The price of Bitcoin skilled an early weekend surge following Federal Reserve Chairman Jerome Powell’s speech on the Jackson Gap symposium. Based on the most recent on-chain remark, the announcement of potential rate of interest cuts has led to a rise in Bitcoin demand previously day.

BTC Demand Sees Progress In The US — Affect On Worth?

In a latest publish on the X platform, CryptoQuant’s Head of Analysis Julio Moreno revealed that demand for Bitcoin has been on the rise in the US previously 24 hours. This progress got here on the again of the Fed disclosing {that a} cycle of decrease rates of interest would quickly begin.

Decrease rates of interest by the central financial institution are sometimes a welcome growth for dangerous property like Bitcoin, the world’s largest cryptocurrency. Falling rates of interest are likely to diminish the earnings on conventional monetary devices reminiscent of bonds, making cryptocurrencies extra enticing choices for traders in search of increased yields.

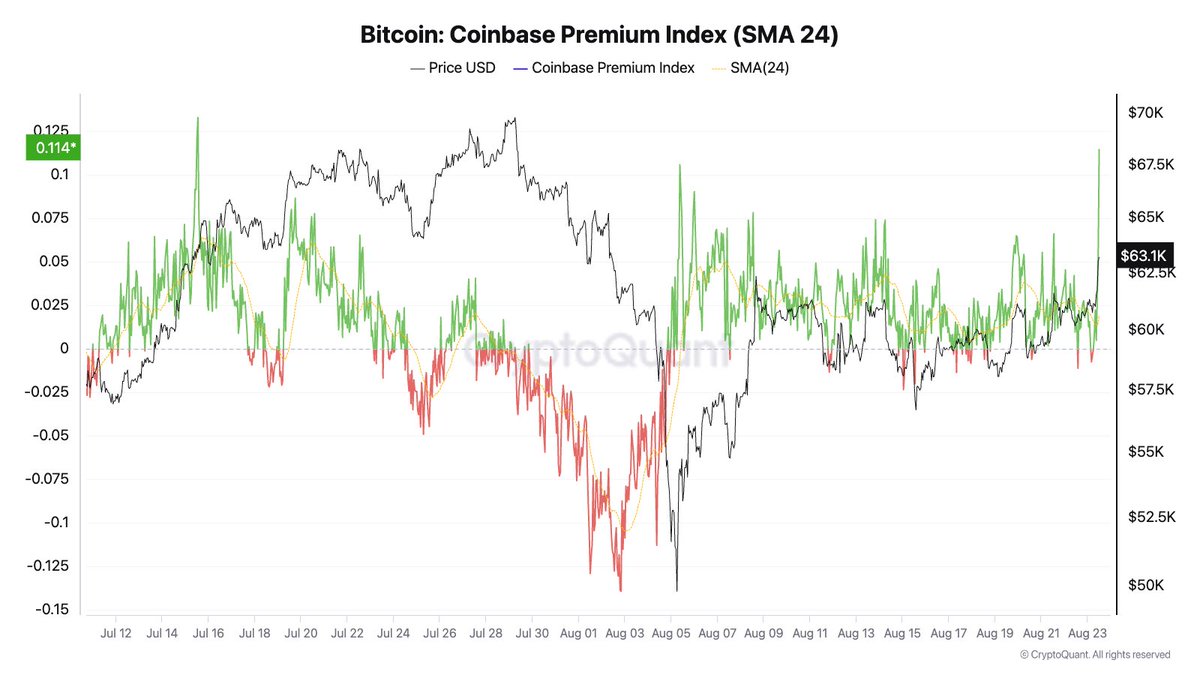

Based on Moreno, the BTC value premium on Coinbase — the biggest cryptocurrency change within the US — has surged to its highest stage since mid-July. For context, the Coinbase premium refers back to the distinction between the coin’s worth on Coinbase and different international centralized exchanges.

Chart exhibiting BTC's Coinbase premium index | Supply: jjcmoreno/X

Sometimes, when the BTC value premium on Coinbase is rising, it implies that there’s growing demand from US investors, as they’re keen to spend extra to amass Bitcoin. As earlier defined, this heightened demand is smart given the chance of rate of interest cuts and fewer worthwhile conventional monetary devices.

Rising demand is a very good signal for the value of Bitcoin, because it means that traders are positioning themselves to reap from a promising crypto future. On the similar time, the rising demand and the rising value premium may end in elevated market volatility.

Moreover, the growing US Bitcoin demand comes simply on the proper time, as demand progress has remained at low ranges over the previous few weeks. CryptoQuant observed in a report that BTC’s obvious demand has been sluggish since April 2024 when the coin’s value was round $70,000.

Based on the blockchain intelligence agency, the obvious demand must see some progress for BTC’s value to see some daylight. Finally, if the rising demand in the US is sustained and unfold to different markets, traders may see the flagship cryptocurrency return to round its all-time excessive.

Bitcoin Worth At A Look

As of this writing, the price of BTC is hovering round $64,000, reflecting an over 5% enhance previously day. Based on information from CoinGecko, the premier cryptocurrency is up by 7.5% previously week.

The worth of BTC on the each day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView