- Bitcoin’s short-term holders held the market with a web place change worth of +750k.

- BTC declined over the previous week by 12.37%.

Since hitting $108k, Bitcoin [BTC] has struggled to take care of an upward momentum. As such, BTC has traded in a consolidation vary between $92k and $97k.

On the time of writing, Bitcoin is buying and selling at $93,905, marking a 2.18% decline on the day by day charts. Moreover, the cryptocurrency has dropped by 12.37% on the weekly charts.

This dip has left most short-term holders at a loss, together with those that purchased Bitcoin in November. The widening loss margins amongst short-term holders have analysts deliberating over the following transfer.

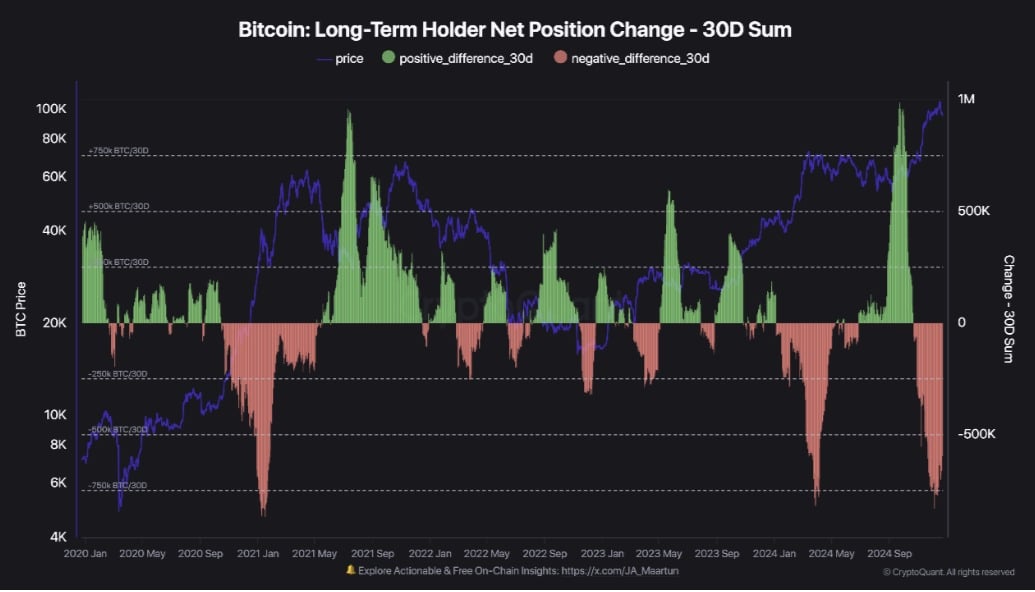

Bitcoin’s LTH vs STH web place change

In line with Cryptoquant, the 30-day web place change for long-term holders (LTH) has turned damaging hitting -750k BTC.

Regardless of this alteration, Bitcoin costs have managed to carry sturdy and didn’t expertise a powerful drop. It is because short-term holders (STH) have continued to build up whilst BTC rallied to a brand new ATH.

Supply: CryptoQuant

The online place change for short-term holders (STH) surged to a optimistic worth of +750k BTC.

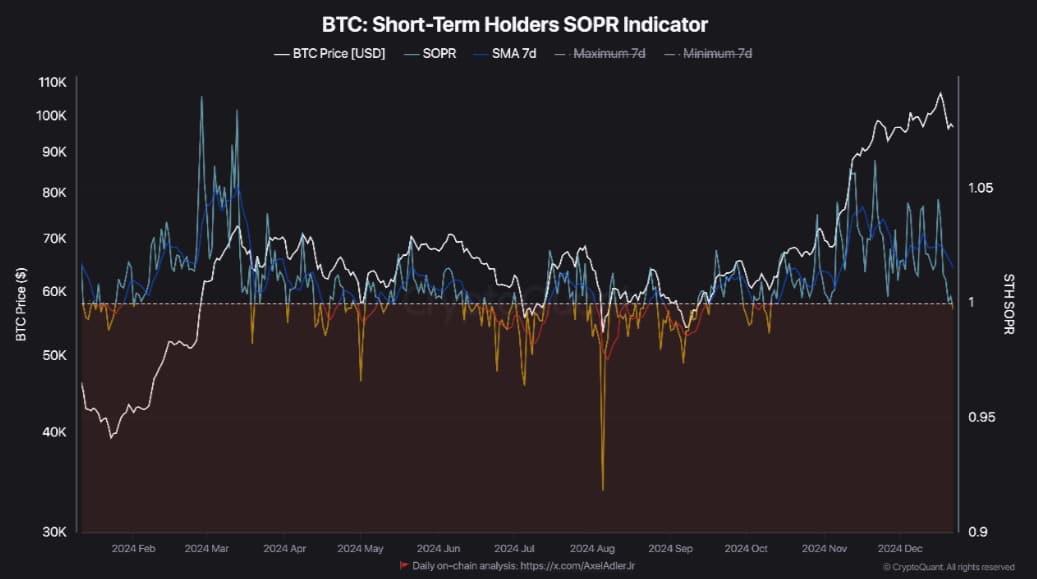

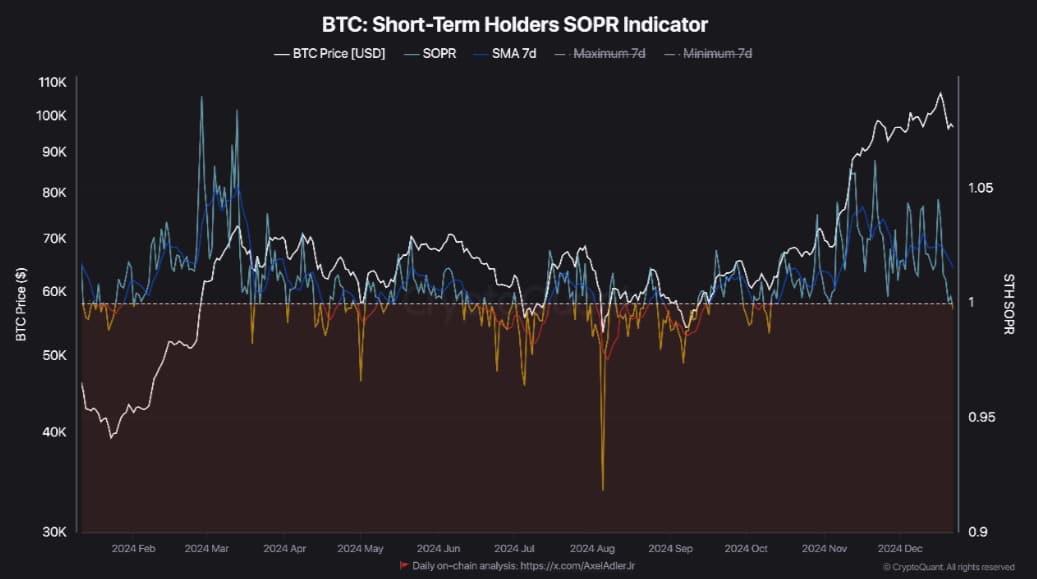

Whereas short-term traders continued to build up as BTC costs surged, the STH SOPR turned damaging. This means that STH holders are working at a loss.

With short-term holders at a loss, they’ve two choices: maintain and look forward to BTC costs to recuperate, or purchase at decrease costs. If STH demand stays sturdy and long-term holder (LTH) demand is impartial or optimistic, it may create optimistic momentum for BTC.

Nevertheless, if STH decides to promote at a loss, it may create promoting stress and drive costs additional down. The route that short-term holders take will have an effect on BTC’s worth trajectory.

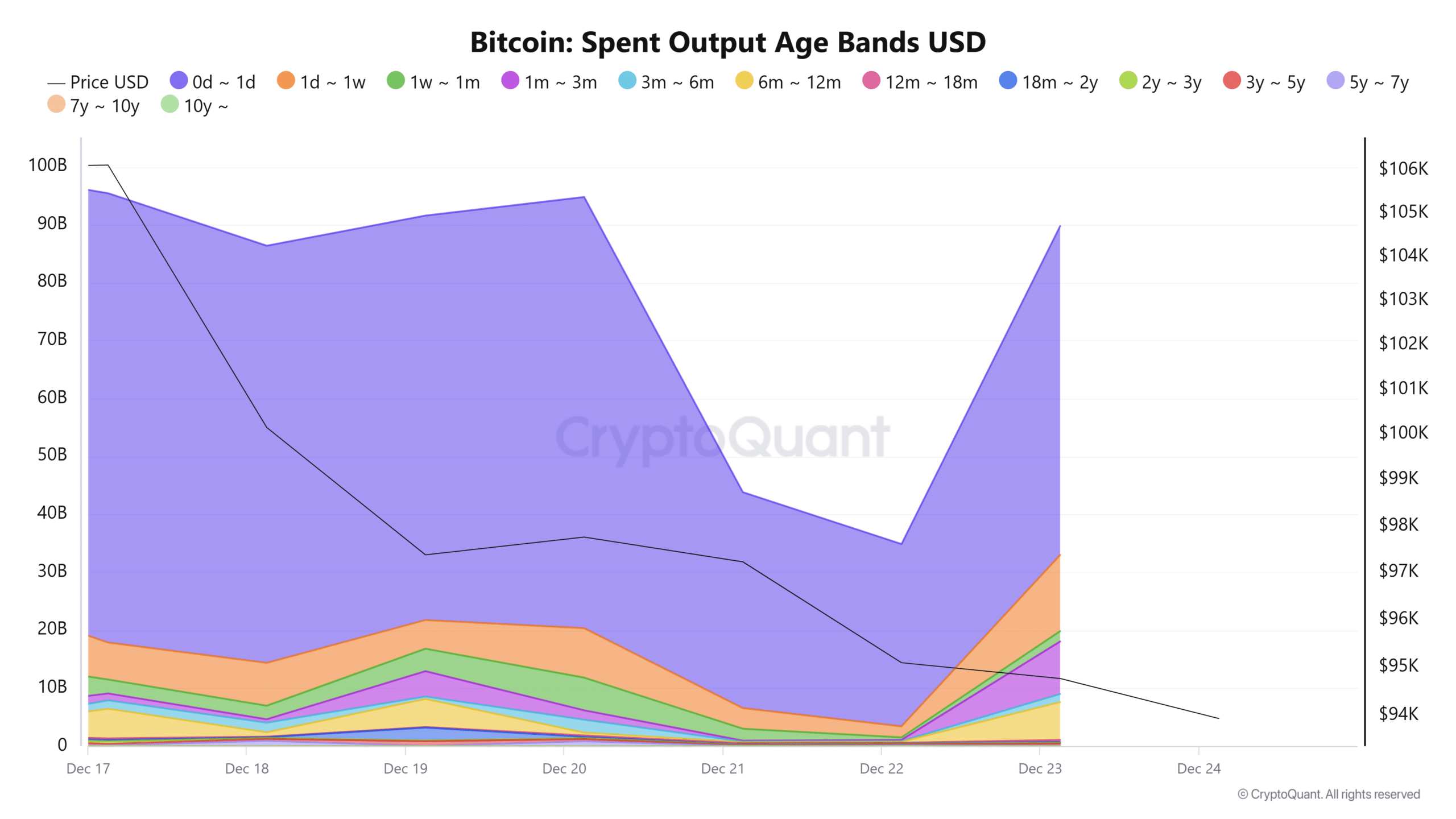

By means of the output spent age bands, we will see short-term holders are actively promoting. Thus short-term holders have spent extra cash than LTH, with cash held for sooner or later hitting 56 million and people held for per week reaching 9 million.

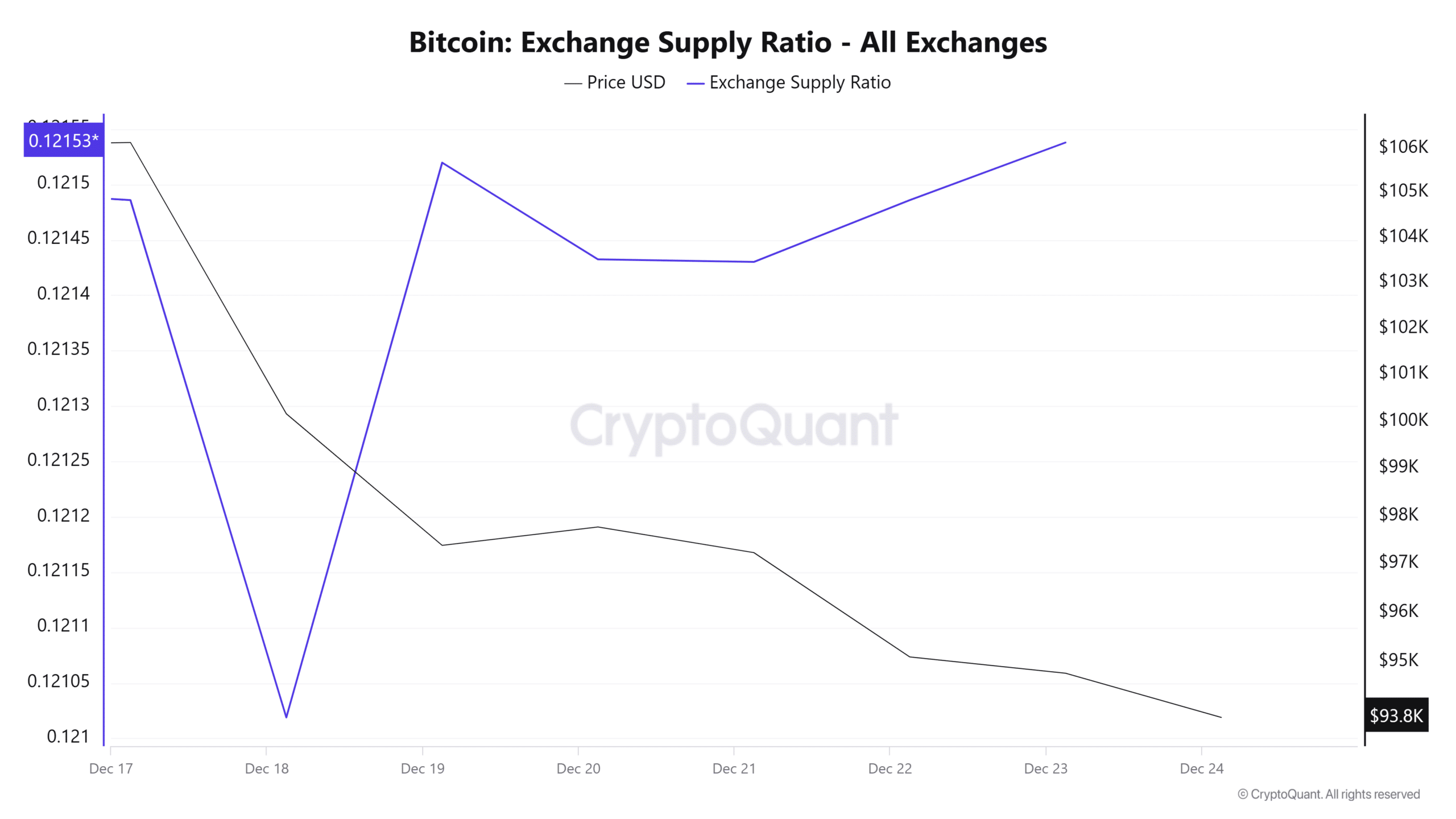

As such, the previous week has skilled a spike within the trade provide ratio. A surge in trade provide means that these spent cash are going to exchanges, thus merchants are transferring extra Bitcoin tokens into exchanges both to promote or making ready to take action.

This means that there’s excessive speculative buying and selling amongst STH merchants and are even promoting at a loss to accumulate at decrease charges.

Implications on BTC?

As noticed above, Quick-term holders are holding the market. As such, BTC dangers dealing with increased promoting stress from this cohort, which may in flip drive costs down.

Learn Bitcoin (BTC) Price Prediction 2024-25

With STH actively promoting their tokens, it exhibits their lack of market confidence and turns to purchase at decrease ranges after promoting at a loss. If their web place adjustments and turns damaging like Lengthy-term holders, Bitcoin may drop additional.

Due to this fact, if this bearish sentiment persists, BTC may drop to $92130. Nevertheless, if the demand from STH continues, BTC will try restoration in the direction of $95800.