- Ethereum’s worth resilience and key resistance ranges counsel potential for an imminent breakout.

- Robust outflows, constructive MACD, and dominant lengthy positions point out a supportive bullish setup.

Ethereum [ETH] has as soon as once more captured consideration because it information a considerable day by day web outflow exceeding 25 million, main all different blockchains in capital motion. Such a large-scale shift may sign profit-taking or strategic repositioning by main buyers.

With ETH buying and selling at $2,618.54, up by 3.32% at press time, this pattern raises the query: may these outflows consolidate liquidity and gas a brand new bullish surge? Let’s break down the technicals and market indicators behind Ethereum’s present worth dynamics.

ETH worth evaluation: Constructing as much as a breakout?

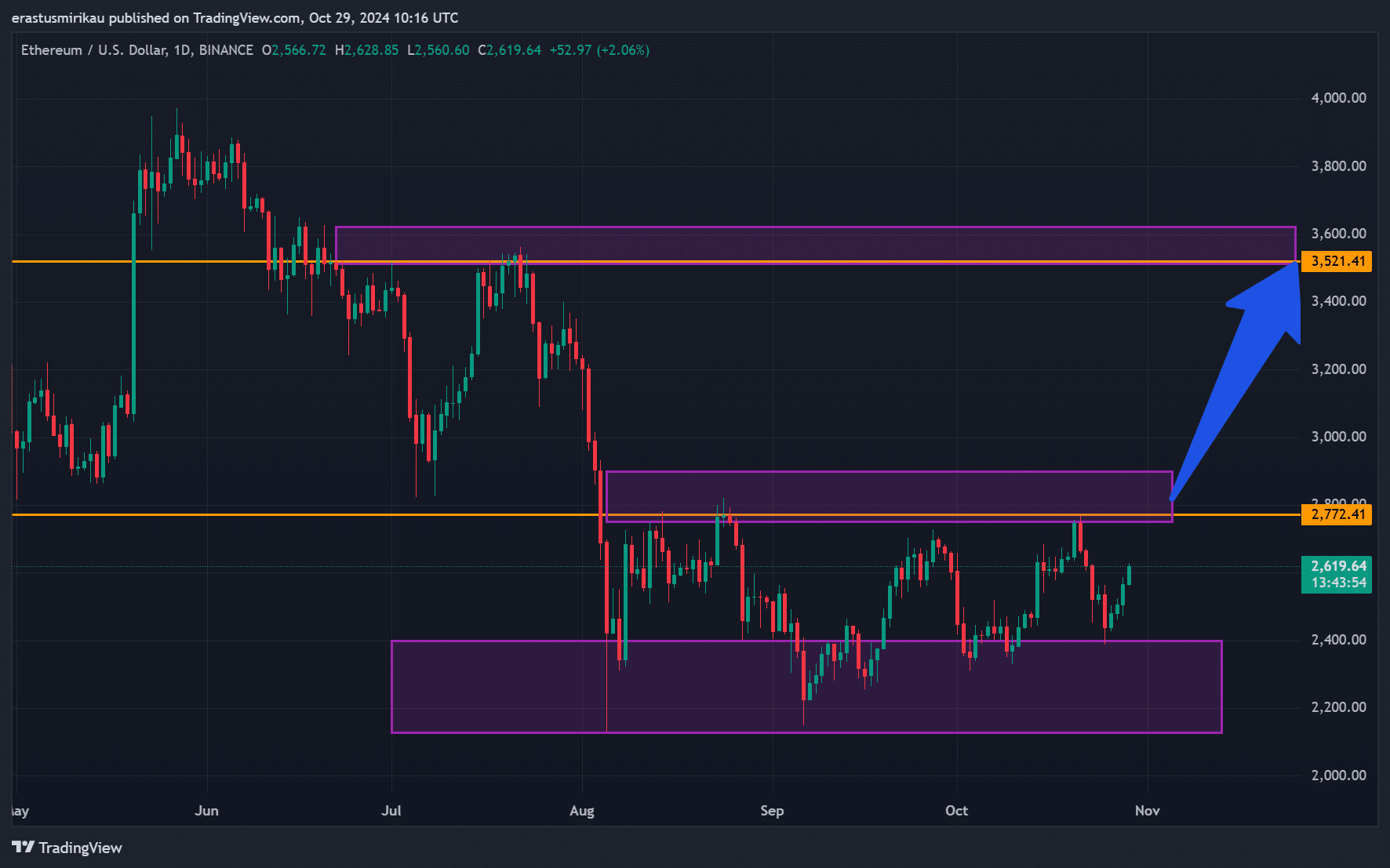

Ethereum’s latest worth actions counsel {that a} breakout is likely to be within the works. ETH has maintained power above $2,500, a key psychological assist, regardless of market fluctuations.

This stage has confirmed resilient and should act as a launchpad for a stronger upward thrust.

Wanting forward, $2,772 stands because the instant resistance stage, whereas $3,521.41 represents a extra vital barrier that might both verify or halt bullish momentum.

If Ethereum efficiently clears these ranges, we may witness a pointy rally. Nonetheless, if resistance holds agency, ETH may enter a consolidation part, awaiting a decisive catalyst.

MACD and RSI point out strengthening momentum

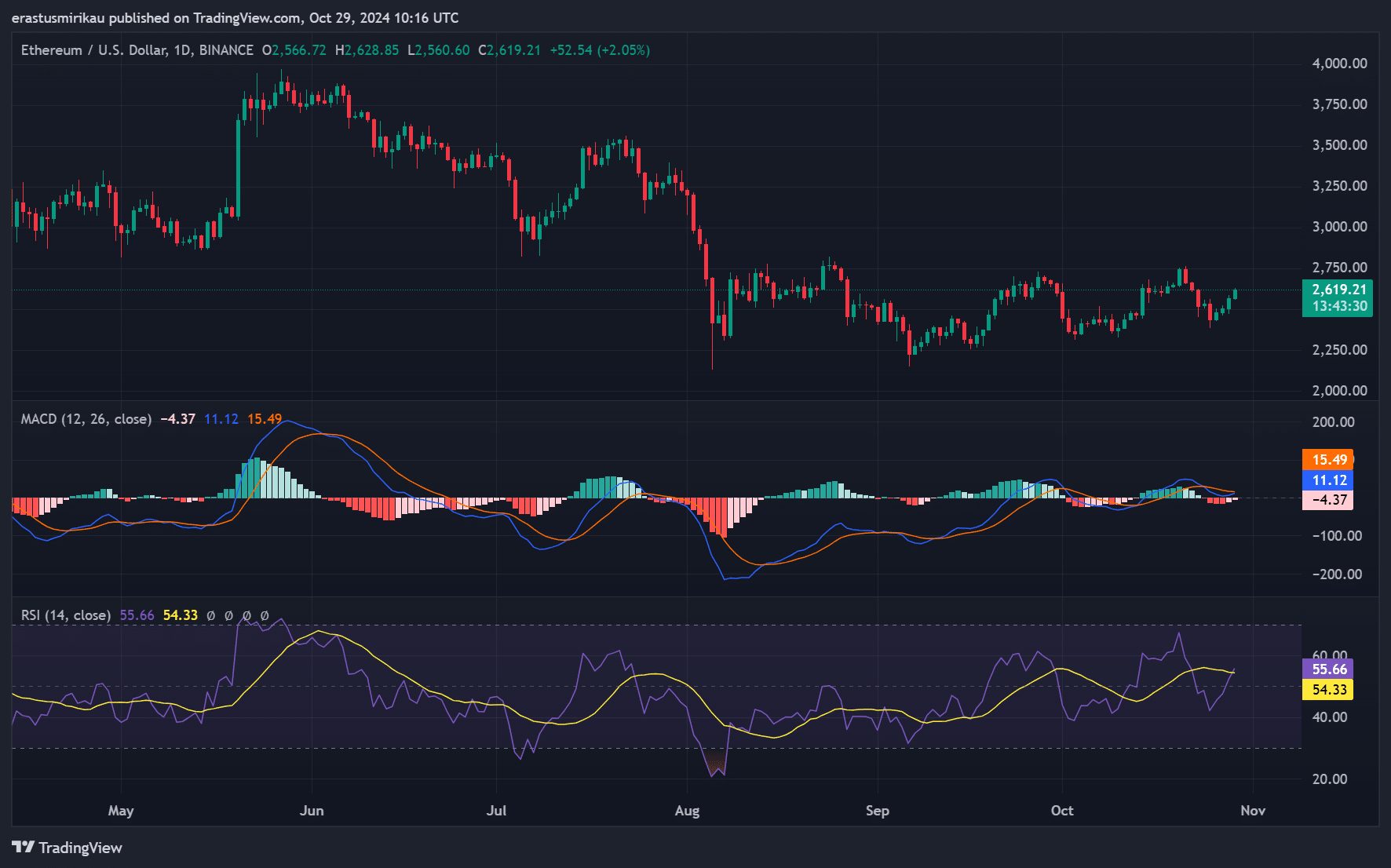

Ethereum’s technical indicators additional emphasize its potential for an upward transfer. The Shifting Common Convergence Divergence (MACD) indicator is exhibiting bullish indicators, because the MACD line has crossed above the sign line, typically seen as a precursor to constructive worth motion.

Moreover, the Relative Energy Index (RSI) is at present round 54.33, a reasonably bullish stage.

Due to this fact, Ethereum has appreciable room for upward momentum earlier than it approaches overbought situations, signaling that patrons may nonetheless drive costs increased within the close to time period.

Main outflows from exchanges: An indication of bullish sentiment?

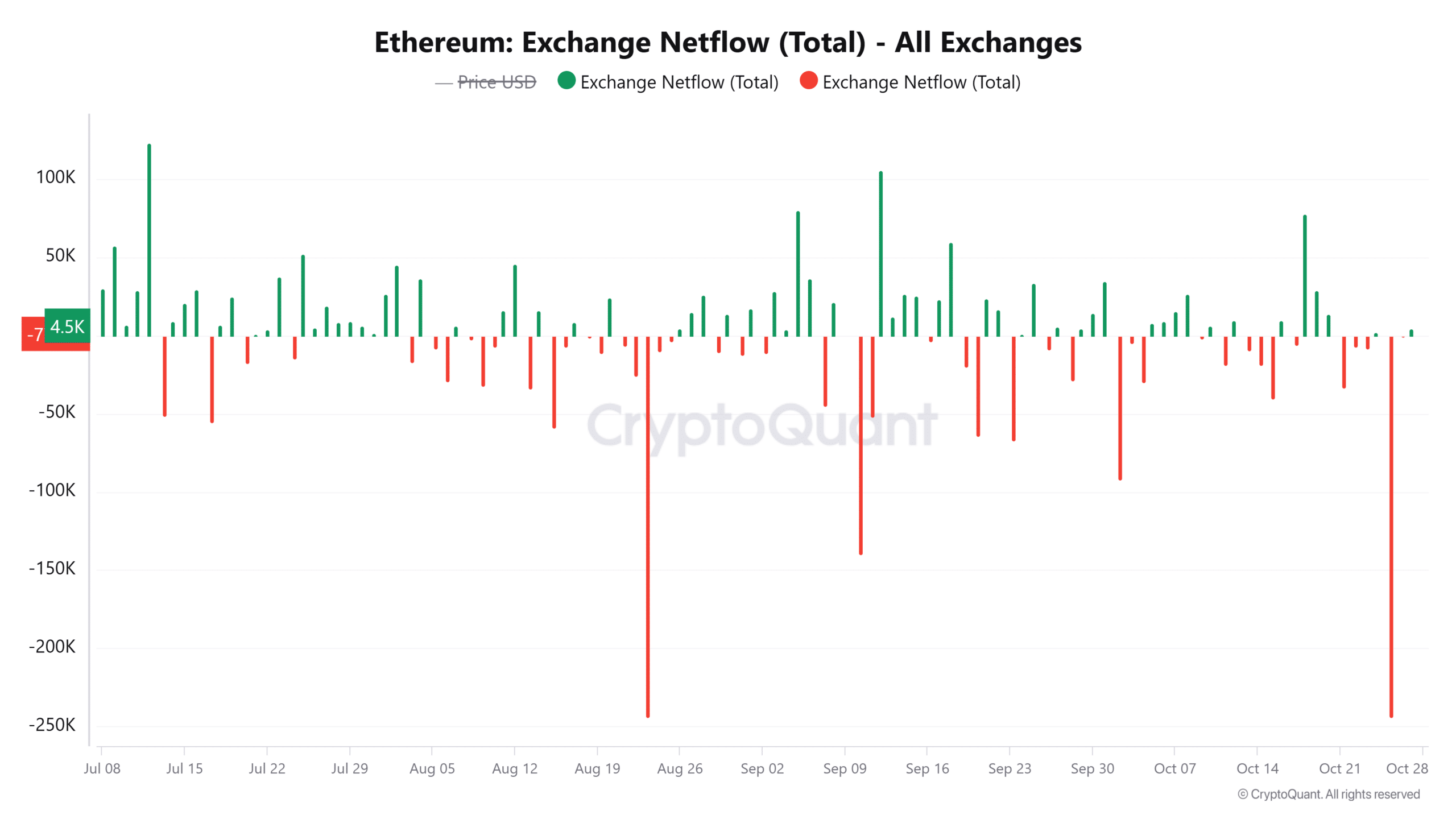

Ethereum’s change netflow information reveals a major outflow of 4.5K ETH over the previous 24 hours, marking a 3.03% decline in out there change liquidity.

Consequently, when massive quantities of ETH transfer off exchanges, it typically means that buyers are selecting to carry their belongings long-term or stake them elsewhere, decreasing instant promote strain.

ETH liquidation information highlights dominance of longs

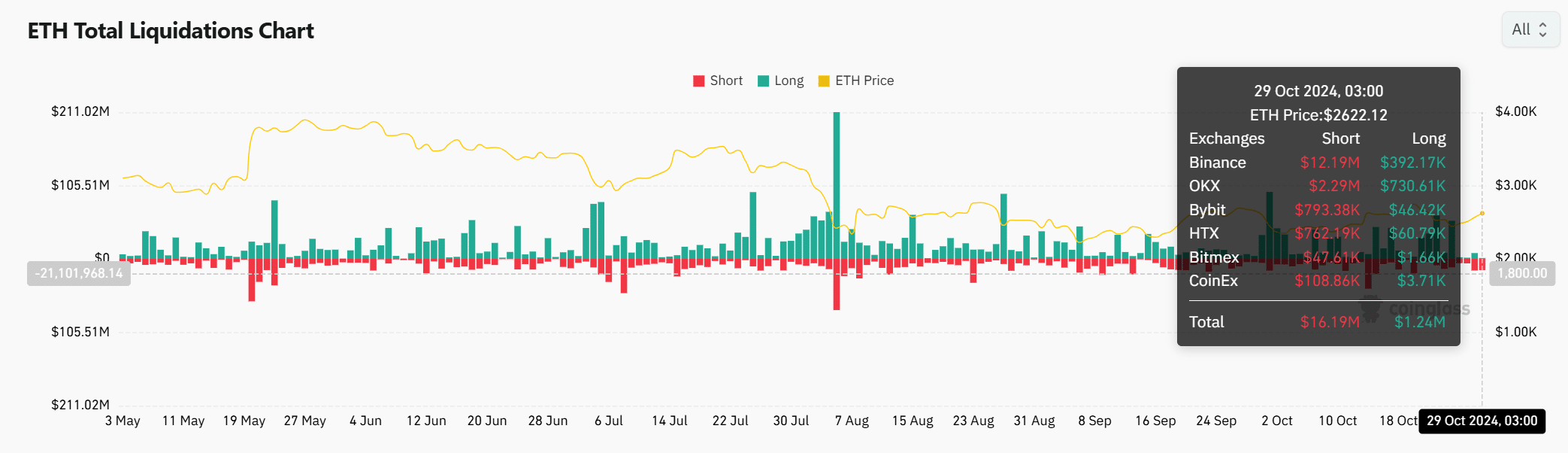

Ethereum’s liquidation information helps a bullish narrative. The vast majority of liquidations are on brief positions, whereas lengthy positions dominate the scene. This pattern signifies confidence amongst merchants in Ethereum’s upward potential, as lengthy holders anticipate continued positive factors.

Consequently, this confidence amongst lengthy positions may add additional upward strain, offering the assist wanted for a sustained rally.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Ethereum’s appreciable outflows from exchanges, at the side of its supportive technical indicators, trace at a possible bullish continuation.

Breaking key resistance ranges may very well be the ultimate set off for a robust rally. Ethereum seems well-positioned for a surge as liquidity consolidates, making the approaching days vital for ETH’s worth motion.