- Bitcoin’s Open Curiosity surged to over $19 billion after a $2.5 billion Futures liquidation.

- BTC faces sturdy resistance at $63,400, with current worth hovering round $62,700 after a 3% rise.

Bitcoin’s [BTC] Open Curiosity skilled important volatility following a current worth surge, with a number of positions being closed.

Regardless of this, Open Curiosity in Bitcoin Futures has maintained excessive ranges, and a notable spike has even been seen in current days, signaling continued dealer curiosity.

Bitcoin Futures expertise a shake-up

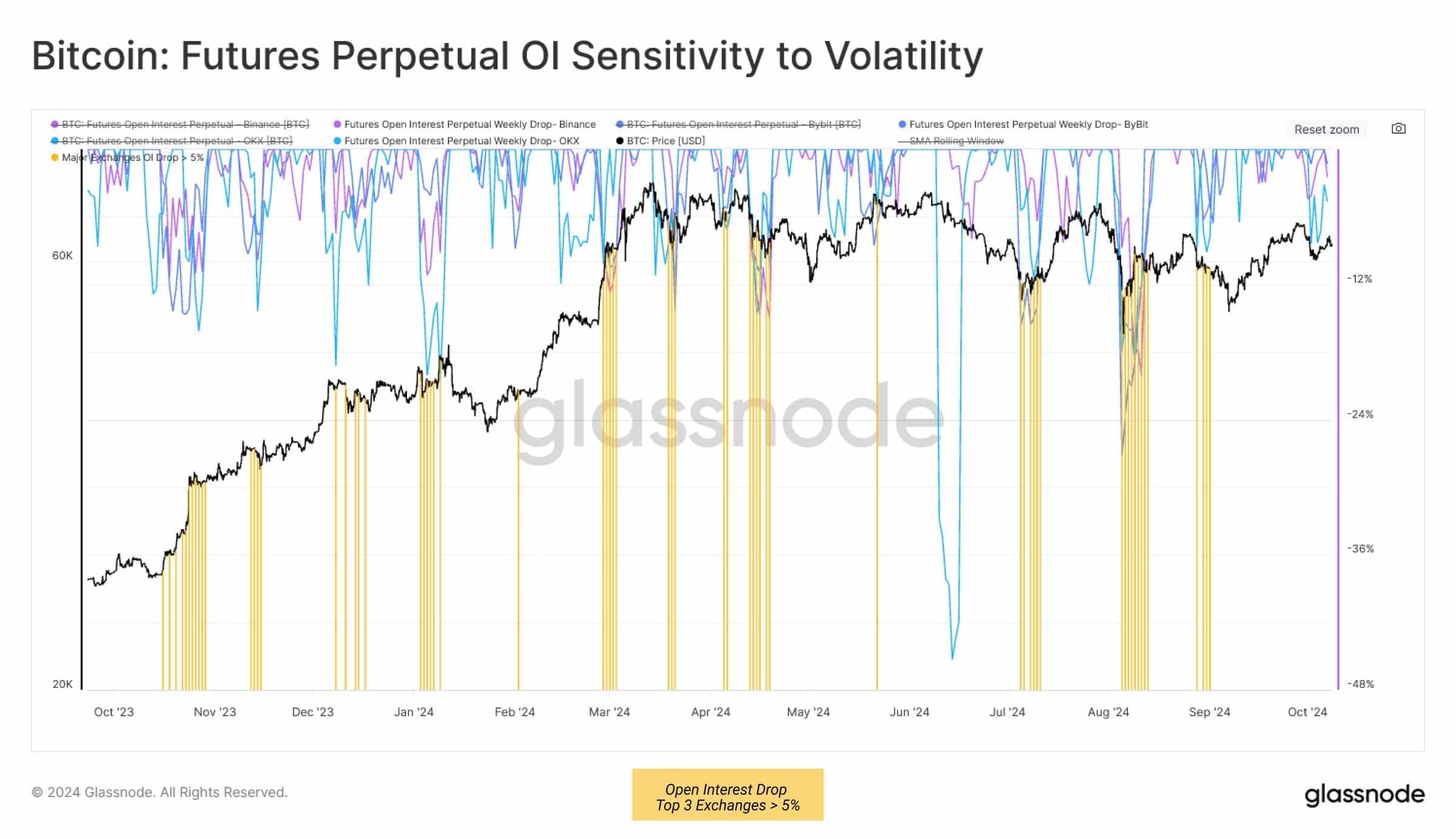

Knowledge from Glassnode revealed that in Bitcoin’s worth rally, roughly $2.5 billion price of Futures Open Curiosity was forcibly closed, doubtless flushing out many quick sellers.

Nevertheless, the share discount in Open Curiosity throughout the highest three perpetual exchanges remained under 5%, indicating that the substantial influence didn’t result in a dramatic market collapse.

This highlighted the market’s resilience, which, even amidst heightened volatility, might proceed to have an effect on leveraged merchants.

Traditionally, the whole price of leverage throughout Bitcoin’s March all-time excessive (ATH) reached as excessive as $120 million weekly.

This determine has dropped to $15.3 million per week in current weeks, reflecting a big discount in speculative, long-biased trades because the market entered a range-bound section.

Elevated funds circulation into Bitcoin’s Open Curiosity

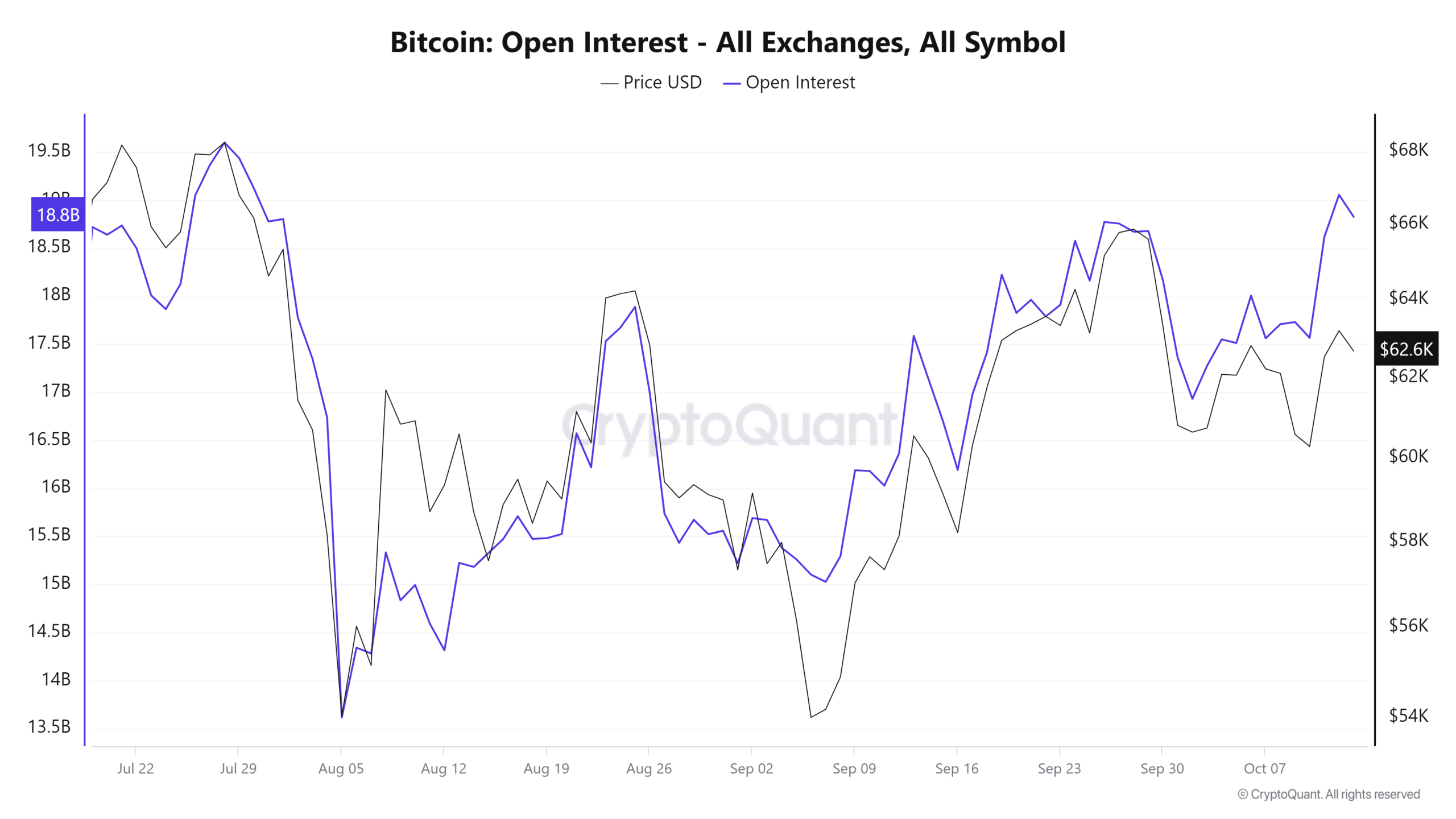

Regardless of the sooner closures of enormous positions, merchants proceed to open new ones.

In response to CryptoQuant, Bitcoin’s Open Curiosity, which was round $17.5 billion on the tenth of October, surged to over $19 billion by the twelfth of October.

Though there was a slight decline since then, Open Curiosity remained sturdy at over $18 billion.

This renewed curiosity from merchants is essentially attributed to Bitcoin’s current worth improve, which pushed the cryptocurrency above the $63,000 mark.

The rise in Open Curiosity alerts that merchants are actively positioning themselves in anticipation of additional worth motion.

BTC faces resistance at key worth ranges

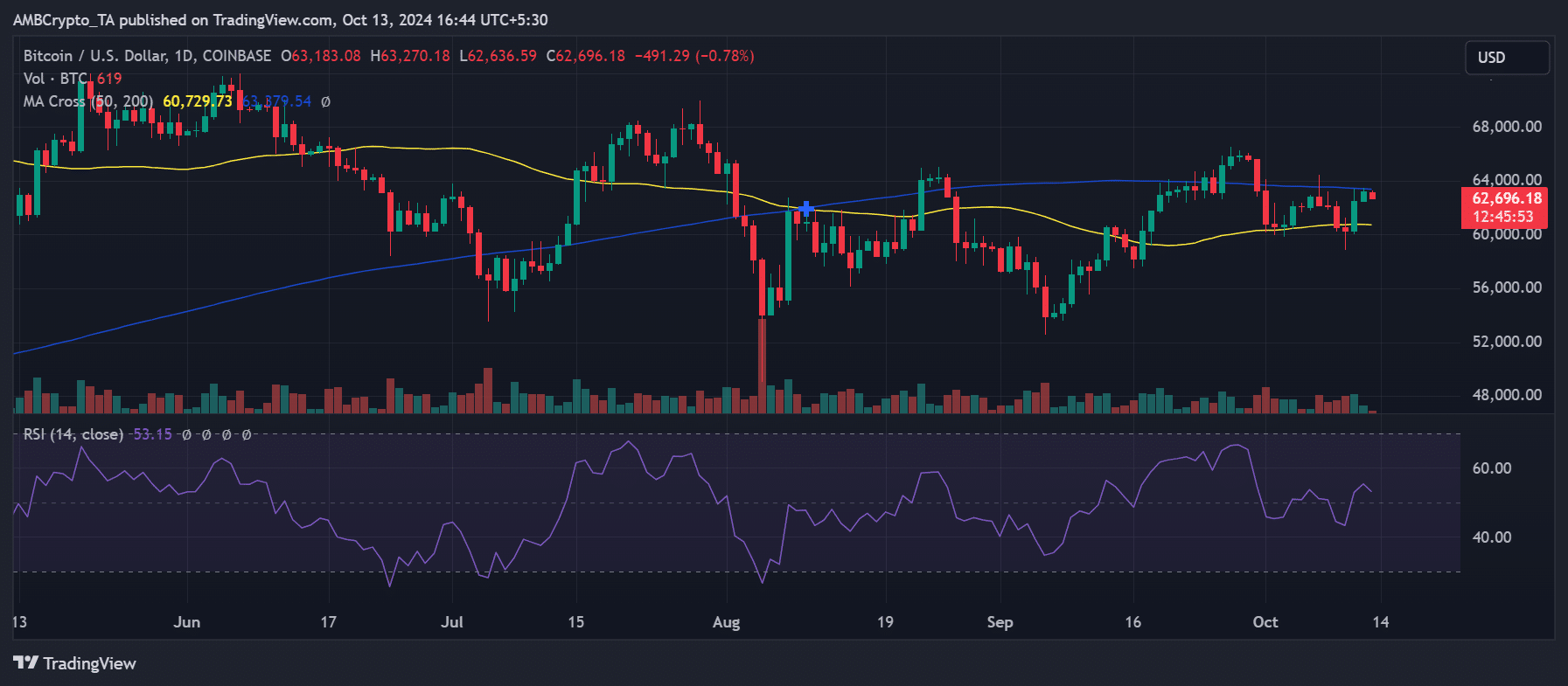

An evaluation of Bitcoin’s each day worth chart confirmed that BTC skilled a 3% worth improve on the eleventh of October, reaching $62,500.

This rally additionally pushed the value above the 50-day transferring common (yellow line), which had beforehand served as a big resistance stage.

Nevertheless, Bitcoin was now going through harder resistance at its 200-day transferring common (blue line), positioned round $63,400.

Whereas the current worth surge pushed BTC to round $63,100, the cryptocurrency failed to interrupt via this significant stage.

As of this writing, Bitcoin has barely declined to $62,700, marking a 1% drop and transferring it farther from the resistance.

Regardless of a interval of volatility and the compelled closure of billions in Futures Open Curiosity, Bitcoin’s Open Curiosity stays sturdy.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

The current worth surge to $63,000 displays growing optimism amongst merchants, though it faces sturdy resistance round $63,400.

The approaching days will decide whether or not Bitcoin can break via this barrier or proceed to face challenges at this key worth level