- ETH dropped beneath $2k once more after remaining above this stage for 2 days.

- Ethereum patrons had been aggressively shopping for, with a unfavorable netflow hitting 150,000 ETH.

Over the previous three days, Ethereum [ETH] noticed a shift in fortunes, reclaiming $2k. Amidst this development reverse, is a better exercise from the purchase facet.

In keeping with CryptoQuant, Ethereum noticed a unfavorable netflow of over 150,000 ETH on spinoff exchanges.

Such a big outflow signifies diminished promoting stress as traders transfer ETH to chilly storage or DeFi. Due to this fact, the massive outflow signifies elevated accumulation by massive entities signaling bullish sentiments from these traders.

This accumulation by massive entities is additional evidenced by the latest whale-buying exercise.

As per Onchain Lens, a whale withdrew 8,313 ETH price $16.46 million from Binance after two months of inactivity. After this transaction, the whale now holds 11,197 ETH price $22.17 million.

Supply: Onchain Lens

When whales start accumulating, it alerts robust bullish sentiment, indicating they consider present costs are undervalued and prone to rebound quickly.

Sustained accumulation by good cash typically boosts market confidence, attracting elevated demand from speculative patrons.

What it means for ETH

Regardless of the rising demand from massive holders, ETH costs proceed to wrestle.

In actual fact, on every day charts, ETH has dropped beneath $2k once more, hitting a low of $1,963. This implies that different market members stay bearish and are much less optimistic about potential worth restoration.

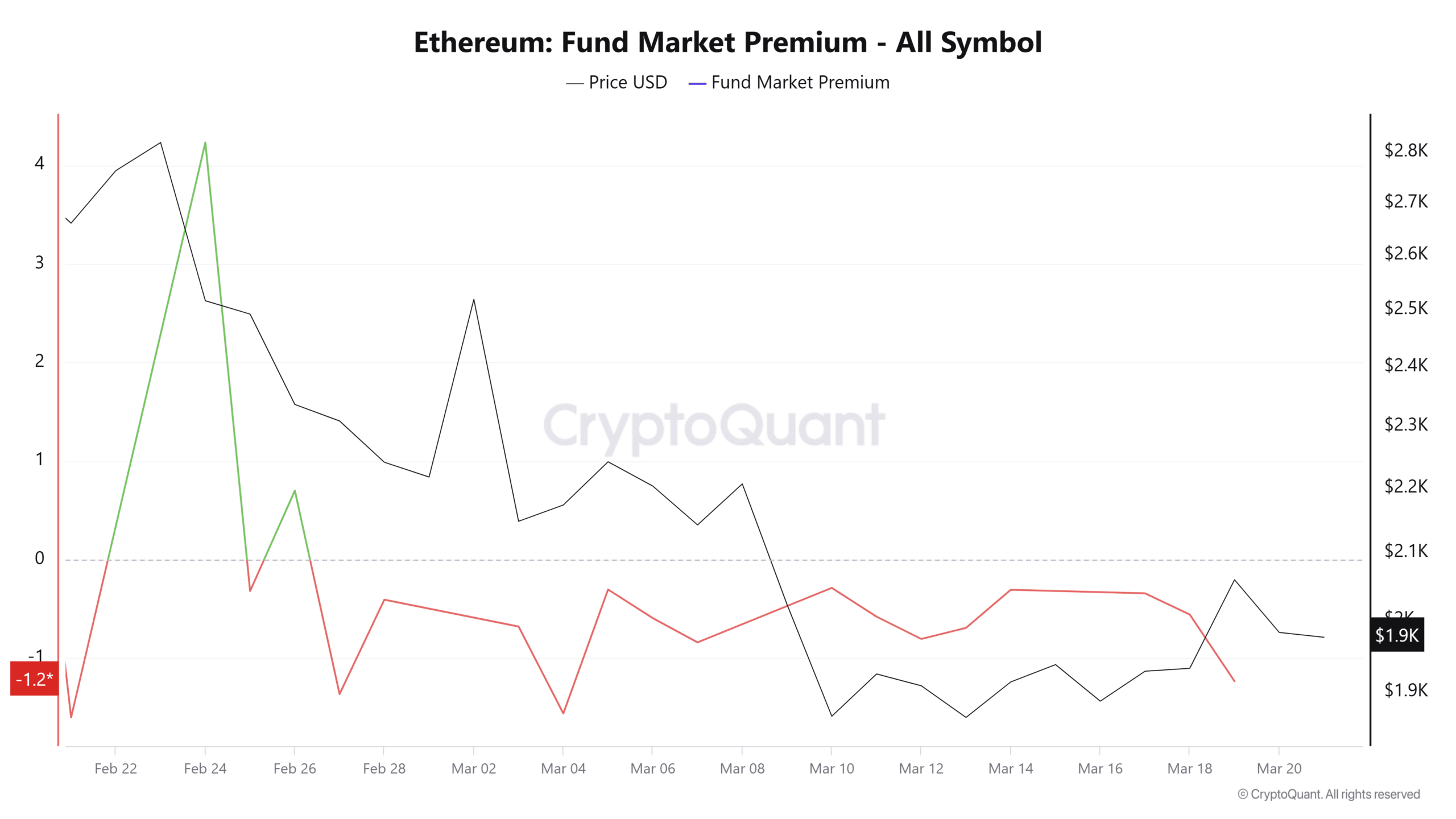

AMBCrypto noticed bearish market sentiment as Ethereum’s Fund Market Premium stayed unfavorable all through the previous week.

A sustained unfavorable premium signifies that traders are closing positions quicker than new patrons are getting into, suggesting a desire to promote at a reduction moderately than maintain. Whereas patrons are collaborating, vendor exercise stays notably excessive.

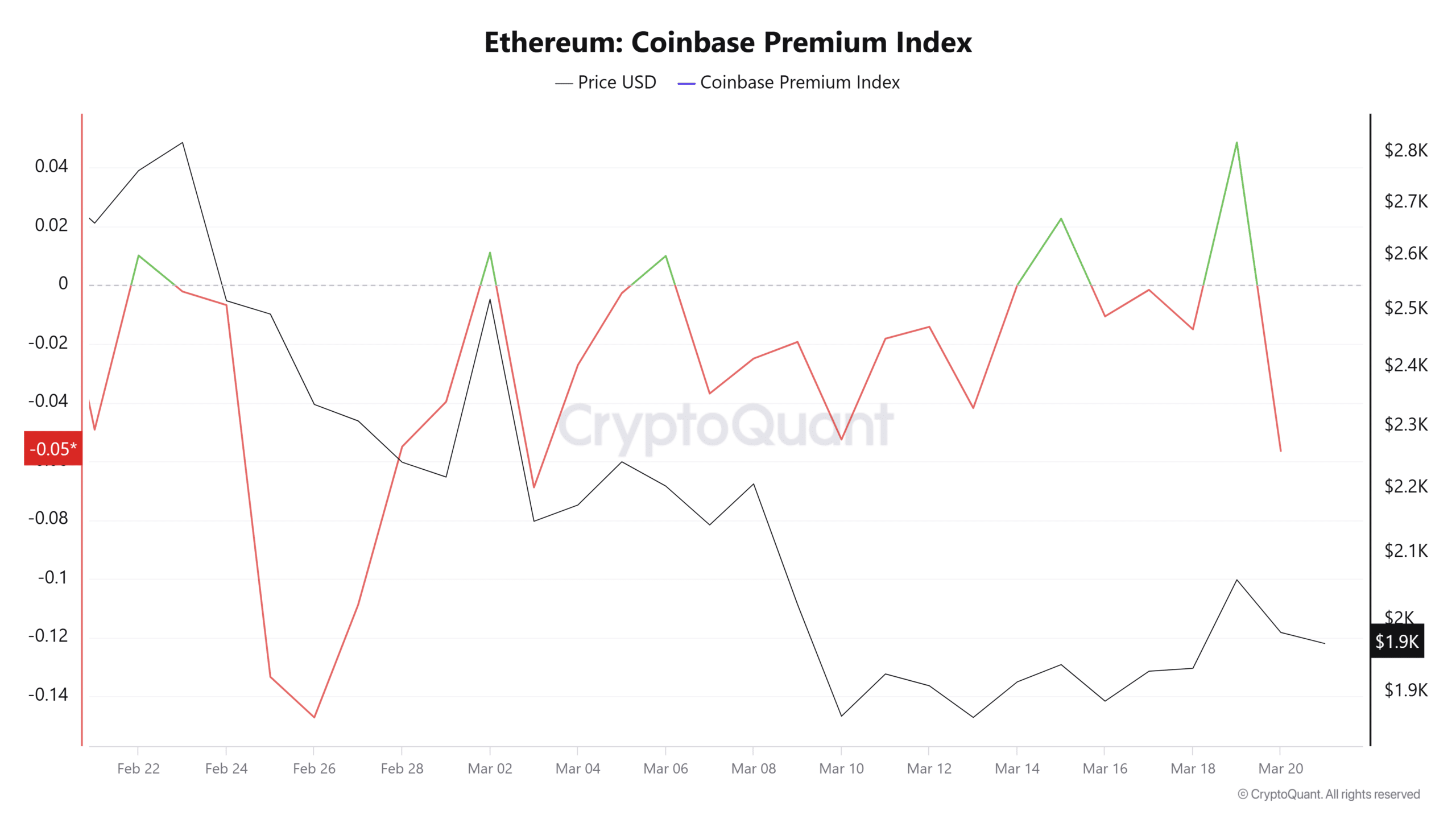

Bearish sentiments are significantly pronounced amongst U.S. institutional traders. The Coinbase premium index, at present at -0.05, signifies energetic promoting by Coinbase traders, reflecting a notable lack of market confidence.

This sentiment locations Ethereum underneath vital downward stress.

Regardless of elevated unfavorable netflows and whale accumulation, Ethereum’s demand stays weak. The continuing tug-of-war between patrons and sellers could hold ETH costs confined to a consolidation vary.

Beneath present circumstances, Ethereum is prone to commerce between $1,862 and $2,100.