- ETH registered a average uptick, mountain climbing by 3.39% on the month-to-month chart

- Ethereum’s MVRV rating declined over the previous month

Over the previous month, Ethereum has seen a reversal of its fortunes. Beforehand, the altcoin appeared to be failing to keep up any upward momentum in any respect.

Nonetheless, on the time of writing, Ethereum was buying and selling at $2441. This marked a 3.39% hike on the month-to-month charts, with the altcoin gaining on the weekly and every day charts too.

As anticipated, prevailing market situations have left many within the Ethereum group deliberating over the altcoin’s trajectory. One in all them is Cryptoquant’s analyst Burak Kesmeci. In response to him, ETH’s present MVRV ranges could current a shopping for alternative.

Ethereum MVRV rating declines for 4 months

In his evaluation, Kesmeci posited that Ethereum’s MVRV rating has continued to say no over the previous 4 months. In response to him, ETH MVRV has did not surpass its March ranges of two.25 factors, with the identical now sitting at 1.22 factors.

To place it in context, ETH’s MVRV rating has fallen for the final 120 days, hitting a low of 1.93. What this implies is that for the altcoin to register one other rally, it should reclaim its March ranges of two.25.

Merely put, for ETH to rally on the charts once more, its MVRV rating should register an uptick. By extension, what this additionally means is that for the reason that altcoin didn’t notice any uptick on the charts, proper now, there may be little potential for a bull run.

What does ETH’s chart say?

Whereas the evaluation supplied by Kesmeci factors to situations that have to be met for ETH to rally, it’s important to test different market fundamentals and decide what the present scenario is.

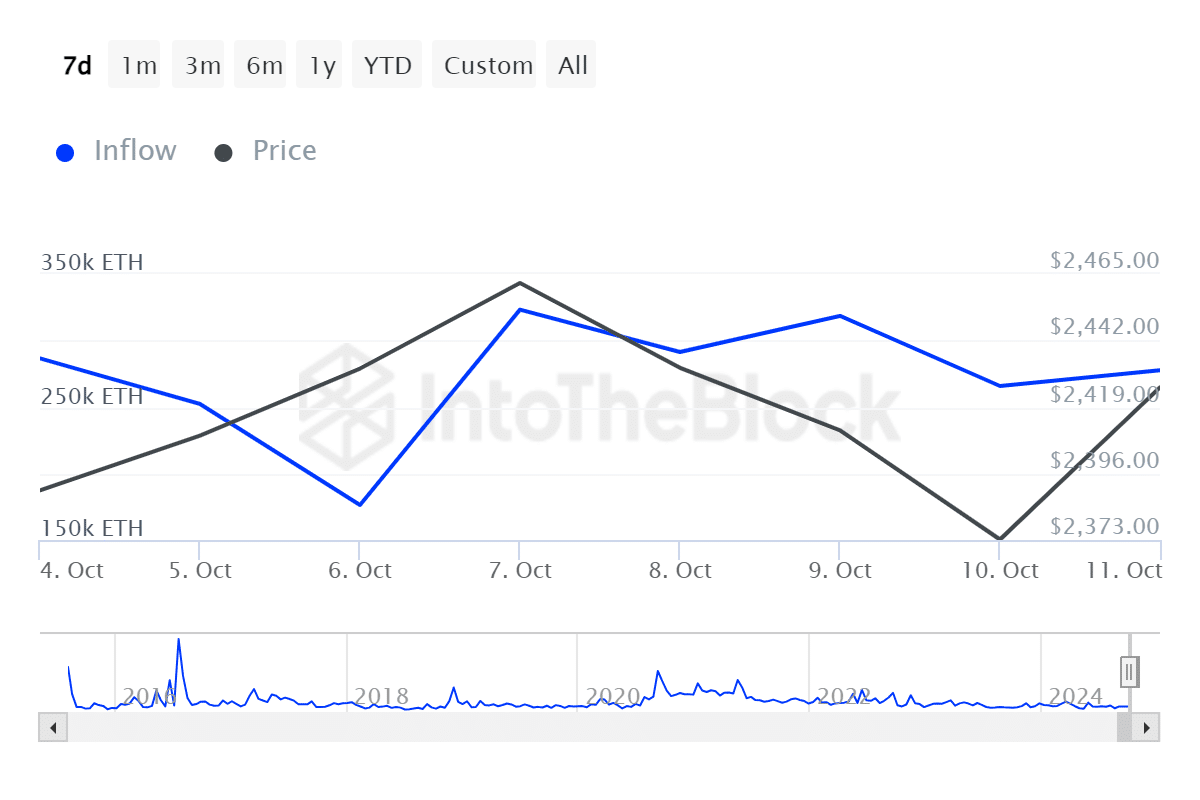

For starters, Ethereum’s giant holders’ influx has elevated by 57.46% from a low of 176.29k to 277.58k over the previous week.

Normally, a spike in giant holders’ influx highlights sturdy shopping for exercise and could possibly be an indication of constructive momentum.

Moreover, Ethereum’s Open Curiosity per alternate rose by 8.89% from $2.25 billion to $2.4 billion.

This recommended that buyers have been frequently opening new positions, whereas holding current ones.

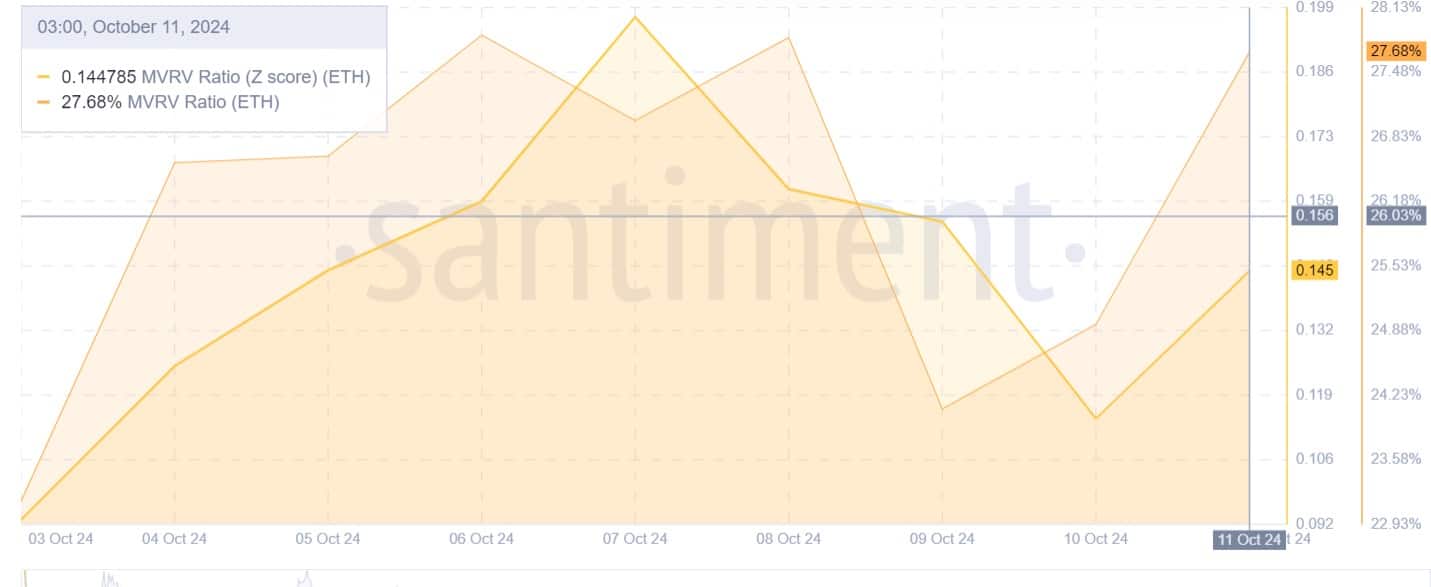

Moreover, Ethereum’s MVRV Z Rating at 0.145 indicated that ETH has been experiencing a wholesome market surroundings.

At this degree, costs are stabilizing after a market correction. Thus, it implied that the prevailing market situations usually are not a speculative bubble nor undervalued.

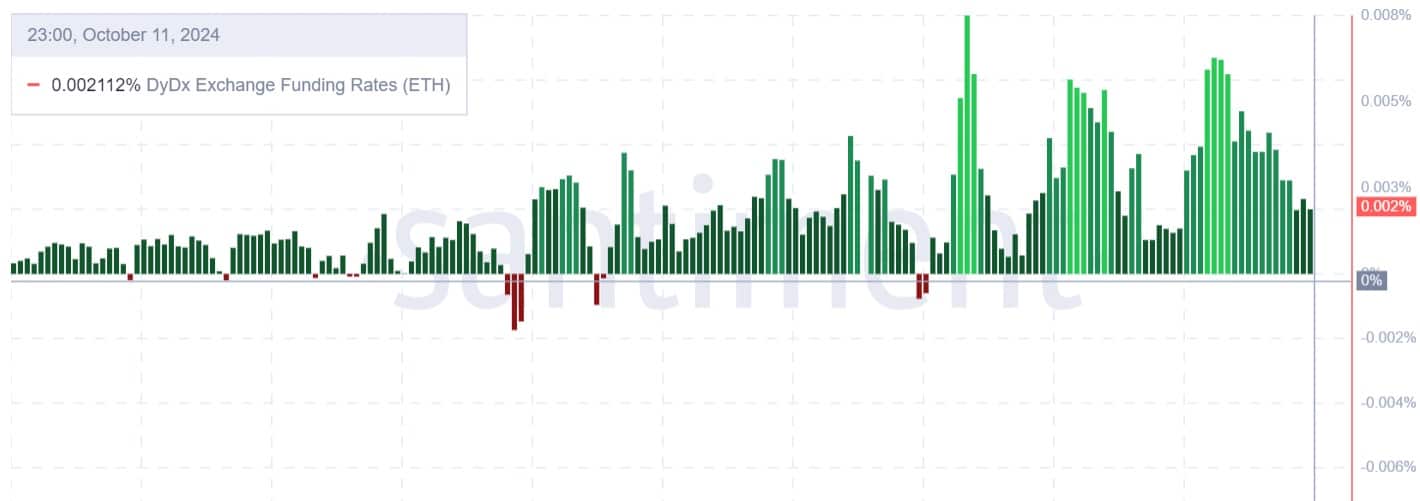

Lastly, Ethereum’s DyDx Alternate funding fee has remained constructive all through the previous week. This alludes to excessive demand for lengthy positions, with buyers keen to pay premiums for his or her positions in the course of the market downturn.

Merely put, whereas ETH is but to rally and it’s early to say a rally has arrived, the present situations present a good surroundings for a possible upswing. As such, if present market situations maintain, ETH will hit its $2557 resistance degree within the brief time period.