- ETH/BTC ratio nears the crucial 0.05 BTC degree, signaling potential additional losses if key assist fails.

- Institutional choice for Bitcoin and Ethereum’s lack of catalysts contributes to ETH’s extended underperformance.

The Ethereum[ETH]-to-Bitcoin[BTC] (ETH/BTC) ratio has confronted persistent struggles, with a staggering 77% of buying and selling days being unprofitable for ETH holders in opposition to BTC.

The latest market turbulence has exacerbated these situations, as evident from on-chain information and worth efficiency charts. However what does this imply for merchants and buyers?

Understanding the ETH/BTC profitability chart

The chart illustrates ETH/BTC’s profitability over time by marking worthwhile and unprofitable buying and selling days. Inexperienced signifies days when ETH outperformed BTC, whereas pink highlights intervals of underperformance.

The orange-shaded space on the backside represents the growing proportion of unprofitable days over time.

Evaluation reveals that since early 2022, ETH has persistently underperformed Bitcoin, with just a few transient intervals of profitability.

The newest downturn in early 2025 has strengthened this bearish pattern, with ETH’s relative weak spot pushing the unprofitable buying and selling days past 77%—a traditionally vital threshold.

ETH/BTC worth motion: A brutal wick

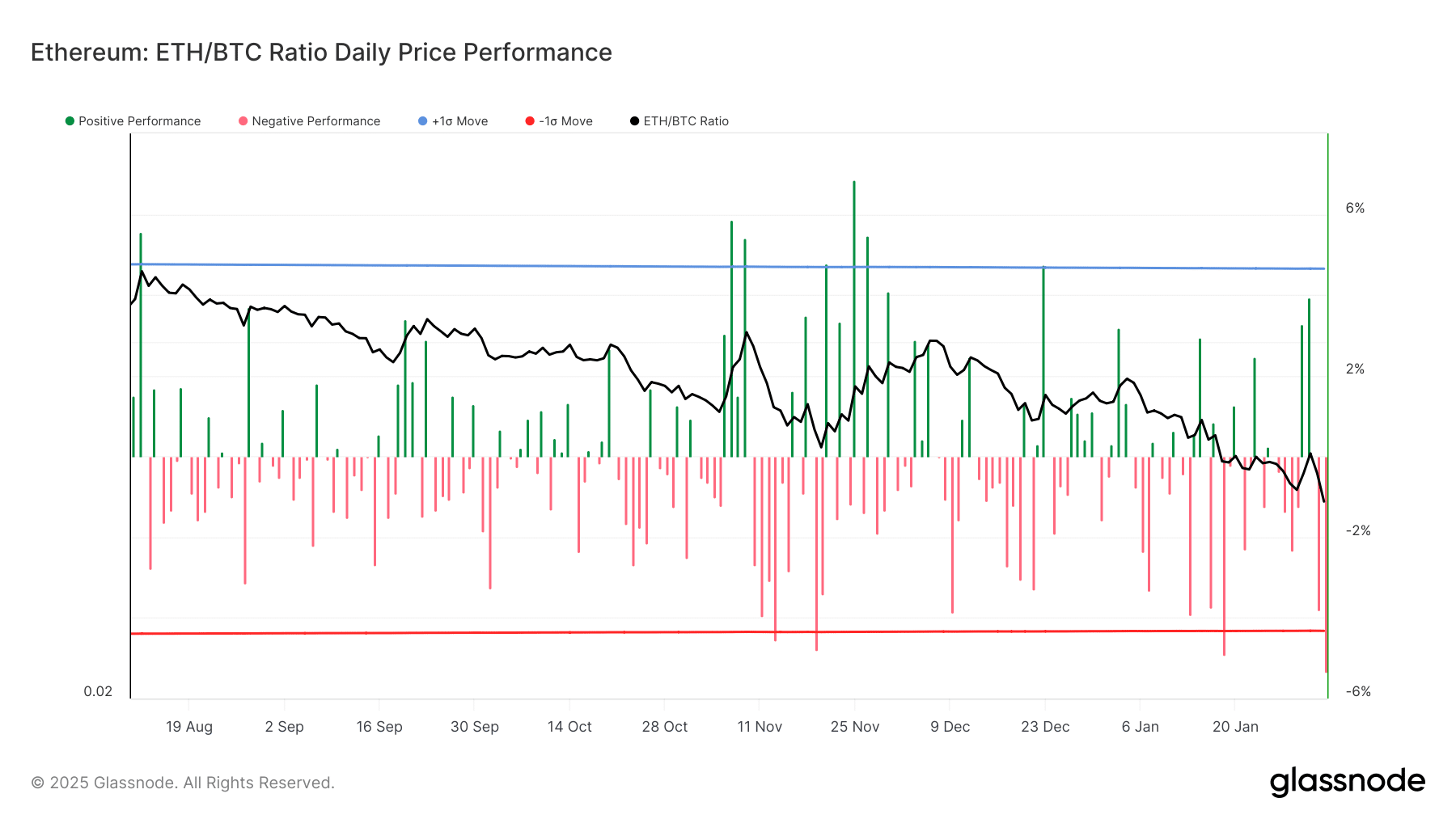

Evaluation of the ratio chart exhibits ETH/BTC’s every day worth efficiency and highlights excessive volatility.

The newest worth motion included a brutal downward wick, underscoring a pointy rejection from resistance ranges and heavy promoting stress.

Each day destructive efficiency bars outnumber constructive ones, indicating a persistent bearish pattern.

From mid-2024 onwards, ETH has struggled to take care of upward momentum in opposition to BTC, forming a gentle downtrend. Every tried restoration has been met with promoting stress, pushing the ETH/BTC ratio decrease.

The newest drop noticed ETH’s worth relative to BTC sink to a multi-year low, with the ETH/BTC ratio across the 0.05 degree—a key psychological and technical assist zone.

Why is ETH struggling in opposition to BTC?

Bitcoin stays the go-to asset for institutional adoption, particularly following spot Bitcoin ETF approvals in early 2024. Capital continues flowing into BTC somewhat than altcoins, together with ETH.

Whereas Ethereum stays a serious blockchain, buyers favor BTC as a safer guess.

In contrast to Bitcoin, which advantages from macroeconomic narratives and institutional adoption, Ethereum lacks rapid, robust catalysts.

Regardless of the ETH ETF approval, the affect has not been vital, as seen from its circulation in comparison with the BTC ETF flow.

– Learn Ethereum (ETH) Value Prediction 2025-26

What’s subsequent for ETH/BTC?

With ETH/BTC approaching traditionally vital assist ranges, merchants ought to watch the 0.05 BTC degree intently. If ETH/BTC breaks under this degree, the ratio might drop additional in direction of 0.045 and even decrease.

This might set off a wave of liquidations and panic promoting. Whereas the pattern stays bearish, a rebound from key assist ranges is feasible, notably if Ethereum sees renewed institutional curiosity.