- Clear Cloud Act proposes CO₂ penalties for energy-intensive AI and crypto information facilities

- Nations like Pakistan are leveraging surplus electrical energy to spice up Bitcoin mining and AI infrastructure

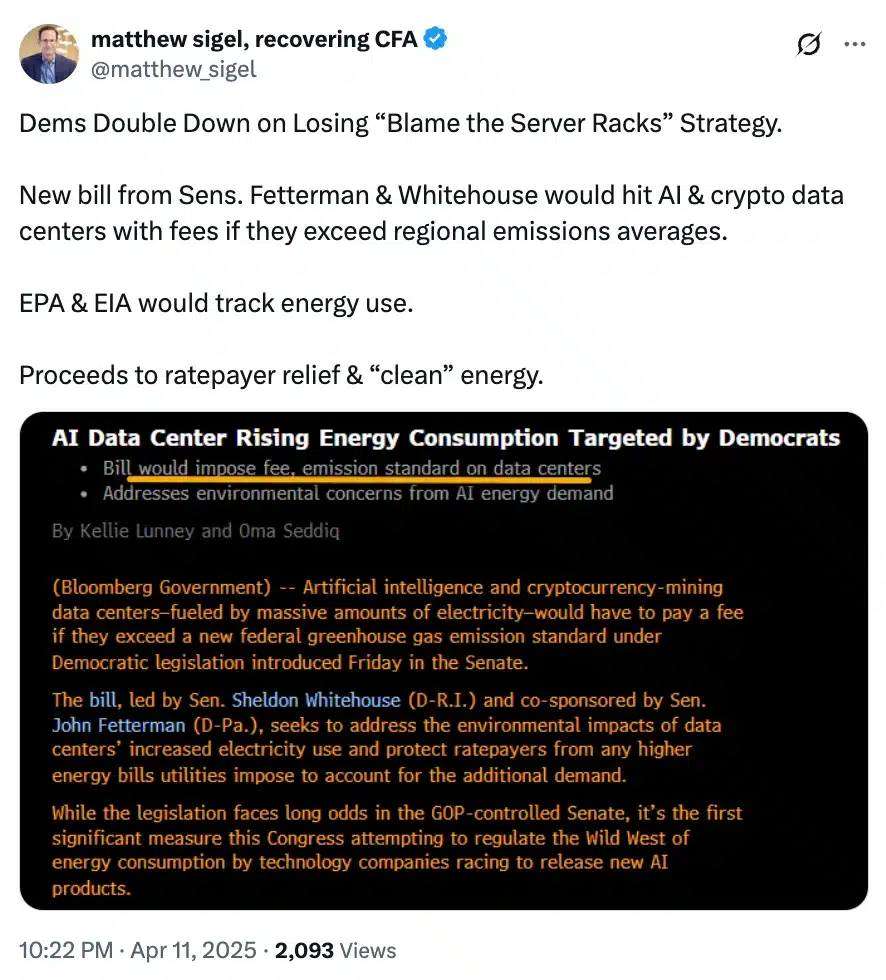

U.S. lawmakers have introduced a draft invoice concentrating on the environmental toll of AI and crypto operations. Titled the Clear Cloud Act, the laws is being spearheaded by Senators Sheldon Whitehouse and John Fetterman.

The invoice seeks to rein within the surging vitality calls for of information facilities by implementing stricter carbon emissions requirements.

What is going to occur if the invoice will get handed?

If handed, the invoice would empower the Environmental Safety Company (EPA) to impose CO₂ penalties on amenities exceeding federally set thresholds.

Offering causes for a similar, Senator Fetterman said,

“Preventing to maintain the US on the slicing fringe of AI know-how and defending our pure assets for our youngsters and grandkids aren’t mutually unique targets.”

Echoing comparable sentiments, Senator Whitehouse famous,

“Vitality-hungry information facilities and cryptomining amenities are overloading our already strained energy grid, driving up shoppers’ electrical energy prices, making it tougher for People to energy their houses and companies, and spiking fossil gasoline emissions.”

Crypto neighborhood criticizes the invoice – Right here’s why

Reactions have been’s constructive throughout the crypto-community although. VanEck’s Analysis Chief Matthew Sigel, as an illustration, believes the invoice unfairly targets Bitcoin [BTC] miners for his or her vitality utilization.

He mentioned,

Additional criticizing the Act, an X user added,

“This in all probability received’t cross however, even when it did, it’s laborious to think about the administration ever implementing it barring a point-blank order from the supreme courtroom to take action.”

Challenges forward

Whereas the Clear Cloud Act awaits Senate approval, doubts persist—Largely resulting from its unique Democratic sponsorship. Nevertheless, Trump’s prior push for U.S dominance in AI and crypto might hold the invoice’s relevance very a lot alive.

Even so, the timing right here is price . Particularly because it appeared to align curiously with Bitcoin miners like Galaxy and Terawulf pivoting to AI-driven HPC providers.

Based on Coin Metrics, miner revenues have seen indicators of stabilization in early 2025. Nevertheless, geopolitical tensions and ongoing commerce disputes nonetheless pose a risk to their fragile restoration.

What’s extra?

Actually, amid rising tools prices and looming regulatory pressures within the U.S, considerations are mounting over a possible decline in home demand for Bitcoin mining rigs.

Hashlabs Mining CEO Jaran Mellerud not too long ago pointed out that this might immediate producers to dump extra stock to abroad markets. This might doubtlessly set off a surge in world mining exercise.

Now, with U.S miners going through mounting challenges, nations like Pakistan are seizing the second.

By leveraging surplus electrical energy, Pakistan is positioning itself to gasoline each Bitcoin mining and AI information middle growth, utterly opposite to what’s unfolding in the US.