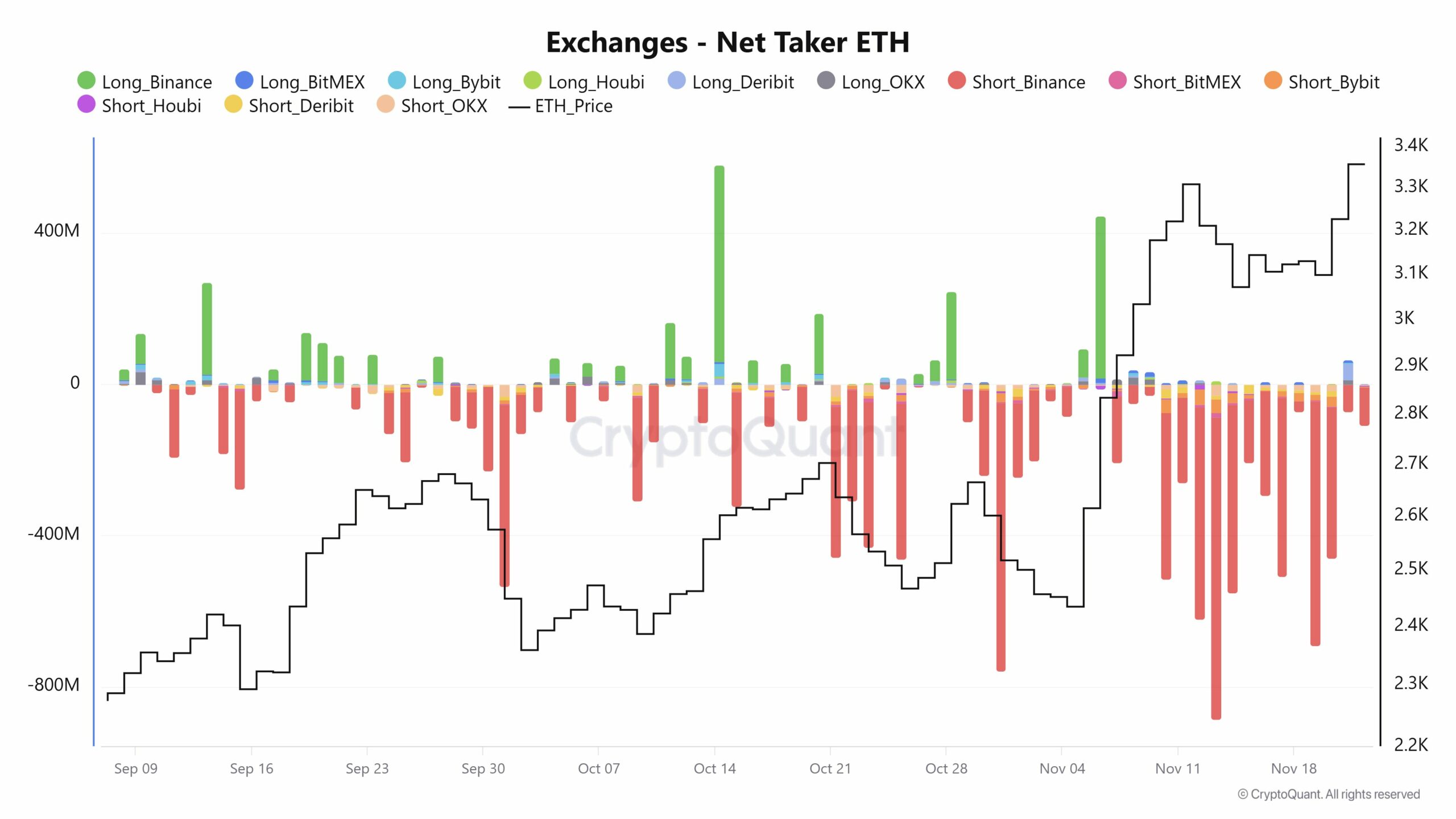

- There’s a huge distinction within the web taker quantity in exchanges of Bitcoin and Ethereum.

- Three elements may affect ETH to alter to the fitting facet.

The change actions between Bitcoin [BTC] and Ethereum [ETH] confirmed that they considerably influenced the market conduct.

For the uninitiated, the Taker Purchase/Promote Ratio on CryptoQuant offers perception into market sentiment by displaying the proportion of purchase orders to promote orders, a important indicator throughout market rallies or corrections.

At press time, each Bitcoin and Ethereum confirmed distinct patterns in web taker quantity in exchanges.

Ethereum’s web taker confirmed that the asset was not shifting equally to BTC, which is pivotal in shaping the short-term and long-term outlooks for these cryptocurrencies.

If most detrimental cash numbers flip to the constructive facet, ETH may see the large pump as extra merchants are taking purchase positions. However when and the way will this occur?

ETH derivatives sign bullish momentum

One influencing issue is the bullish momentum within the Ethereum derivatives market, indicated by Open Curiosity hovering previous its earlier ATH to exceed $13 billion.

This 40% improve during the last 4 months prompt engagement in Ethereum’s derivatives sector.

Reasonably constructive funding charges additional highlighted that long-position merchants dominated, additional affirming bullishness within the quick time period.

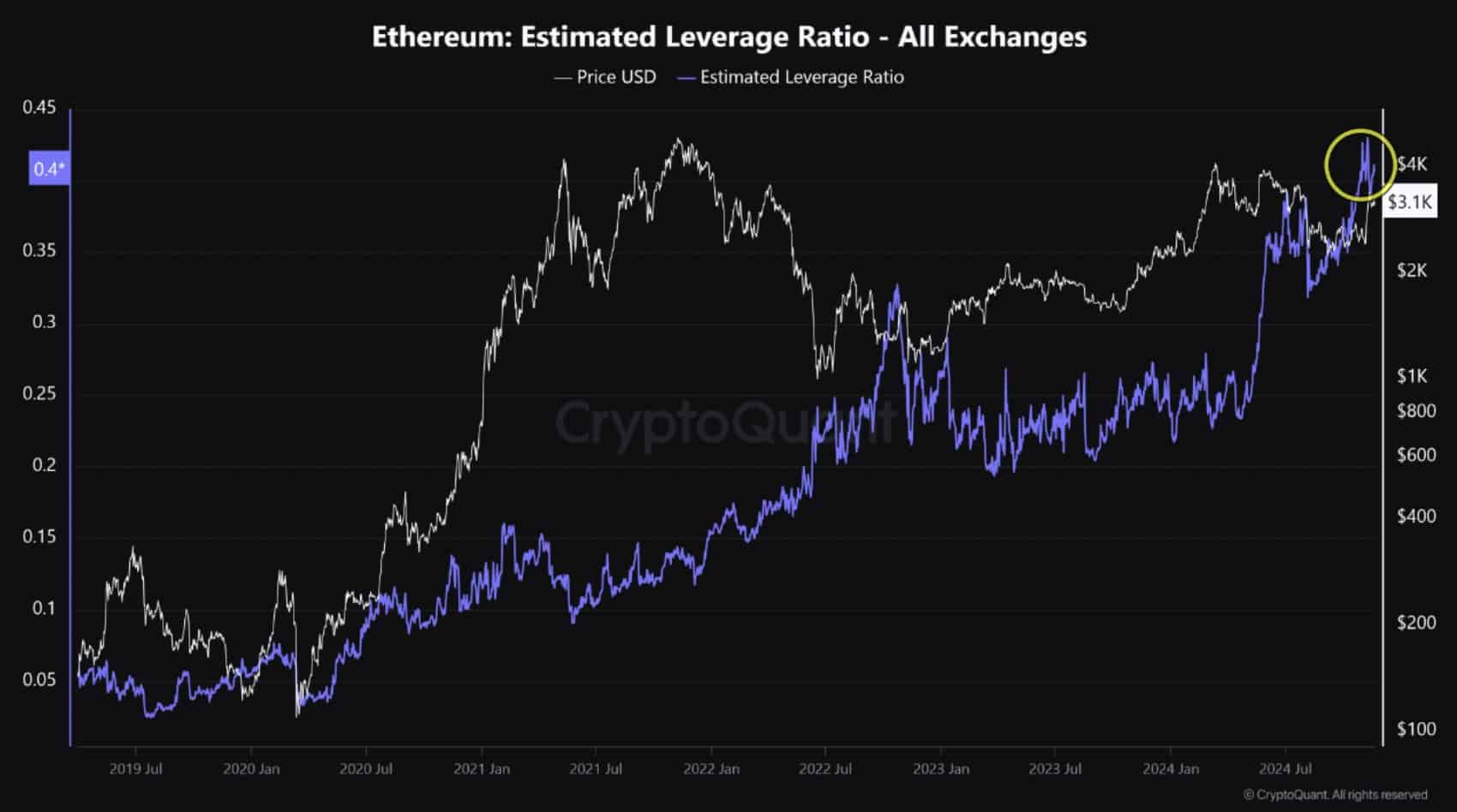

Furthermore, Ethereum’s estimated leverage ratio has hit a brand new peak, reaching +0.40 for the primary time.

This indicator of rising leveraged positions mirrored a better inclination for risk-taking amongst traders.

Regardless of the optimism, the prevailing excessive leverage and dominance of lengthy positions may heighten the potential for an extended squeeze.

Such a market correction may happen if abrupt value volatility prompts these merchants to liquidate positions swiftly, reminding them of the inherent dangers related to extremely leveraged buying and selling.

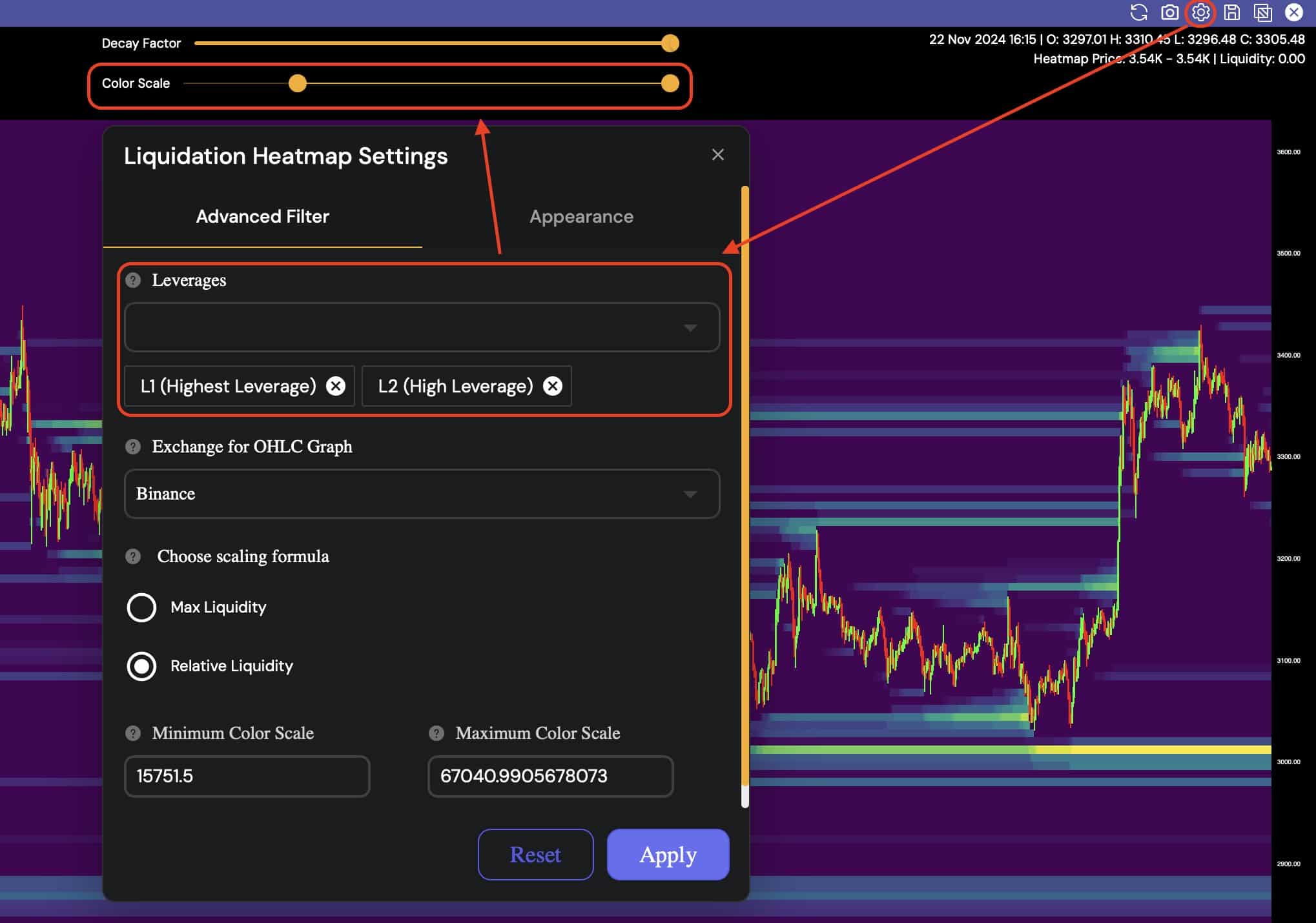

Excessive-leverage liquidations and altcoin season

Once more, high-leverage liquidations continued to loom over ETH’s value on the heatmap.

With changes set to focus solely on excessive [L1 and L2], leverage confirmed important areas the place massive liquidations may set off important value actions.

This adjustment helped spotlight the main liquidation clusters, revealing the chance zones straight above the present value.

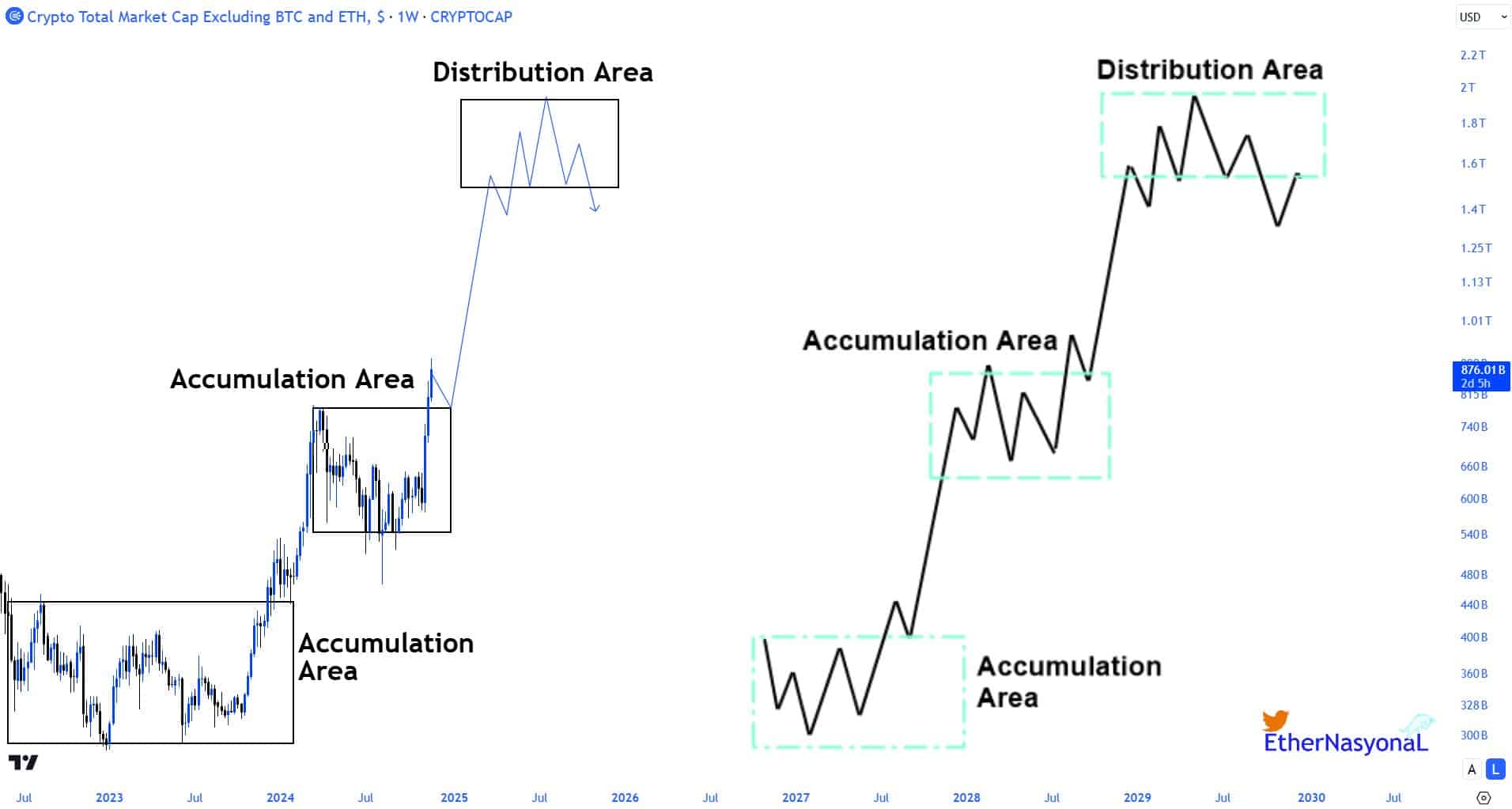

Lastly, the altcoin market, represented by the TOTAL3 index, started its second parabolic part in October 2023.

This motion marked a transition out of the Wyckoff technique’s second accumulation zone, propelling altcoins into a robust uptrend.

The current value actions noticed altcoins retesting after which securely surpassing channel highs, finally eclipsing the Could 2024 peaks.

The present inflow of capital was focusing on massive caps and choose mid-cap altcoins, fueling this rally.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Ethereum, regardless of a key participant, has exhibited a slower however constant rise, setting a stable basis that diverges from Bitcoin’s extra speedy surge.

This methodical climb may doubtlessly result in a change of conduct for the king of altcoins.