- ETH bears consider that low charges, L2 fragmentation, and competitors from BTC and SOL might dent value prospects.

- Nonetheless, ETH bulls foresee a long-term demand and worth appreciation for the altcoin.

Ethereum [ETH] has had a bittersweet value motion within the present market cycle. Between late 2023 and early 2024, the biggest altcoin rallied over 150%, leaping from $1600 to $4K.

Nonetheless, general market headwinds and the SEC’s combined indicators on ETH’s safety standing in Q2 2024 dented its sentiment. Regardless of a last-minute pivot by the SEC and the profitable launch of US spot ETH ETF, the altcoin’s value has remained muted.

ETH’s bull vs bear case

On the time of writing, ETH’s worth was beneath $3K, and the crypto neighborhood appears divided on its value prospects. As highlighted by Flip Analysis, the bull and bear camps have sturdy and compelling arguments.

ETH’s bear case

For the bear case camp, the market analysis analyst famous that ETH’s diminished income, L2 fragmentation, and direct competitors from Bitcoin [BTC] and Solana [SOL] didn’t bode effectively for the altcoin’s worth.

For context, after the Dencun improve, charges dropped, and extra customers migrated to L2s.

‘Profitability has dropped off a cliff post-Dencun, and it doesn’t seem like that can change quickly’

Nonetheless, L2s’ fragmentation has intensified, giving Solana’s monolithic chain a aggressive edge and additional denting ETH’s value outlook. Per Flip Analysis,

‘At present @l2beat is monitoring 71 L2s, 20 L3s, and an unimaginable 82 upcoming launches. That is considerably degrading UX, and changing into a big barrier to widespread adoption. In the meantime, SOL has proven the potential of a monolithic chain & ecosystem.’

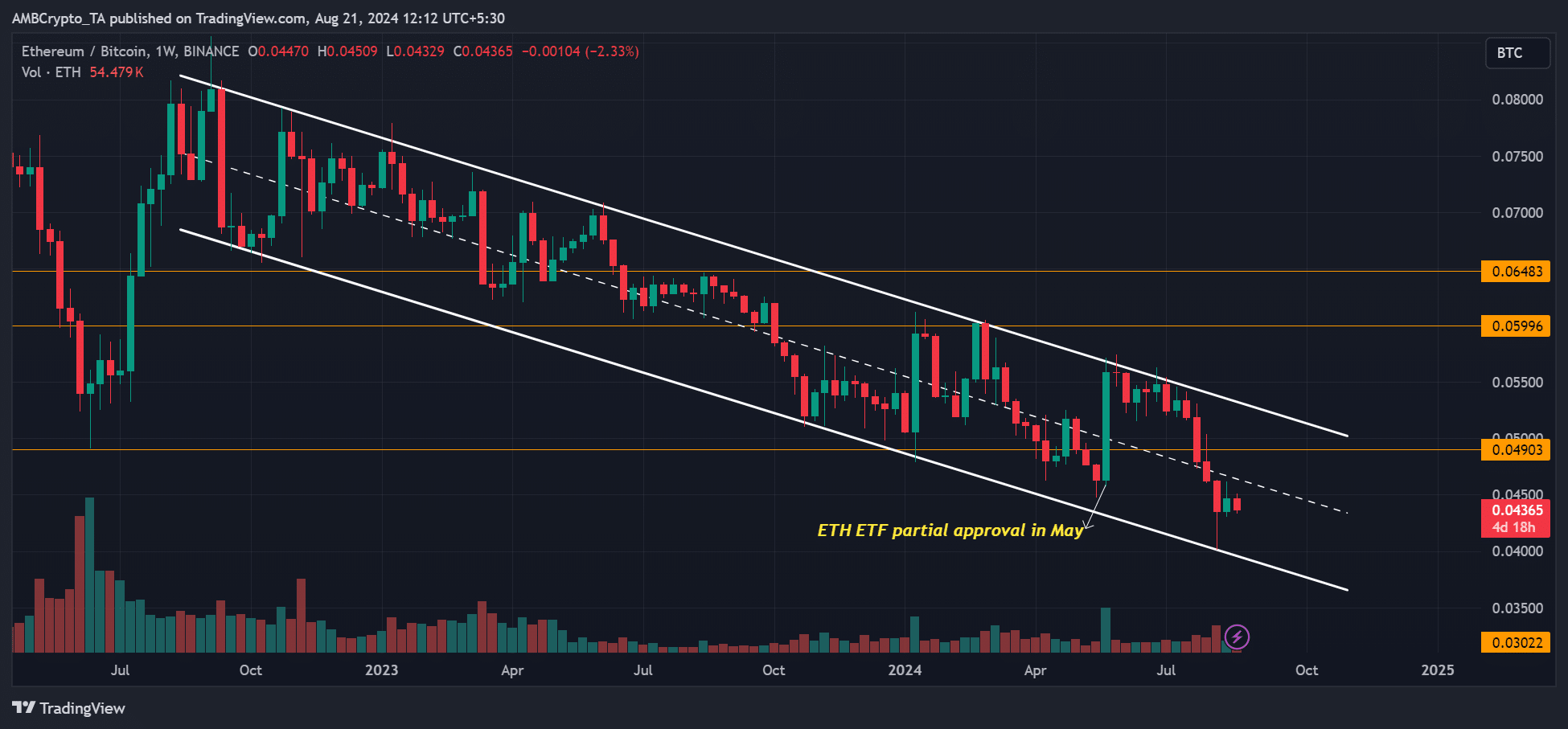

Moreover, ETH has been underperforming SOL and BTC, as proven by the declining SOLETH and ETHBTC ratios. This underscored weak sentiment on the main altcoin, per Flip Analysis.

The ETHBTC ratio, which tracks ETH’s relative efficiency to BTC, has decreased regardless of the US spot ETH ETF approvals. This meant that ETH underperformed BTC over the identical interval.

ETH’s bull case

Nonetheless, ETH bulls have countered the bear camp with stable arguments. Flip Analysis famous that memes eclipsed the DeFi narrative. However a story shift was underway.

‘ETH’s underperformance this 12 months has coincided with a rotation from DeFi to memes. Nonetheless, it appears to be like just like the narrative could also be shifting.’

One other essential level was that ETH was the one institutional-grade and battle-tested chain. BlackRock’s curiosity within the chain for on-chain tokenization additional supported this argument.

‘Lots of the smartest minds within the house are collaborating on the ETH roadmap. Any institutional onboarding will probably be executed on ETH, whether or not or not it’s RWAs and on-chain tokenisation, prediction markets and so forth.’

Coinbase analysts additionally projected a continued demand for ETH in the long term as utilization in L2 protocols surges.

‘Present tendencies lead us to anticipate continued power in ETH demand from different protocol-based avenues similar to collateral in cash markets or buying and selling pairs in DEXs’

Nonetheless, on his half, Ali Muneeb, one of many pioneers of Bitcoin DeFi and Stacks [STX] founder, said that he would choose Solana over Ethereum.

‘I’d choose Solana over Ethereum any day.’

In the meantime, ETH has been consolidating above $2500 for the second week as general crypto market sentiment stays weak. With stable arguments on either side, whether or not ETH’s sentiment will enhance or not stays to be seen.