- Nearly 11% of ETH’s whole provide was accessible for lively buying and selling.

- Traders confirmed much less willingness to half with their ETH holdings.

Are you interested by shopping for Ethereum [ETH] however not getting sufficient sellers out there? Effectively, you won’t be the one one!

ETH’s liquid provide dwindles

With a formidable begin t0 2024, gaining almost 57% year-to-date (YTD), and the prospect of a spot ETF looming, ETH may be one of many hottest entities within the crypto market at the moment.

However demand will not be the issue for the king of altcoins. Provide is.

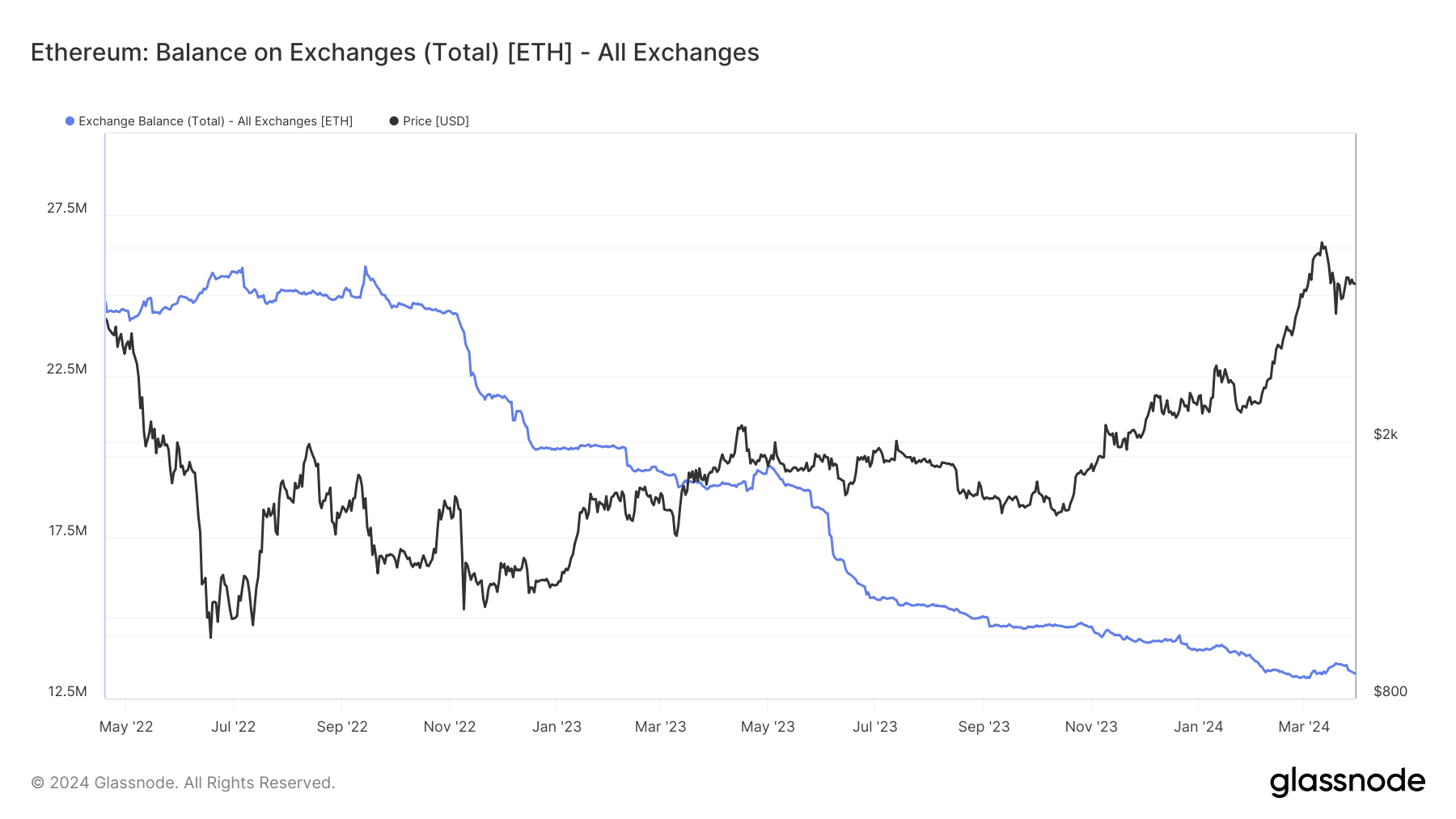

Based on AMBCrypto’s evaluation of Glassnode’s knowledge, ETH reserves on exchanges plunged to new lows as of this writing.

In truth, nearly 11% of whole provide was accessible for lively buying and selling, down from 15.8% right now final 12 months.

The pattern has continued in 2024, regardless of a 57% enhance in ETH’s worth year-to-date (YTD). If the downward trajectory continues, the availability crunch would worsen additional.

Usually, such shortages assist in bolstering costs in the long term, offered demand stays robust.

As evident, the availability plummeted all through 2022 and 2023, however ETH nonetheless underperformed, owing to bear market-induced uncertainties.

Nonetheless, with enhancing sentiment relating to cryptocurrencies, coupled with ETH’s personal potential bullish catalysts like spot ETFs, the pursuit to seize the second-largest digital asset might solely get stronger.

ETH whales busy stockpiling

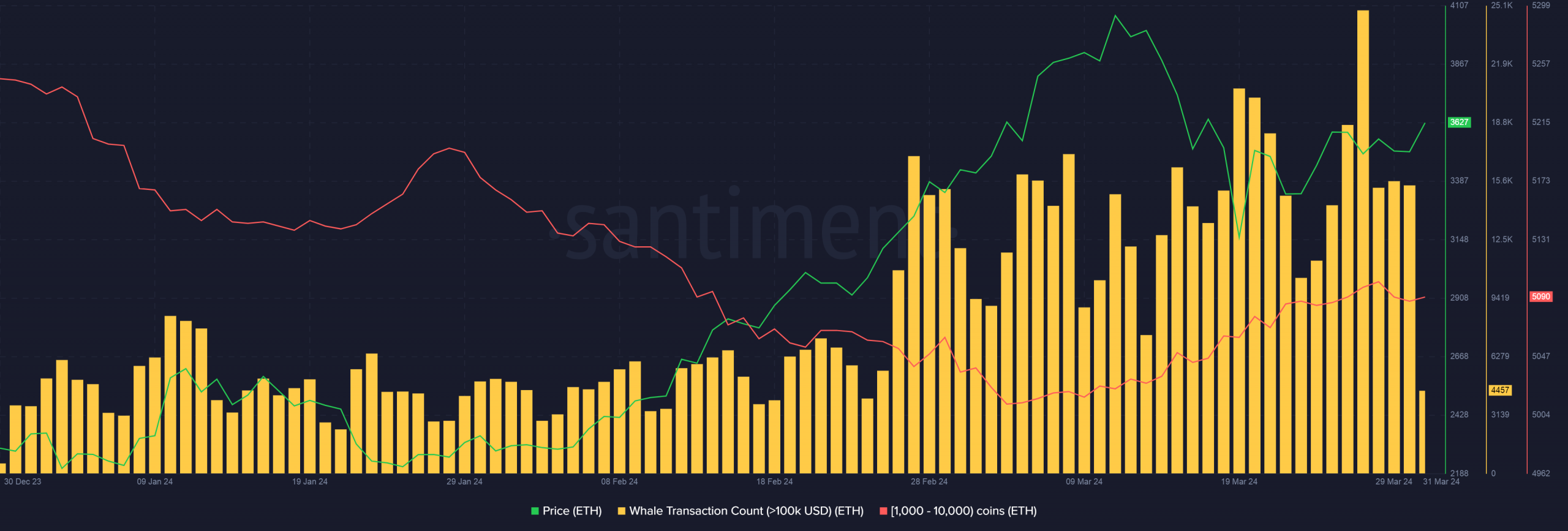

Whales, who’re recognized for possessing a big chunk of ETH’s provide, appear to be bullish on ETH as nicely.

As per AMBCrypto’s evaluation of Santiment’s knowledge, whale transactions value over $100k elevated these days regardless of a value correction.

These transactions led to an uptick within the variety of wallets holding between 1,000 to 10,000 cash.

What are you able to anticipate from ETH?

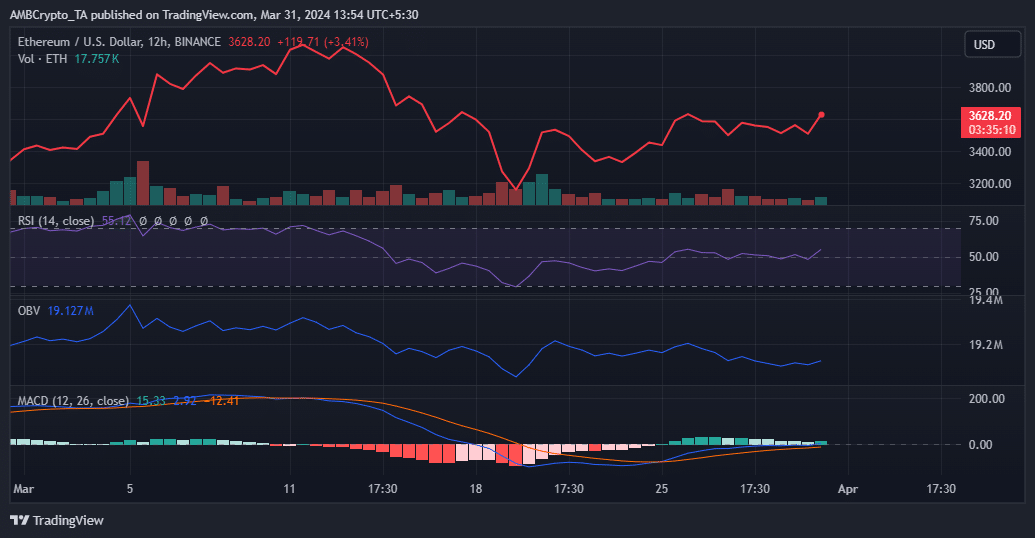

To realize a greater view of ETH’s present market state, AMBCrypto analyzed a few of its key technical indicators utilizing TradingView.

The Relative Power Index (RSI) bounced above the impartial 50 line for the primary time since mid-March. A transfer above 60 might consolidate bullish sentiments and pave manner for its rise in direction of $4,000.

That being mentioned, the On Steadiness Quantity (OBV) did not make larger peaks like value, moved sideways within the final 10 days. This steered that the uptrend would possibly stall.

Is your portfolio inexperienced? Try the ETH Profit Calculator

Furthermore, the Transferring Common Convergence Divergence (MACD) was on the threat of going beneath the sign line within the subsequent few days. Such an occasion would strengthen bearish narratives.

Conversely, a transfer above zero might help in additional value positive aspects.