- Ethereum welcomed a brand new on-chain privateness characteristic that retains illicit funds at bay.

- ETH’s sentiment didn’t enhance a lot regardless of the constructive replace.

Ethereum [ETH] has welcomed a brand new layer of consumer privateness and security from illicit funds after Privateness Swimming pools went reside.

Image this: you want to donate or ship funds on-chain with out recipients or nosy sleuths unnecessarily doxxing (checking your identification and stability in your pockets handle).

On the similar time, this stage of privateness ought to be achieved however avoided illicit funds like those from Lazarus Group. That’s exactly what Privateness Swimming pools does.

Oxbow, the agency behind the Privateness Swimming pools protocol, noted,

“ETH customers can now obtain on-chain privateness, whereas nonetheless dissociating from illicit funds. It’s now as much as all of us to Make Privateness Regular Once more.”

Impression on Ethereum

The protocol emphasised its non-custodial nature, giving customers better management, whereas initially setting deposit limits between 0.1–1 ETH ($186–$1800). These limits might be raised after preliminary monitoring.

This isn’t Ethereum’s first try at enhancing privateness. Crypto mixers like Twister Money and Railgun have lengthy hid on-chain transaction particulars. Nonetheless, Twister Money confronted scrutiny for enabling teams like Lazarus Group to launder billions in stolen funds.

New platforms like Privateness Swimming pools purpose to stability privateness with compliance by blocking illicit transactions. Ethereum co-founder Vitalik Buterin, a proponent of such expertise and a frequent Railgun consumer, has already tested the platform.

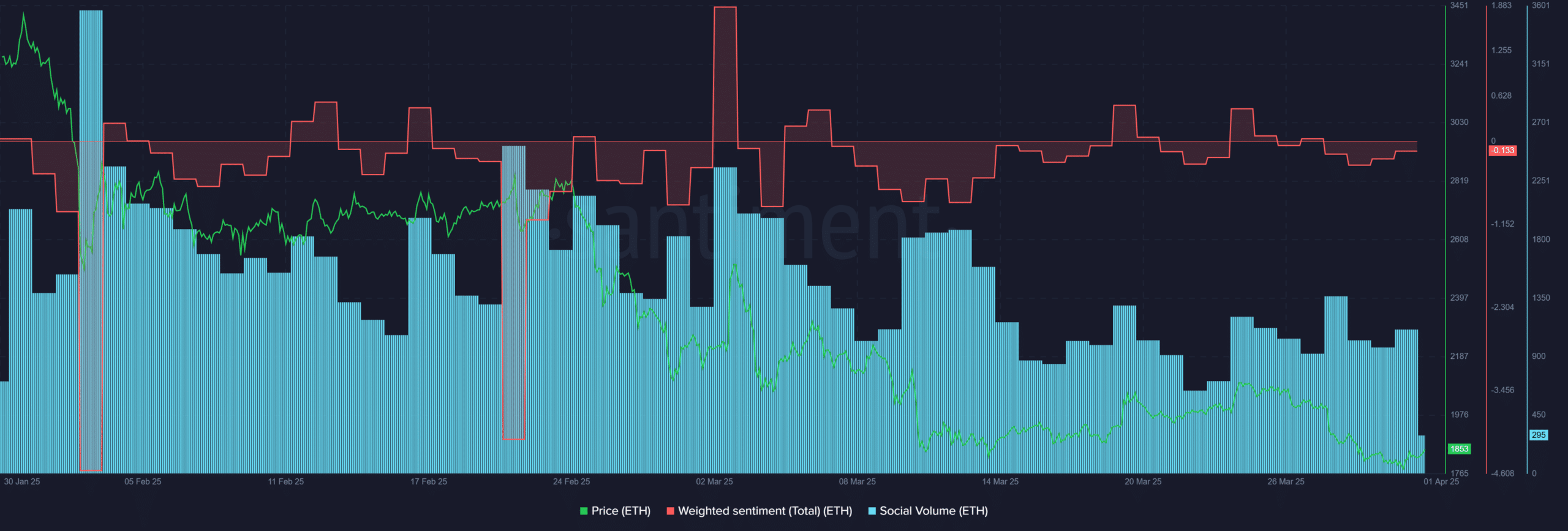

Regardless of the constructive replace, nevertheless, ETH’s sentiment didn’t sharply reverse to ‘posiitve’ aspect. Since February, ETH’s weighted sentiment has been overly unfavourable. This instructed general warning amongst traders.

Moreover, social quantity dipped to new lows in March in comparison with February. This revealed that there wasn’t a lot market curiosity within the altcoin.

This has stored the altcoin beneath $2K and might be dragged to $1.6K if muted demand persists within the subsequent few days.