- An in depth above $3,700 might assist the worth again to $4,000.

- The Pi Cycle Prime indicator revealed that the ETH may rally.

Ethereum [ETH] appeared to have turn out to be a shadow of its former self after the worth collapsed from $3,633 to $3,22o within the final 24 hours.

Regardless of the decline, AMBCrypto agrees that the worth of the altcoin may retest $4,000. Nevertheless, this prediction may not come low-cost or straightforward.

That is due to the variety of addresses that gathered ETH round $3,700. This has made it a key resistance zone.

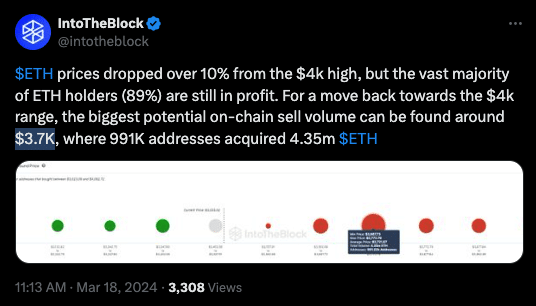

In keeping with IntoTheBlock, ETH’s earlier rise above $4,000 positioned 89% of its holders in revenue.

Who determined what’s subsequent?

Nevertheless, the latest decline meant that there was a promote wall at $3,700 the place 991,000 ETH addresses bought 4.35 million cash.

With ETH buying and selling beneath the area, the holders have a chance to interrupt even when the worth climbs.

If the members resolve to e-book income, the altcoin may discover it difficult to revisit the psychological $4,000 mark.

However, if shopping for stress outweighs the on-chain promote quantity, then ETH may cruise above $3,700.

However whether or not the cryptocurrency would proceed to languish within the purple doesn’t rely on the on-chain outlook alone.

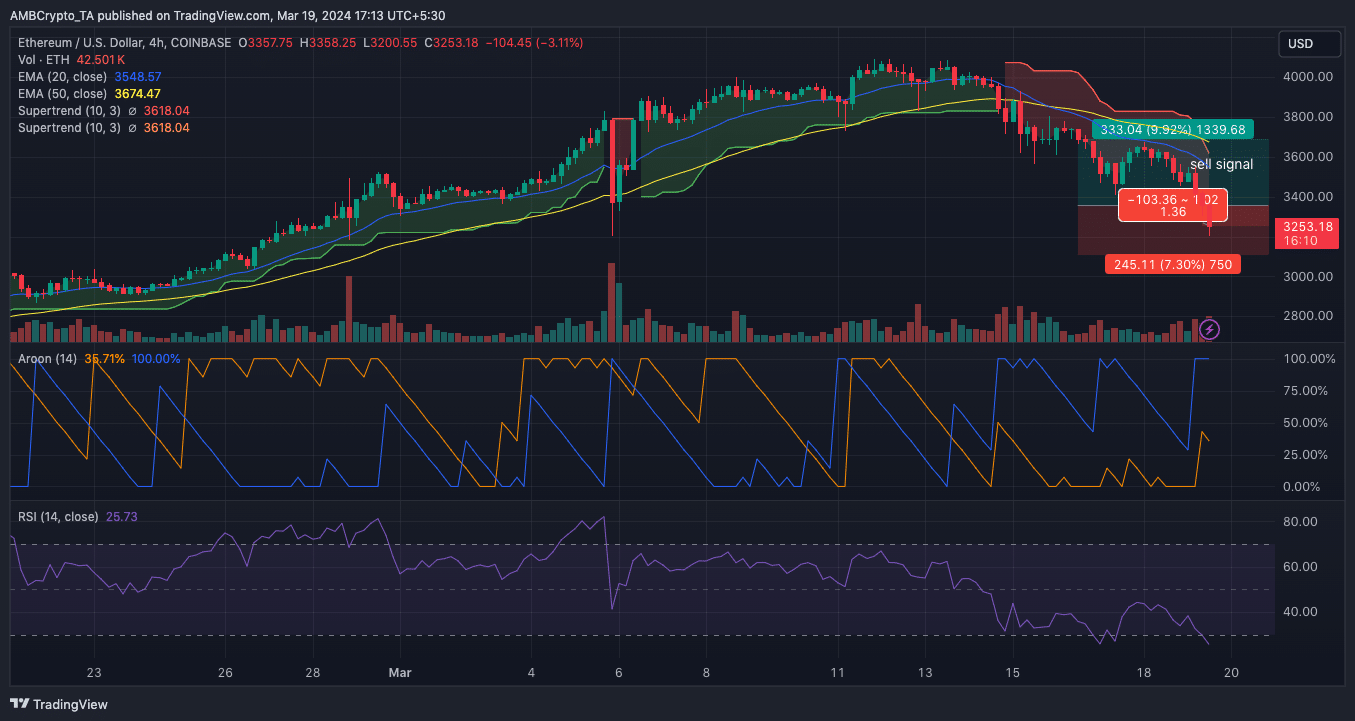

Subsequently, AMBCrypto gauged the worth motion from a technical perspective. In keeping with the 4-hour ETH/USD chart, the Exponential Shifting Common (EMA) depicted a short-term bearish pattern for the altcoin.

At press time, the 20 EMA (blue) crossed beneath the 50 EMA (yellow). With this pattern, the worth of the cryptocurrency may drop by one other 7.30%. Ought to this occur, the worth could hit $3,112.

A have a look at the Aroon Indicator additionally strengthened the bearish bias. As of this writing, the Aroon Down (blue) was 100% whereas the Aroon Up (orange) was 35.71%. This means that sellers had been in command of the worth motion.

ETH is oversold

Moreover, an evaluation of the Supertrend indicated that ETH has not but flashed a purchase sign. However there was an earlier promote sign at $3,780.

In the meantime, the Relative Energy Index (RSI) was within the oversold area. If the studying continues to lower, then the possibilities of a tougher bounce may also improve.

In a extremely bullish case, ETH may climb to $4,500 when the market turbulence fizzles.

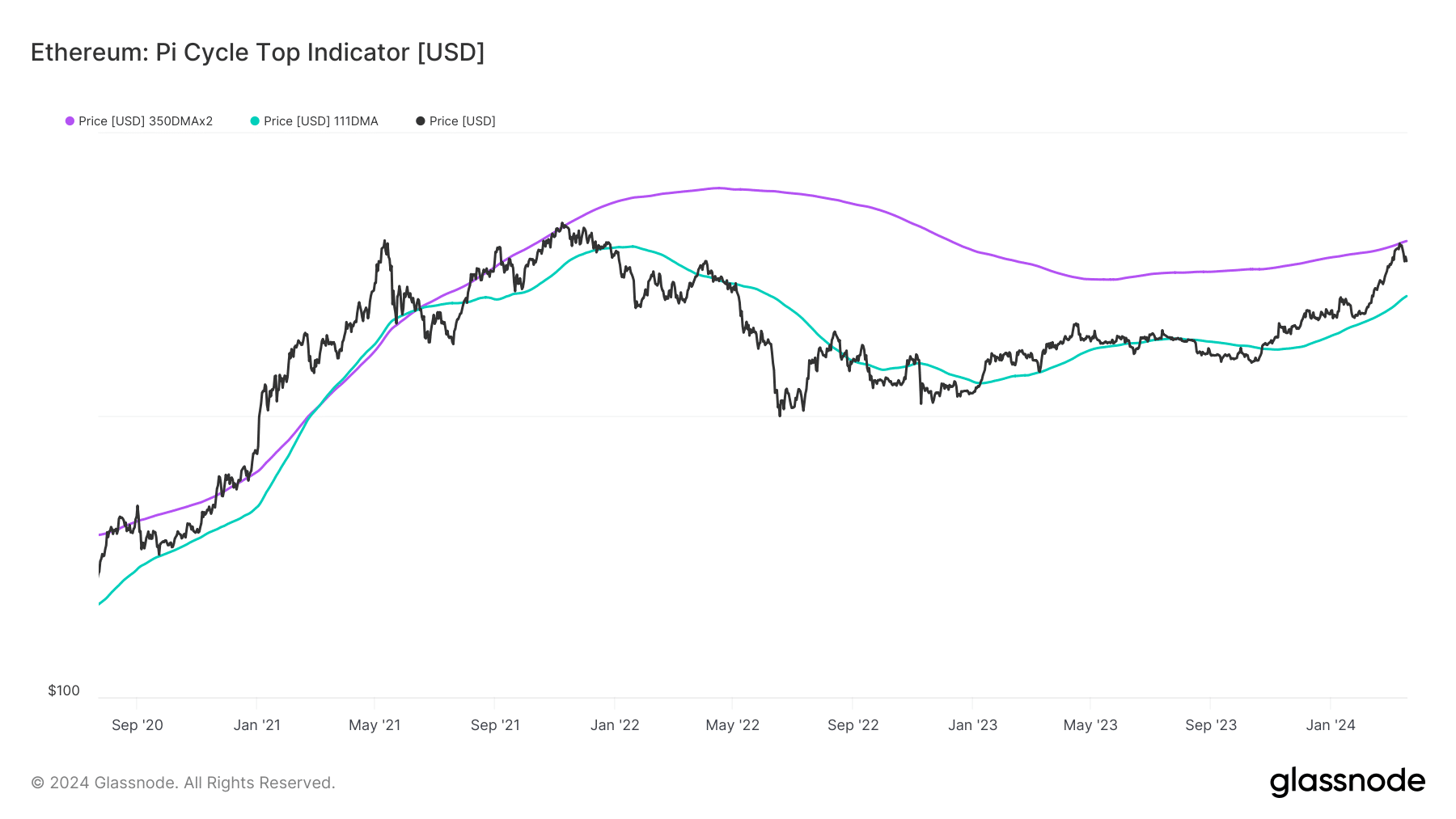

Whereas the short-term outlook seemed gloomy for ETH, the Pi Cycle Prime indicated in any other case for the mid to long-term.

Traditionally, the indicator tells when a cryptocurrency is near the underside or has hit the market prime.

How a lot are 1,10,100 ETHs worth today?

If the 111-day transferring common (MA), in inexperienced hits the identical area because the 350-day MA (purple), then Ethereum would have hit the highest of this cycle.

However that was not the case, because the 111-day MA was decrease than its reverse quantity. Thus, the worth of ETH might need plenty of upside potential over the forthcoming months.