- Ethereum’s promote stress from giant holder flows outperformed inflows from the identical class.

- A recap of the combined indicators, and why ETH might be on the verge of a retracement.

Holders have been holding on to hopes that Ethereum [ETH] may rally above $4,000 earlier than the top of 2024.

Whereas the cryptocurrency demonstrated indicators of sustaining the bullish momentum achieved in November, a large pullback might be brewing.

Whale exercise signifies that ETH promote stress is likely to be build up. An unsurprising consequence contemplating that the beforehand strong momentum has seemingly cooled off.

On high of that, ETH giant holder exercise has been rising and could also be contributing to bearish momentum.

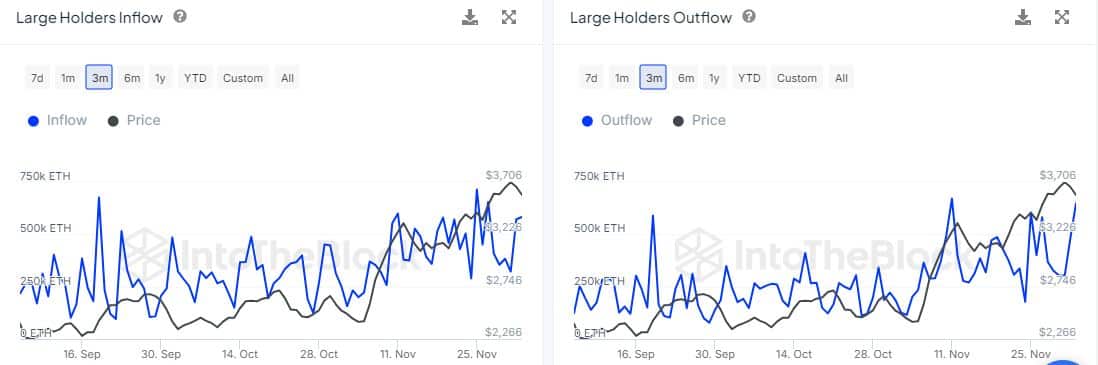

IntoTheBlock knowledge revealed that enormous holder outflows peaked at 647,220 ETH on the third of December. Giant holder inflows additionally grew within the final three days and peaked at 582,710 ETH as per the most recent knowledge.

The distinction between inflows and outflows steered that there was extra promote stress from whales than demand. This was not the one signal demonstrating bullish weak spot.

Ethereum ETF inflows remained bullish to this point this week. Nonetheless, they declined significantly in comparison with every week in the past.

For context, Ethereum ETFs had optimistic flows on the third of December at $132.6 million, an enchancment from $24.2 million throughout yesterday.

Ethereum ETFs soared as excessive as $332.9 million on Friday final week. This implies ETF inflows declined significantly.

Is bullish demand weakening?

Whereas one might view the disparity as an indication of shrinking demand, it’s value noting that demand might develop or decline from someday to a different.

Nonetheless, the above observations do spotlight the slowdown in ETH bullish demand through the weekend.

Whereas giant holder flows and Ethereum ETFs sign doubtlessly declining demand, spot flows painted a unique image.

Spot inflows peaked at $285 million within the final 24 hours and $252.69 million on the third of November.

The optimistic spot flows have been in tune with ETH’s value motion. This bullish demand contributed to the cryptocurrency’s restoration within the final two days.

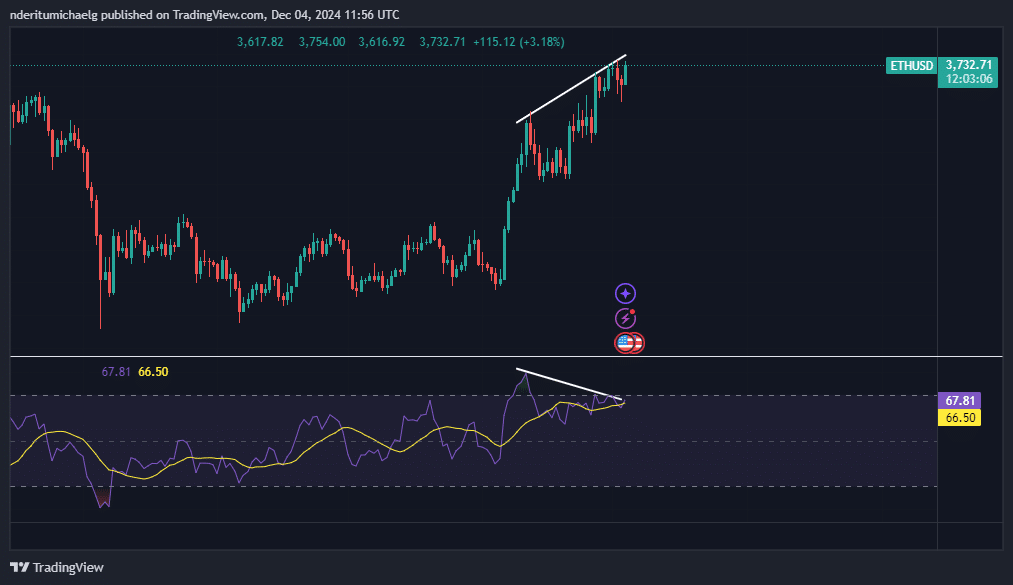

ETH exchanged fingers at $3,731 on the time of writing, recovering from the preliminary promote stress noticed at the beginning of the week. Nonetheless, there may be one main motive for the rising expectations of a retracement.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

ETH’s value motion has been forming a bearish divergence with the RSI. This means {that a} sizable pullback might be on the playing cards.

A retracement from the present degree may see value dip all the way in which to the $3050 value degree. This is likely one of the more moderen assist ranges or the cryptocurrency.