- Ethereum’s value surged to $3,380, marking a 4.6% hike inside simply 24 hours

- Latest whale deposits on Kraken, alongside rising OI, hinted at potential short-term value strain

Ethereum (ETH), the second-largest cryptocurrency by market cap, continues to exhibit dynamic market traits in early 2025. An enormous whale just lately deposited 20,000 ETH (Valued at $67.6 million) into Kraken, reigniting discussions about large-scale investor exercise and its affect on Ethereum’s value motion.

This whale, who as soon as withdrew 217,513 ETH from exchanges in September 2022, has been actively participating with Kraken since March 2024.

Such strikes typically sign vital shifts in market sentiment and liquidity, prompting merchants to judge key indicators and put together for potential value adjustments.

A better have a look at Ethereum’s market efficiency

On the again of weaker-than-expected CPI information, Ethereum’s value climbed to $3,380 after beneficial properties of virtually 5% in 24 hours. Its 24-hour buying and selling quantity hit a powerful $26.2 billion, highlighting sturdy market exercise and vital curiosity from each retail and institutional buyers. Equally, the altcoin’s market cap sat at $407.2 billion – An indication of regular investor confidence regardless of intervals of heightened volatility.

The aforementioned whale’s newest 20,000 ETH deposit appeared to be in step with Ethereum’s newest value peak, hinting at potential profit-taking or anticipation of a value correction. Traditionally, large-scale deposits by whales have preceded bouts of promote strain on ETH’s value because of larger sell-side liquidity. Nonetheless, this sample is just not all the time definitive.

Exterior components equivalent to macroeconomic developments and Bitcoin’s value correlation additionally play a vital function in Ethereum’s trajectory. As Bitcoin stabilizes above $95,000, Ethereum merchants can anticipate sustained bullish momentum. Moreover, the growth of ETH staking and the deflationary impact of EIP-1559 additional bolsters its long-term attraction.

ETH’s value motion and key indicators

Ethereum’s value has seen vital volatility, formed by each technical components and large-scale investor exercise. In actual fact, over the previous yr, ETH’s value has moved inside a spread of $1,500 to $4,500, demonstrating each bullish and bearish phases.

Right here, it’s price declaring that the whale’s deposit historical past lends some perception into potential future value actions. Between March 2024 and now, this whale deposited 146,639 ETH to Kraken at a mean value of $3,170 – An indication of strategic profit-taking at larger value ranges.

Technical evaluation additionally revealed that ETH’s current rally examined a powerful resistance stage at $3,400. Breaking previous this stage might pave the best way for Ethereum to problem the $3,500-$3,600 vary within the brief time period. Conversely, a failure to keep up momentum might push ETH in the direction of the $3,200-$3,100 assist zone.

An examination of key shifting averages additionally highlighted that Ethereum has been buying and selling above its 50-day and 200-day shifting averages.

Ethereum’s community resilience

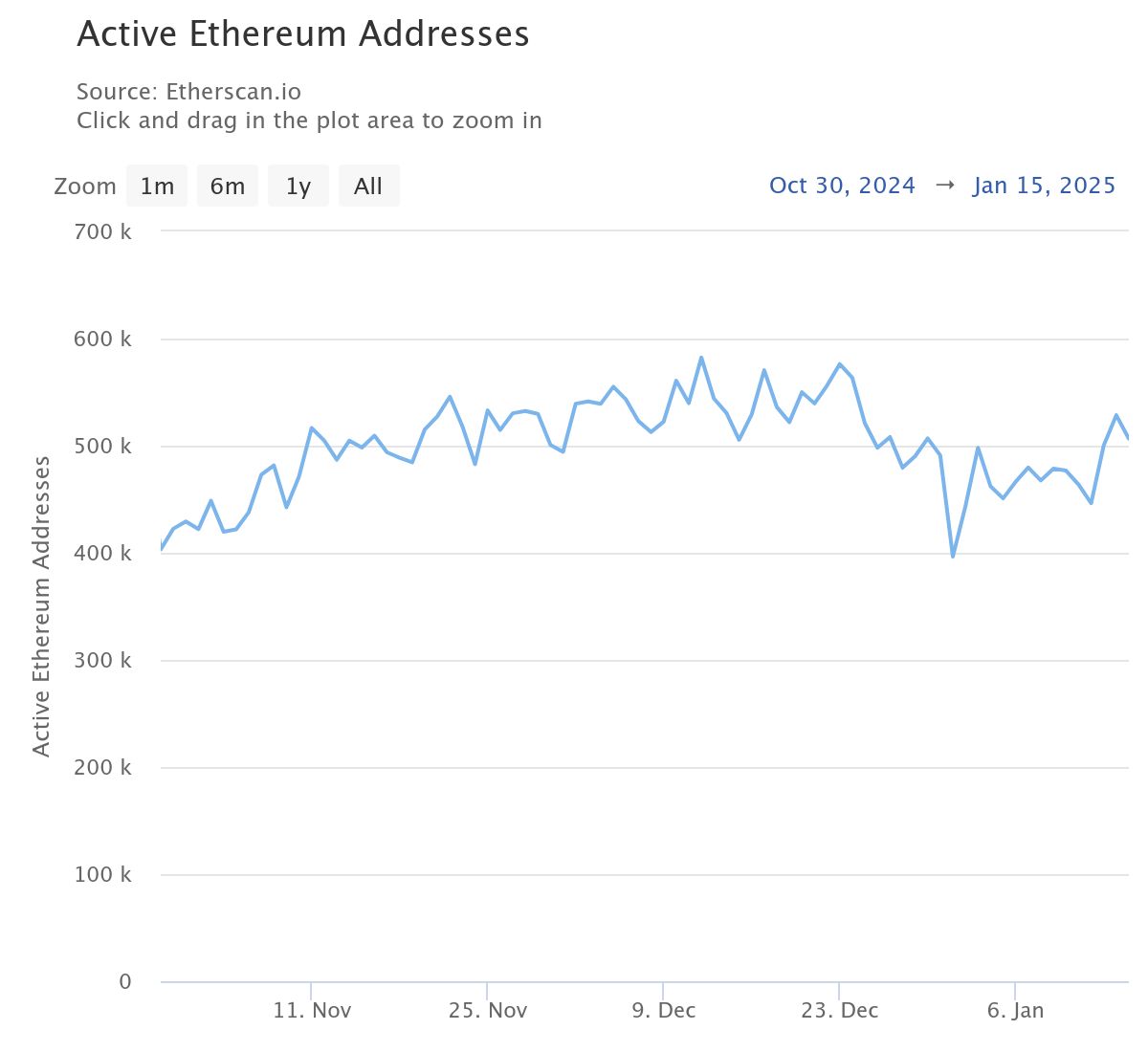

Moreover, Ethereum’s energetic addresses noticed a gentle uptick over the previous few months. In actual fact, on-chain information revealed that energetic addresses persistently hovered round 400,000 each day, demonstrating robust participation throughout the ecosystem.

When analyzing the development additional, one can see that intervals of rising energetic addresses have typically coincided with value rallies – An indication of rising demand and community utility. For instance – The current hike in energetic addresses aligned with Ethereum’s value surge to $3,380, reinforcing the correlation between community exercise and market efficiency.

Nonetheless, a decline on this metric, then again, might imply diminished community exercise and potential downward strain on ETH’s value. In gentle of Ethereum’s sturdy developer ecosystem and steady innovation, the community’s exercise ranges are prone to stay a dependable barometer of market sentiment and future value actions.

Indicators for Ethereum’s subsequent transfer

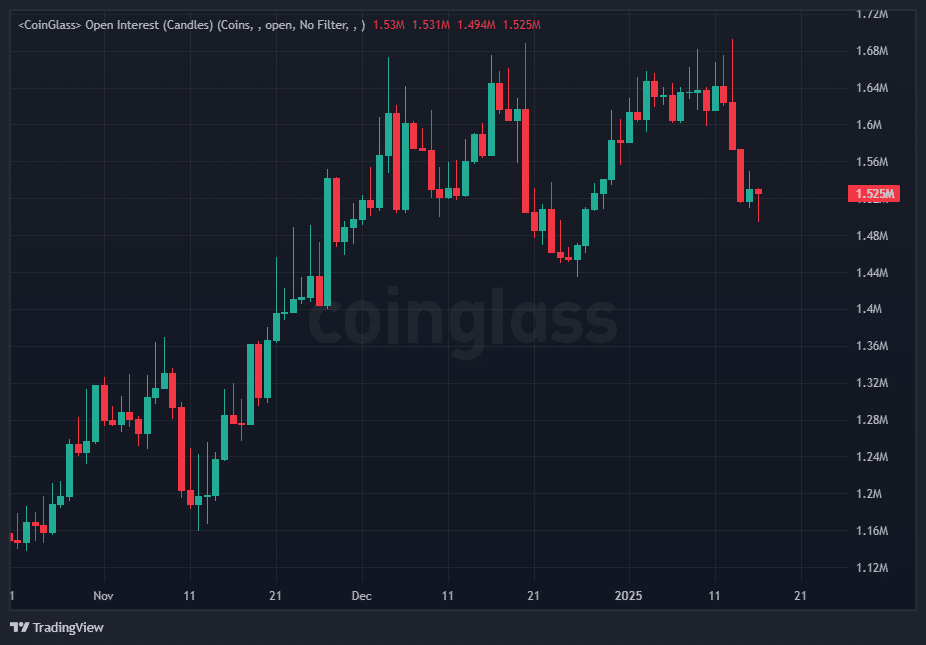

Ethereum’s Open curiosity (OI) has just lately recorded notable fluctuations, indicating heightened exercise within the derivatives market. On the time of writing, Ethereum’s OI throughout main exchanges stood at $1.52 million following a big weekly hike. This hike corresponded with ETH’s newest value rally, that means that merchants are coming into new positions in anticipation of additional volatility.

Spikes in open curiosity have typically preceded vital value actions, as they point out larger participation and leverage out there.

The current whale deposits on Kraken, alongside rising OI, hinted at potential short-term value strain. If the vast majority of positions are lengthy, a sudden market downturn might set off liquidations, accelerating the decline. Conversely, sustained shopping for strain may result in a brief squeeze, propelling ETH’s value larger.

Gauging Ethereum’s market sentiment

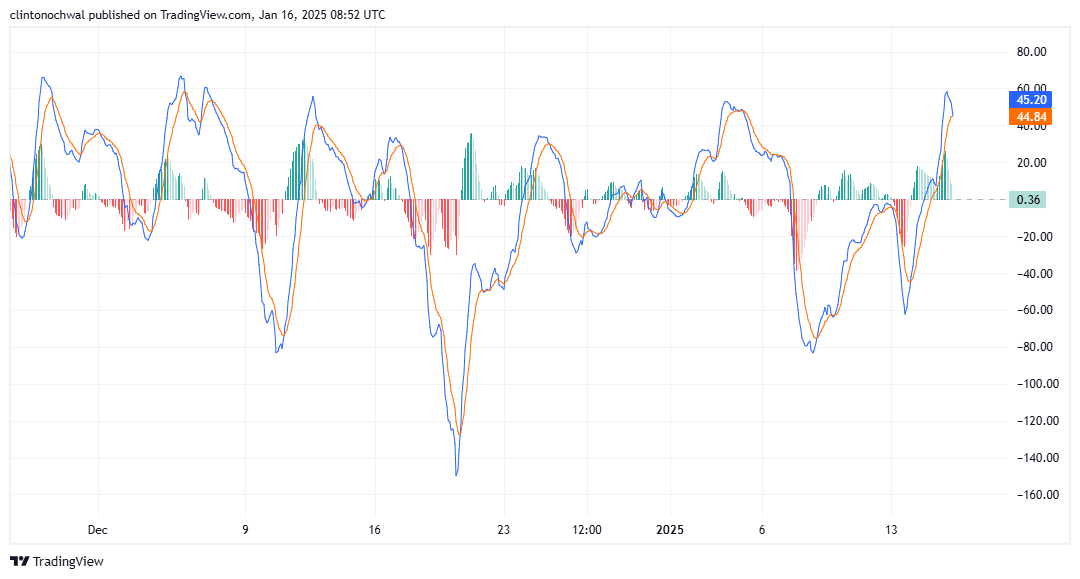

Lastly, Ethereum’s MVRV ratio indicated that long-term holders are in vital revenue, whereas short-term holders face tighter margins. This disparity highlighted the market’s bullish sentiment, with long-term holders benefiting from the current value surge.

When the MVRV ratio for long-term holders peaks, it typically means an approaching native value prime. Particularly as profit-taking by these holders can introduce promote strain.

Conversely, a declining MVRV ratio for short-term holders may point out undervaluation and potential shopping for alternatives. On the time of writing, Ethereum’s MVRV ratio appeared to be nearing crucial ranges the place long-term holders may start to understand income, posing a possible short-term correction danger.