- Bitcoin has surged 4% because of the ‘Christmas Rally,’ with secret Santas driving the momentum.

- Nevertheless, psychological dangers stay, conserving the bull rally simply out of attain.

Ten days in the past, Bitcoin [BTC] hit a brand new ATH of $108K, a stage it’s been eyeing because the “Trump pump.”

However even with no indicators of an overheated market and greed staying effectively beneath the 90 mark, investor warning soared because the FOMC warned of a “cautious” 2025 forward.

The end result? BTC noticed a pointy decline, wiping out a lot of the beneficial properties made in the course of the ultimate part of the election cycle.

With a possible correction looming, many selected to money out on the $94K value level – resulting in over $7.17 billion in earnings being realized.

Whereas it would look like a setback, the exit of weak fingers is usually seen as a ‘wholesome’ retracement, setting the stage for contemporary gamers to enter and seize the obtainable provide.

Now, with BTC creeping again towards $100K, is new capital flooding again into the market, or is the aftermath of that ‘sudden’ decline nonetheless contemporary, conserving buyers on edge?

Threat-averse buyers exit amid warning

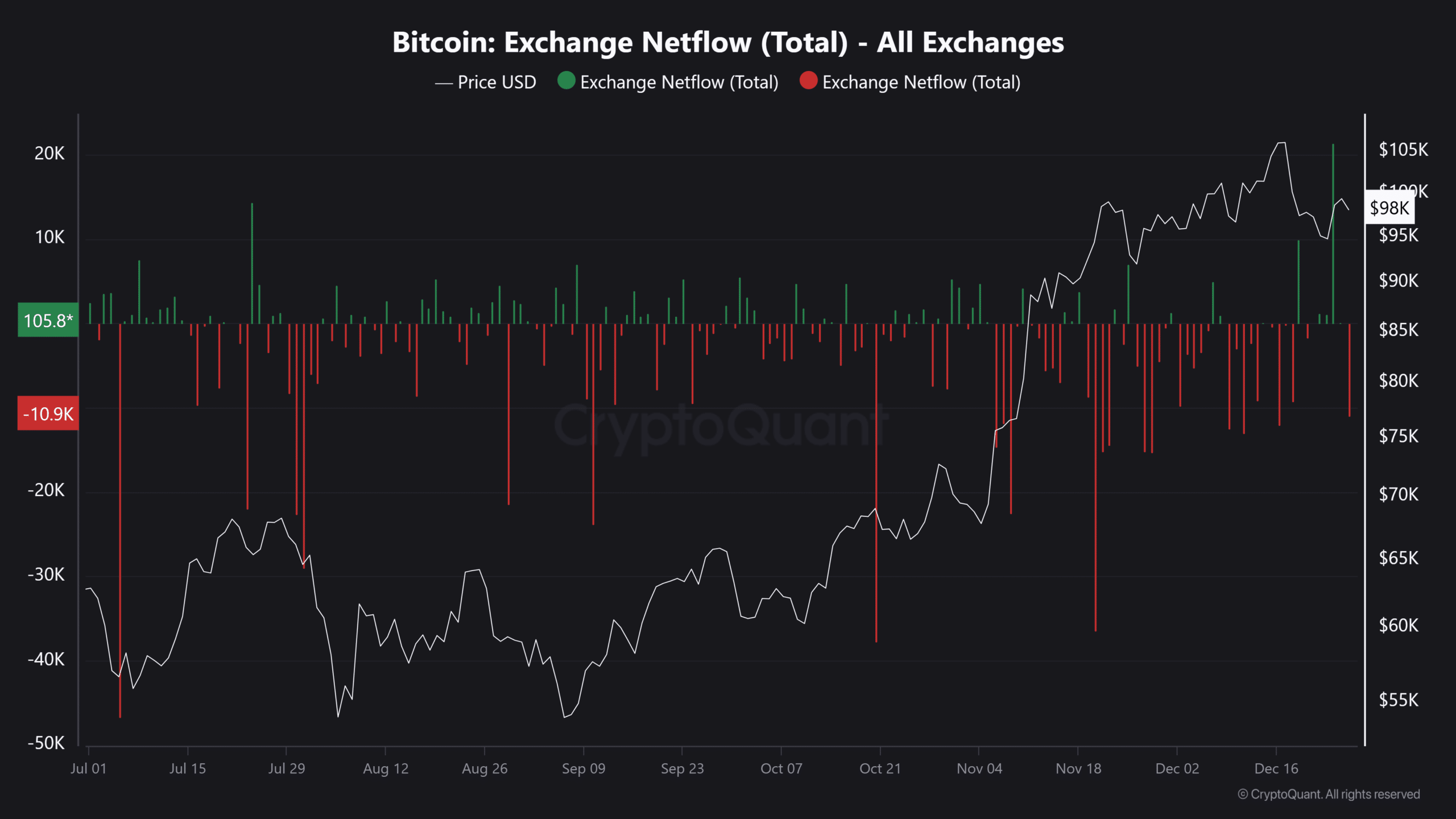

Following the large cash-out, Bitcoin change reserves surged to 2.427 million – the very best spike since November.

Quick-term holders’ SOPR additionally hit 1.04, signaling that these with lower than 5 months of publicity have been cashing out and locking in earnings.

As well as, BTC influx into exchanges reached a five-month excessive, with 21K BTC deposited at a mean value of $98K.

This despatched BTC right down to $92K, its lowest stage in over two weeks, with $94K clearly proving to be a powerful profit-taking zone.

However simply as issues gave the impression to be heading south, the vacation cheer kicked in.

Earlier than a deeper pullback to the $88K-$90K vary may take maintain, BTC bounced again with a 4% bounce, discovering itself again within the $98K-$100K band.

Regardless of this restoration, institutional demand via Bitcoin ETFs has remained sluggish, persevering with a four-day consecutive outflow streak.

This implies that the present value level has but to draw vital institutional capital.

On the retail aspect, shopping for has picked up, although not aggressively sufficient to sign full “accumulation.” Because the New 12 months pleasure builds, BTC may vary between $100K-$105K. But, a brand new ATH nonetheless feels a bit far off.

In the end, the ‘danger’ issue looms giant. With current declines nonetheless contemporary in buyers’ minds, the psychological resistance may deter new capital from flowing in.

So, is Bitcoin heading south?

Traditionally, the primary quarter of every 12 months has been bullish for Bitcoin, marked by a provide shock the place restricted provide meets excessive demand, creating the proper financial imbalance.

Nevertheless, with the present metrics in thoughts, it wouldn’t be shocking if Bitcoin diverges from its typical sample.

Exterior forces have gotten extra highly effective, and the shortage of clear financial alerts may pose a big hurdle in 2025, even with wholesome on-chain metrics.

So, until BTC breaks its earlier all-time excessive by mid-January, calling a bull rally simply but could also be untimely.

The absence of considerable retail and institutional capital means even massive gamers like MSTR may not be sufficient to spark the rally.

Learn Bitcoin’s [BTC] Price Prediction 2025-26

As a substitute, a consolidation within the $95K–$98K vary may very well be simply what Bitcoin must construct momentum for the subsequent massive transfer.

This might maintain risk-averse buyers within the recreation by squeezing their revenue margins, whereas reigniting FOMO and setting the stage for the rally that would carry us via the subsequent couple of weeks.