- Each Bitcoin and Ethereum hiked by over 3% within the final buying and selling session

- In comparison with ETH, BTC appeared overvalued at press time

Bitcoin and Ethereum have lengthy been two of the market’s largest cryptos. Nonetheless, tribalism throughout the group has typically positioned them at reverse ends of any spectrum, which is why comparisons are widespread.

Based on latest knowledge although, Bitcoin could also be delivering a higher response for each greenback invested, than Ethereum. This differential response might point out market perceptions concerning the valuation of those two outstanding cryptocurrencies.

Bitcoin and Ethereum see totally different funding influence

Based on the Realized Capitalization Multiplier indicator from CryptoQuant, in 2024, for each $1 invested in Bitcoin, its market capitalization elevated by $5. Quite the opposite, for Ethereum (ETH), it elevated by solely $1.3. To place it merely, Bitcoin’s market capitalization is extra conscious of new investments than Ethereum’s.

Contemplating the Realized Capitalization Multiplier, Bitcoin’s higher responsiveness to new investments suggests a better multiplier. This might indicate that Bitcoin is perceived as extra overvalued, relative to the precise realized worth of its cash.

However, Ethereum’s decrease hike in market cap per greenback invested suggests it has a decrease multiplier. This can be an indication that its market worth is nearer to its realized worth, doubtlessly making it extra secure or undervalued.

What will be drawn from Bitcoin and Ethereum’s MVRV?

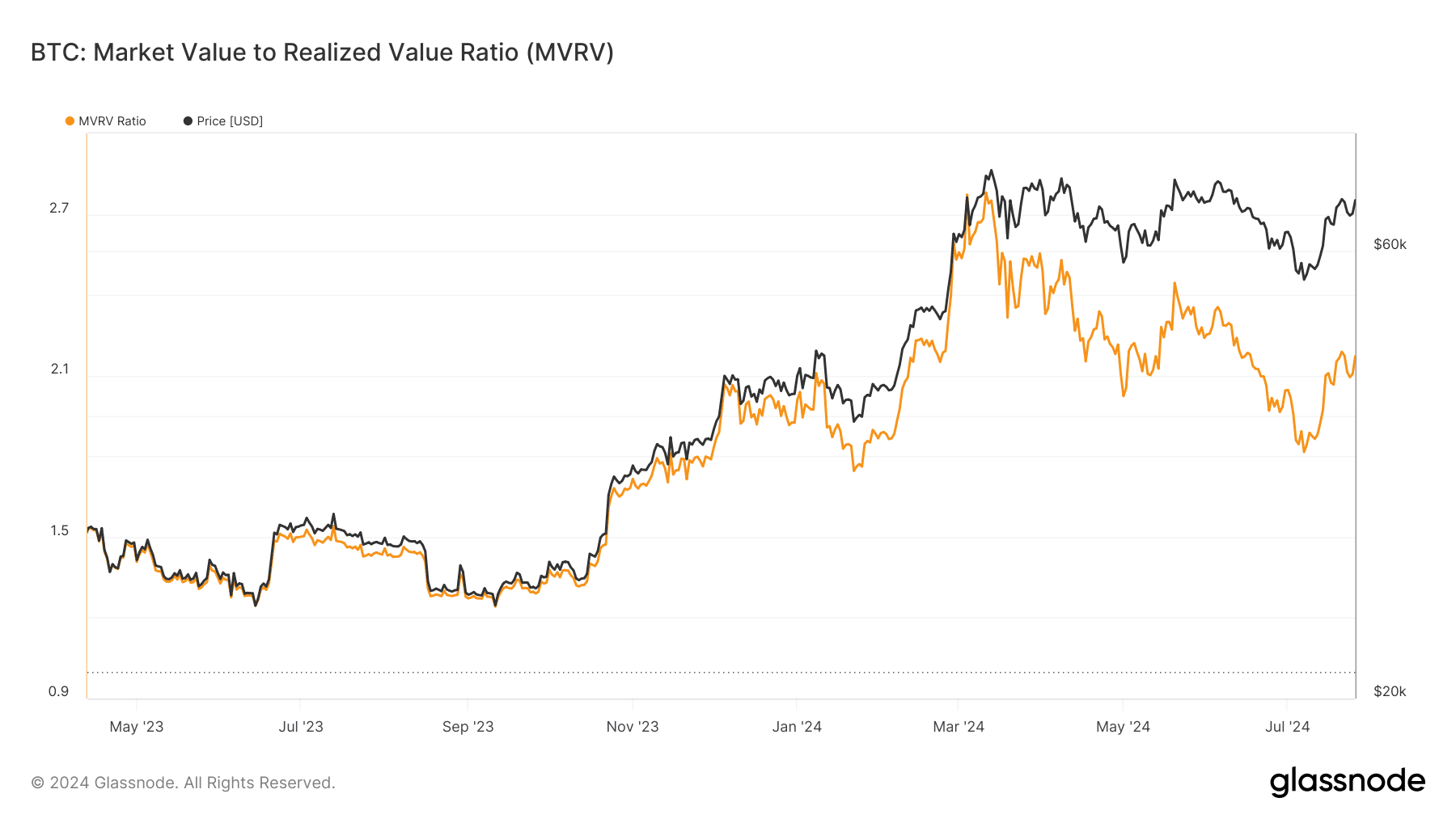

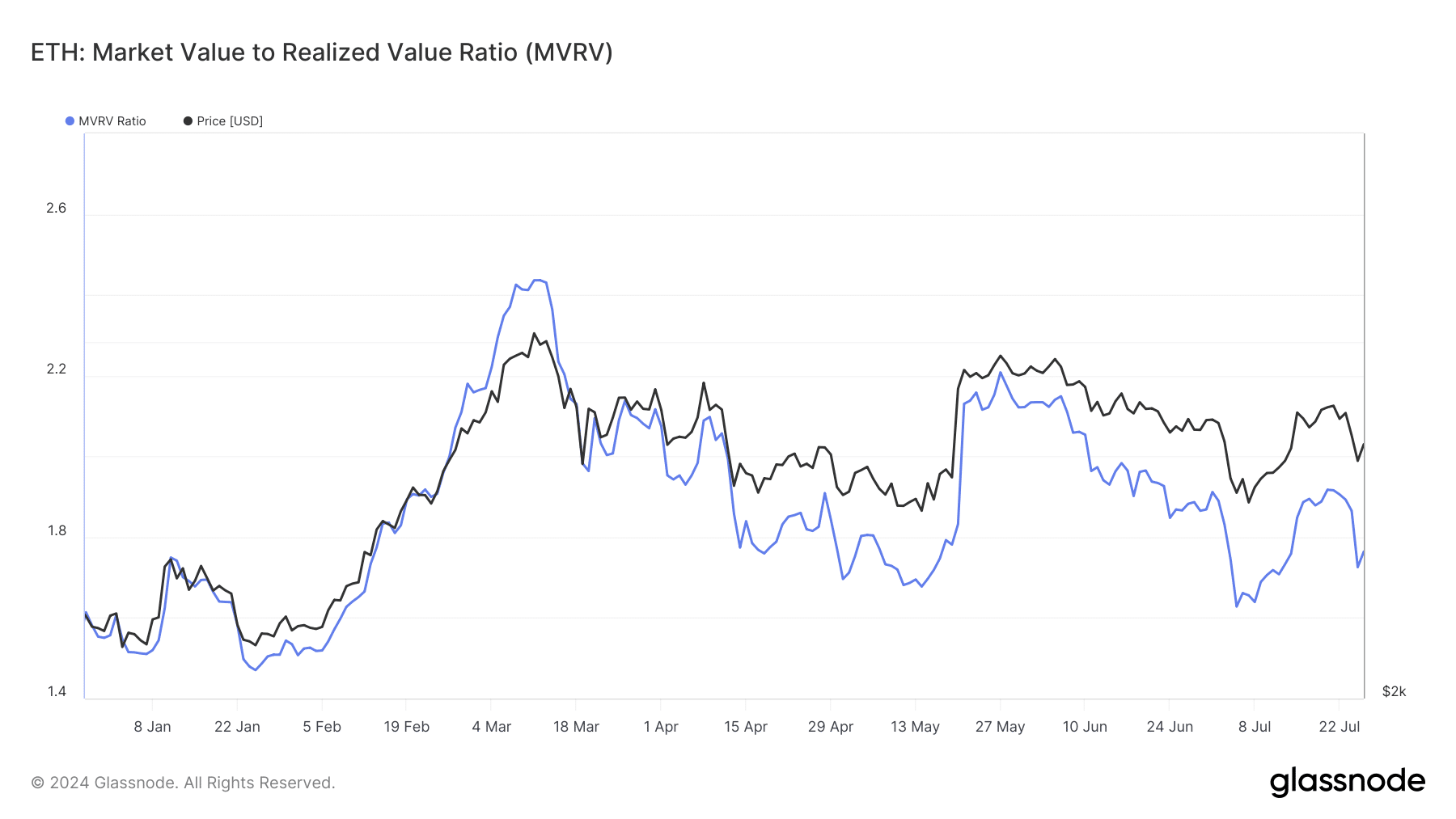

A latest evaluation of the Market Worth to Realized Worth (MVRV) ratios for Bitcoin and Ethereum, primarily based on knowledge from Glassnode, highlighted differing traits for these two cryptocurrencies over the previous couple of weeks.

For Bitcoin, the MVRV ratio has proven extra uptrends than downtrends all through July. On the time of writing, the MVRV stood at over 2%. Usually, an MVRV ratio approaching the three% mark signifies being overvalued.

This will also be interpreted as an indication that the worth of BTC could be exceeding the common worth at which cash had been final moved (i.e., their “realized” worth).

Conversely, Ethereum’s MVRV ratio has exhibited extra declines than uptrends this month, in comparison with BTC.

At press time, ETH’s MVRV ratio had a studying of round 1.7 – Farther from the edge generally related to being overvalued.

These traits in MVRV ratios recommend that BTC could also be nearer to being thought-about overvalued, than Ethereum. This conclusion aligns with the observations made primarily based on the Realized Capitalization Multiplier’s evaluation too.

One other 3% in worth

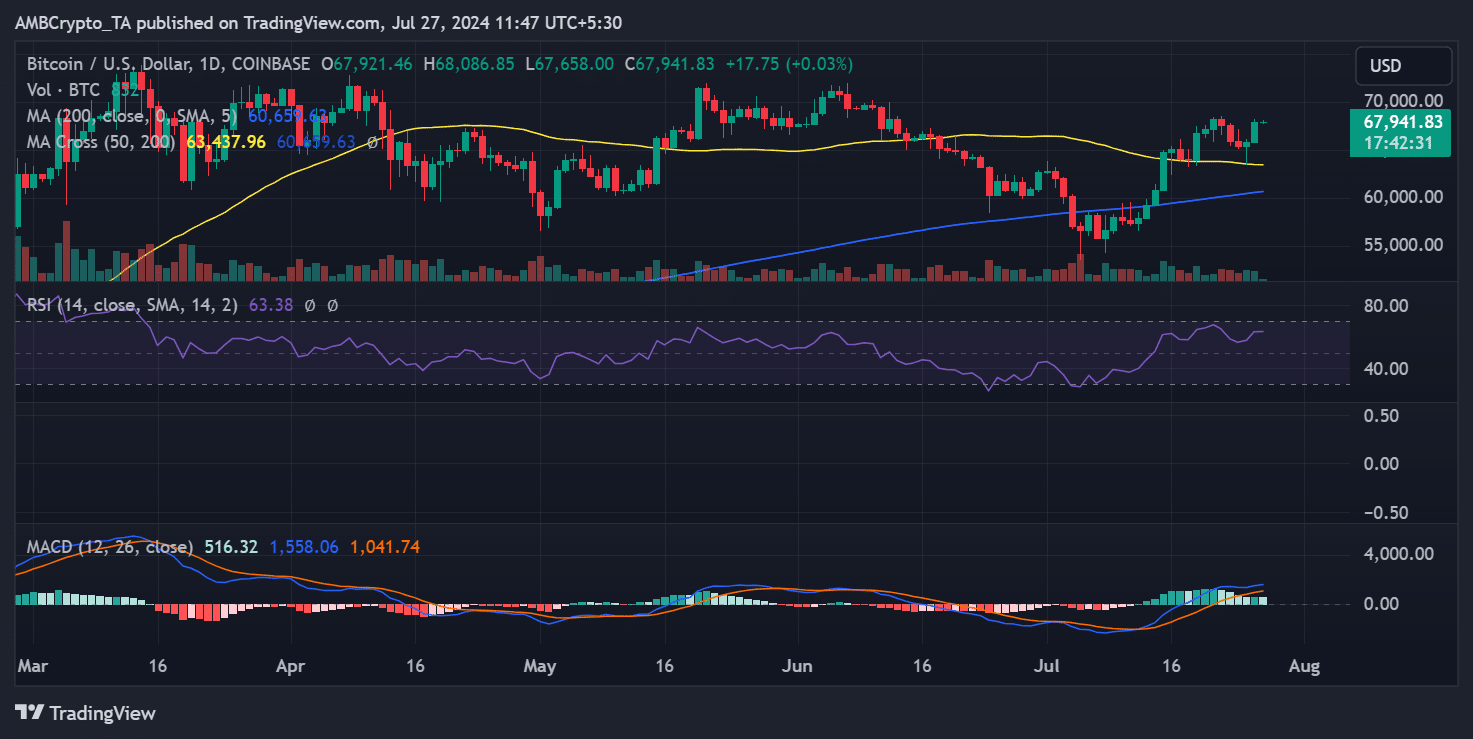

An evaluation of Bitcoin’s worth pattern on the day by day timeframe indicated a major improve of over 3% on 26 July. Based on AMBCrypto, the worth rose by 3.24%, climbing above $67,000 and practically touching $68,000.

– Learn Bitcoin (BTC) Price Prediction 2024-25

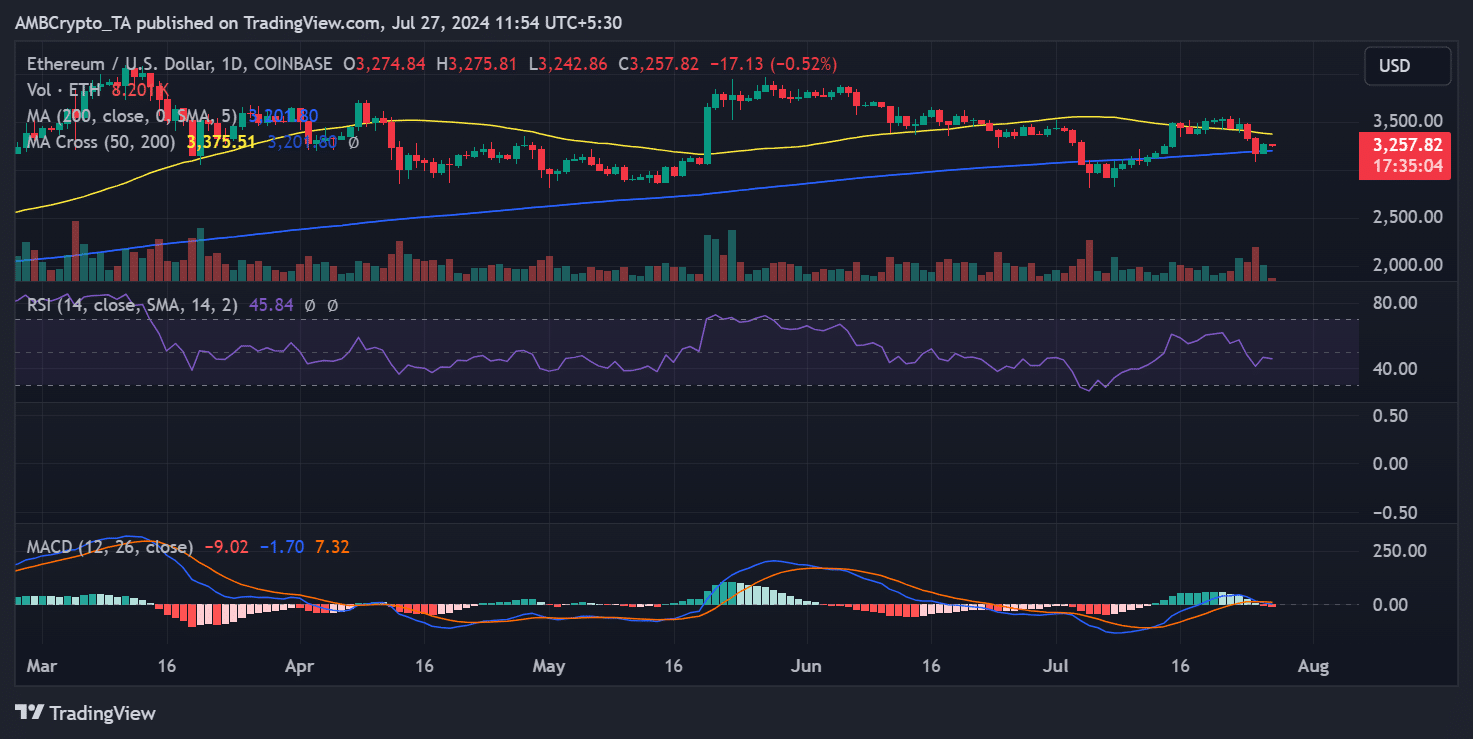

Equally, Ethereum additionally recorded a notable hike on the identical day. Its worth appreciated by 3.17%, bringing it to roughly $3,274.

Nonetheless, there was a slight retracement since then, with ETH buying and selling at round $3,258 at press time.