- The Bitcoin Rainbow Chart steered that BTC was “nonetheless low-cost.”

- Promoting strain was rising on BTC, which may trigger bother.

Sentiment round Bitcoin [BTC] remained bullish because the king of cryptos managed to commerce nicely above the $61k mark. In reality, if the newest knowledge is to be thought of, then issues may get even higher.

This was the case as there have been excessive probabilities of a golden crossover, which may push the coin’s value additional up.

Bitcoin’s upcoming golden crossover

CoinMarketCap’s data revealed that BTC bulls dominated final week because the coin’s value surged by greater than 7%. On the time of writing, BTC was buying and selling at $64,003.47 with a market capitalization of over $1.2 trillion.

Whereas the bulls led the market, Ali, a well-liked crypto analyst, posted a tweet revealing an attention-grabbing improvement. As per the tweet, BTC’s MVRV ratio and its 365-day easy transferring common (SMA) have been on the verge of a crossover.

If that occurs, then BTC may expertise one more bull rally, which might push the coin’s value additional up.

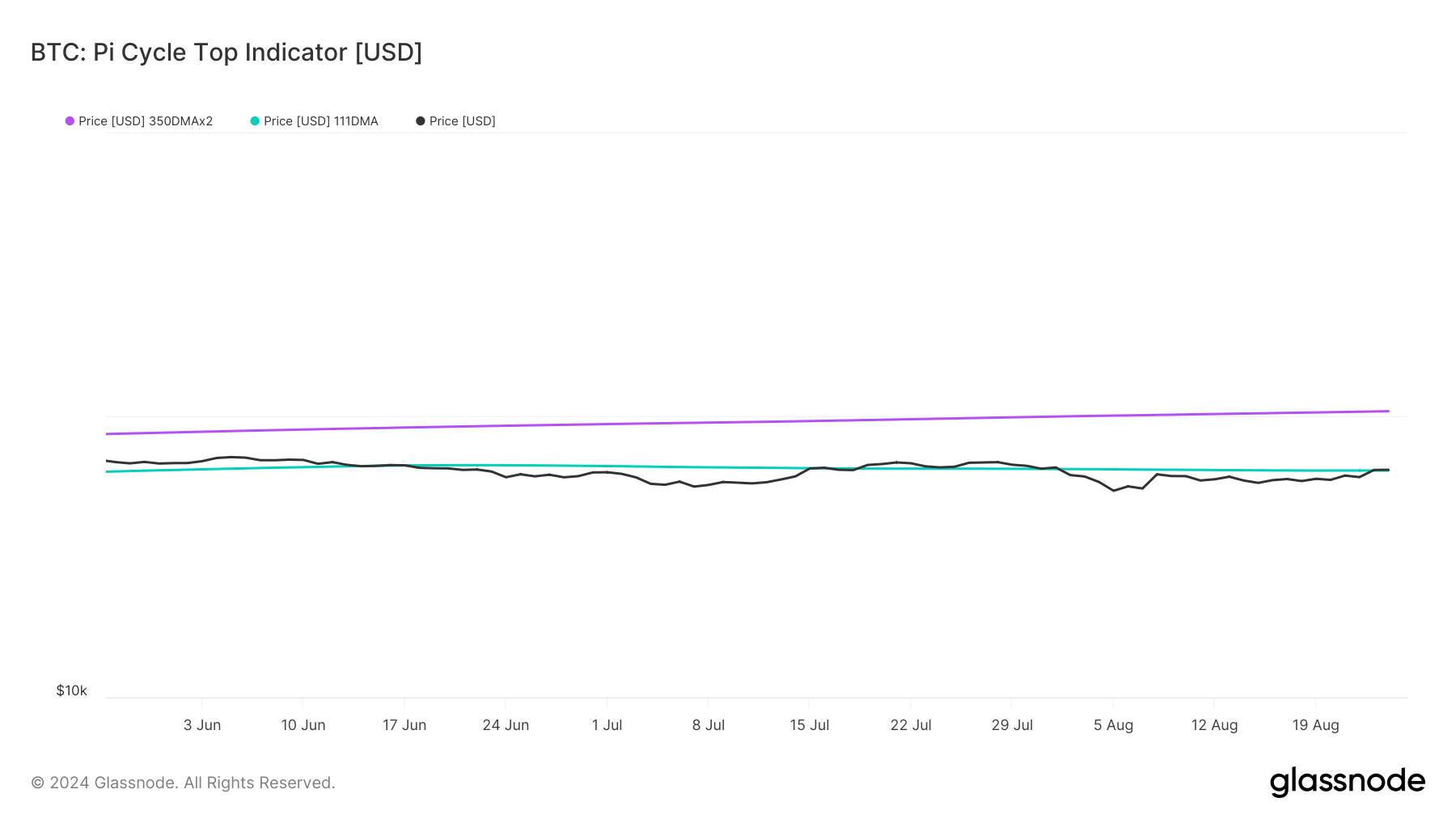

Due to this fact, AMBCrypto investigated additional to search out out the percentages of the golden crossover occurring. As per our evaluation of Glassnode’s knowledge, BTC’s value lastly touched its attainable market backside, in response to the Pi Cycle High indicator.

In case of a golden crossover, then BTC may quickly rally to its attainable market prime of $103k.

BTC’s highway forward

Our evaluation of CryptoQuant’s data revealed that BTC’s change reserve was growing, that means that promoting strain was rising. Aside from this, BTC’s lively addresses dropped by -39.25% in comparison with yesterday.

The overall variety of transactions additionally decreased by -25.39% in comparison with yesterday. Each of those metrics regarded bearish on Bitcoin.

Issues within the derivatives market additionally regarded fairly bearish. This was evident from its crimson taker purchase/promote ratio, suggesting that promoting sentiment was dominant within the futures market.

Nonetheless, a have a look at the Bitcoin Rainbow Chart identified that there may nonetheless be time for traders to build up extra. The chart revealed that at press time, BTC’s value was within the “nonetheless low-cost” zone.

This clearly meant that traders may think about shopping for the coin earlier than its value takes off.

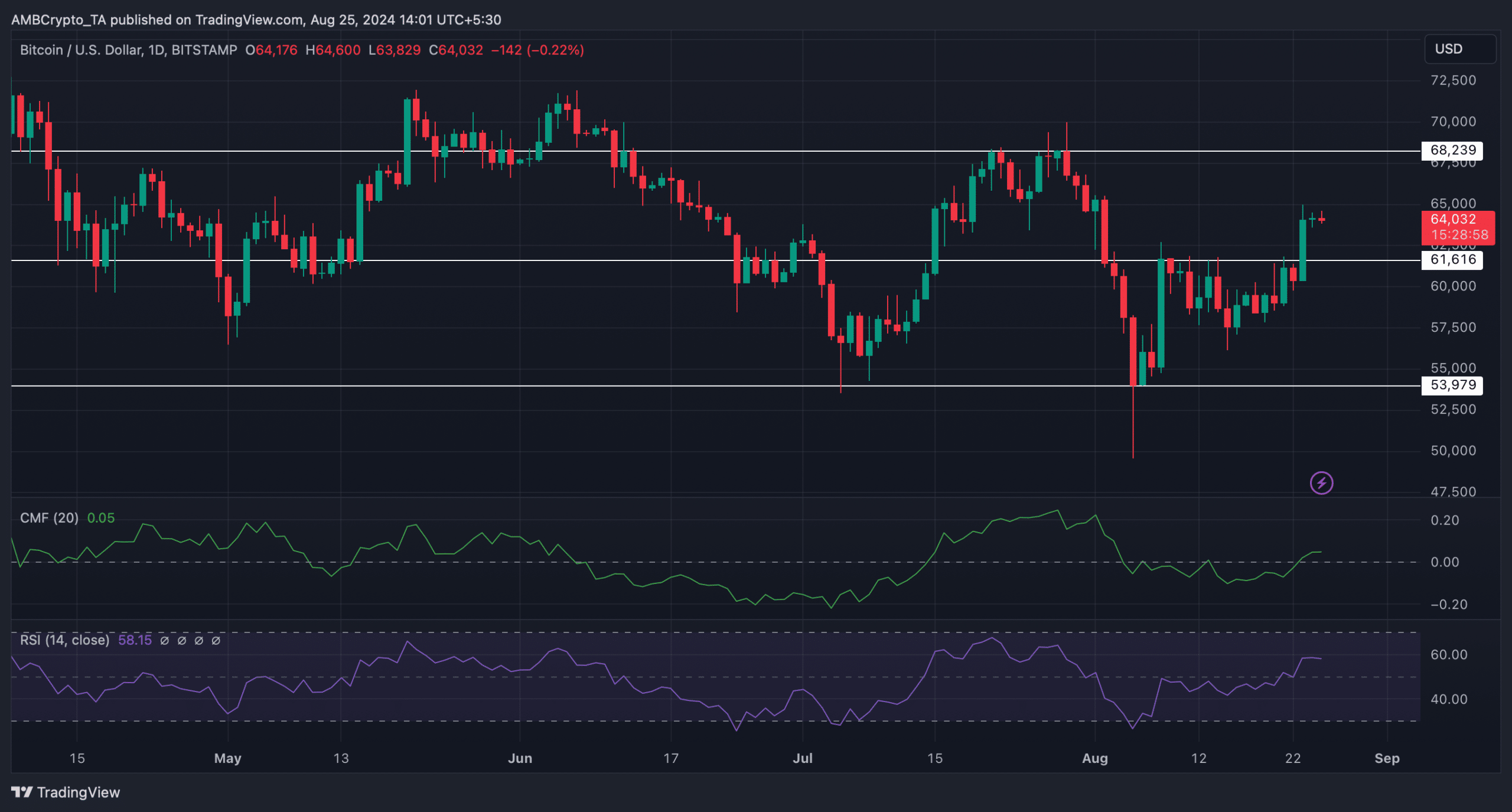

We then assessed the coin’s day by day chart to search out out what market indicators steered. The Relative Power Index (RSI), after a pointy uptick, took a sideways path.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

BTC’s Chaikin Cash Move (CMF) additionally adopted an analogous development, hinting at a couple of gradual transferring days.

In case of a golden crossover, BTC’s may first goal $68k earlier than it eyes its attainable market prime of $103k. Nonetheless, if the bears take over, then the coin may drop to $54k once more.