In a freshly shared four-hour chart of the DOGE/USDT buying and selling pair on Binance, crypto analyst Carlos Garcia Tapia warns of potential draw back for Dogecoin as weekend buying and selling approaches. “If bears break this sample, it’ll get ugly… particularly because the weekend is coming,” Tapia warns.

Dogecoin Value Crash Incoming?

His chart posted through X depicts an ascending wedge formation operating right into a confluence of resistance between $0.338 and $0.343, in addition to a notable assist zone within the $0.31 area.

The chart highlights greater lows (marked as “LL” on the chart) forming the decrease boundary of an ascending wedge. In the meantime, overhead resistance (an oblong zone round $0.338–$0.343) has repeatedly capped upward value actions. This wedge seems to be compressing value motion—usually a setup for a significant breakout or breakdown.

A horizontal resistance zone round $0.34 stands out. DOGE’s value has tried a number of short-term strikes above this degree however didn’t safe a confirmed breakout, suggesting sellers are firmly defending that zone.

Associated Studying

On the draw back, a inexperienced field spanning roughly $0.310 marks an space the place shopping for curiosity has traditionally picked up. Under that degree, the chart references a decrease assist marker close to $0.262, indicating a extra substantial potential drop if the wedge sample breaks down decisively.

The analyst particularly factors to the upcoming weekend as a wildcard. Traditionally, decrease buying and selling volumes on Saturdays and Sundays can exacerbate volatility. If Dogecoin fails to carry its rising pattern line—at the moment close to $0.328–$0.330—and liquidity thins out, the value may swiftly check the decrease assist round $0.310, or doubtlessly slide towards the $0.262 zone if the promoting momentum accelerates.

Associated Studying

Whereas a breakout above $0.343 may invalidate this bearish setup, Tapia’s cautionary be aware underscores the importance of a possible breakdown from the wedge formation. Weekend value motion usually diverges from midweek patterns on account of lowered participation, which means a pointy transfer in either direction may unfold extra rapidly than regular.

DOGE Wants To Maintain $0.31

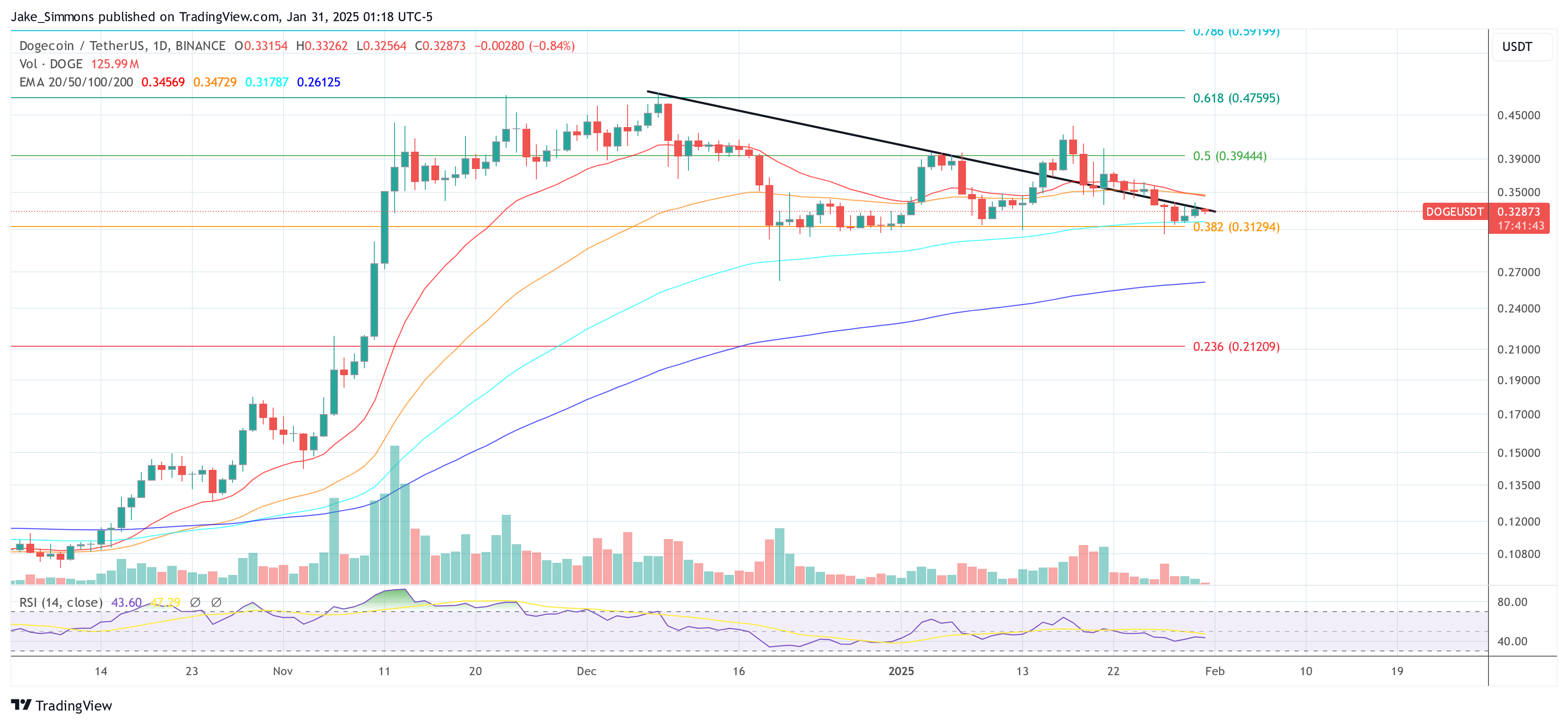

The day by day chart helps Tapia’s thesis. There, Dogecoin (DOGE) finds itself below intensifying downward stress as value motion hugs a persistent downtrend line. After hitting an area excessive in December, DOGE has retreated under key exponential shifting averages (EMAs). The 20-day EMA (at the moment at roughly $0.3457) and the 50-day EMA (close to $0.3473) have each curved decrease, signaling waning short-term momentum.

A look on the chart reveals that DOGE is now simply barely above the 0.382 Fibonacci retracement degree, calculated round $0.313. This Fib zone has acted as probably the most essential assist since mid-December, however any decisive day by day shut beneath it may speed up promoting. Merchants are conserving an in depth eye on the 100-day EMA (round $0.3179), which is sandwiched simply above this Fib degree.

If the value fails to defend the world between $0.313 and $0.317, then eyes will flip to the 200-day EMA at roughly $0.2613 as a essential long-term assist. If this degree breaks to the draw back as nicely, the 0.236 Fib at $0.212 may rapidly turn out to be a actuality.

Featured picture created with DALL.E, chart from TradingView.com