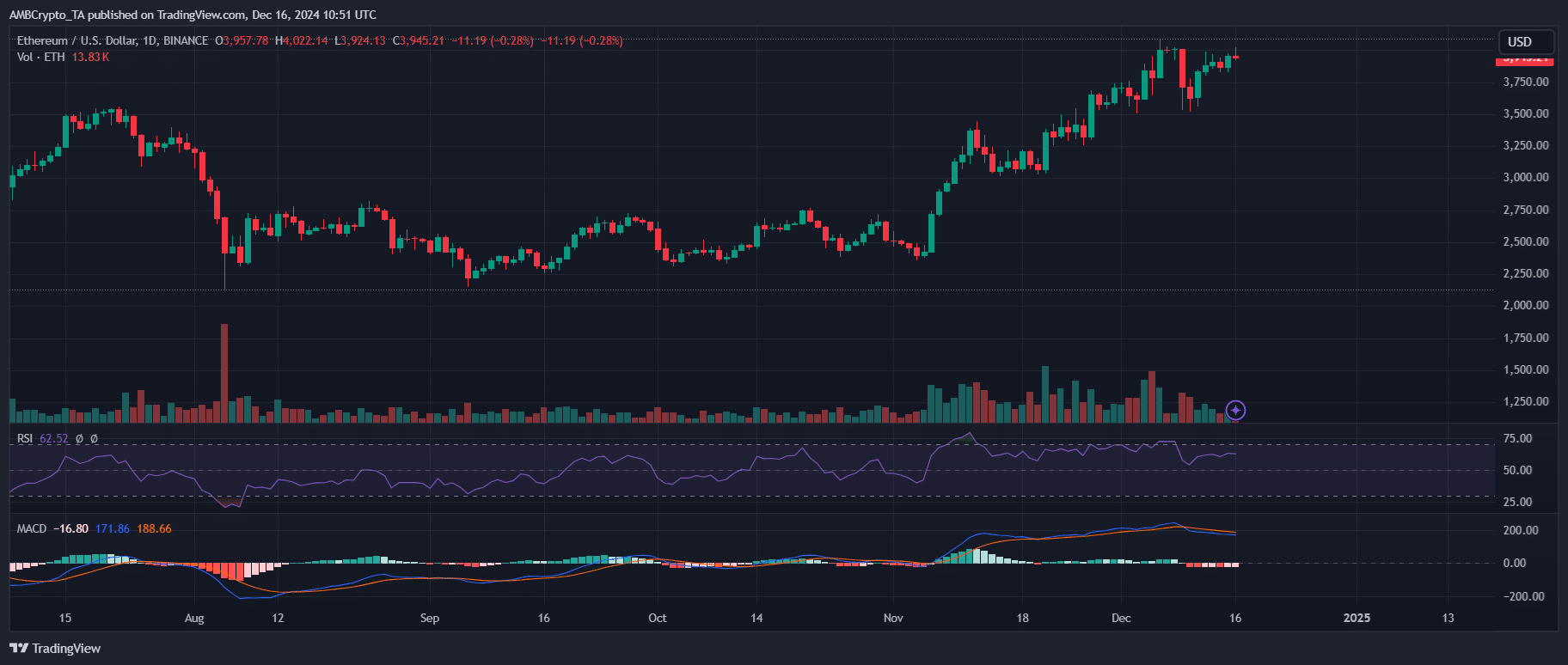

Quick ahead to now, and an fascinating improvement has caught AMBCrypto’s consideration. On the day by day chart, whereas Ethereum’s value motion has continued to reflect Bitcoin’s strikes, its value swings—each ups and downs—have turn into more and more sharp and risky.

Subsequently, reclaiming $4K gained’t be a straightforward feat for Ethereum. The preliminary pump will seemingly come from Bitcoin, however holding that value and flipping it into stable help is proving to be a difficult job.

On this situation, a ‘wholesome’ pullback appears prone to flush out weak fingers. Moreover, the shopping for stress on varied premiums hasn’t surged, suggesting that both capital is flowing into Bitcoin or FOMO hasn’t totally kicked in but.

Until this development reverses, Ethereum will seemingly proceed to expertise volatility on its day by day chart, with sharp value swings making it arduous to foretell a transparent route within the brief time period.

Whales are pulling the strings on ETH

AMBCrypto has uncovered a big improvement that might influence Ethereum each within the brief and long run. The focus of Ethereum held by whales has reached 44%, bringing it dangerously near the 47% held by retail buyers.

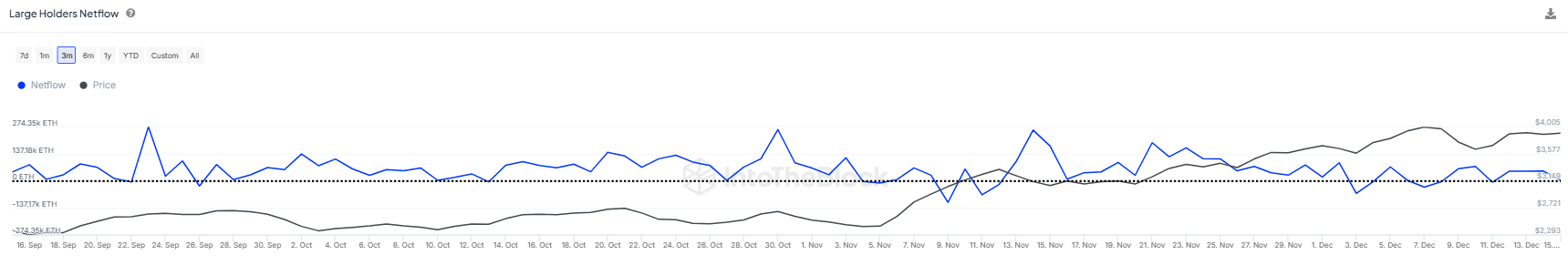

Whales usually manipulate the market by shopping for on the backside and promoting at a premium, however over the previous 90 days, their orderbook has proven rising inconsistency.

The influence on Ethereum was evident: for 2 consecutive days, these whales deposited 40K ETH into exchanges when ETH reached $4,000 on December sixth — the identical day Bitcoin surpassed $100K for the primary time.

This led to a pointy 7% drop in ETH the next day. Whereas these whales have been accumulating ETH, they’ve expertly timed the “dip,” solely to money out simply earlier than Ethereum might break crucial psychological targets, executing a textbook manipulation technique.

Learn Ethereum (ETH) Price Prediction 2024-25

With all these components at play, a pullback appears increasingly seemingly. Analysts are predicting a Bitcoin correction, which might seemingly drag Ethereum down too.

Nonetheless, if FOMO takes over once more, each retail and large gamers might seize the chance to purchase the dip at $3,700, the place 4.6 million tokens have been previously scooped up.