- Bitcoin’s decrease Hash Value instructed it could be nearing a worth backside, doubtlessly signaling a rebound.

- Rising lively addresses and rising Inventory-to-Move ratio pointed to rising market confidence and shortage.

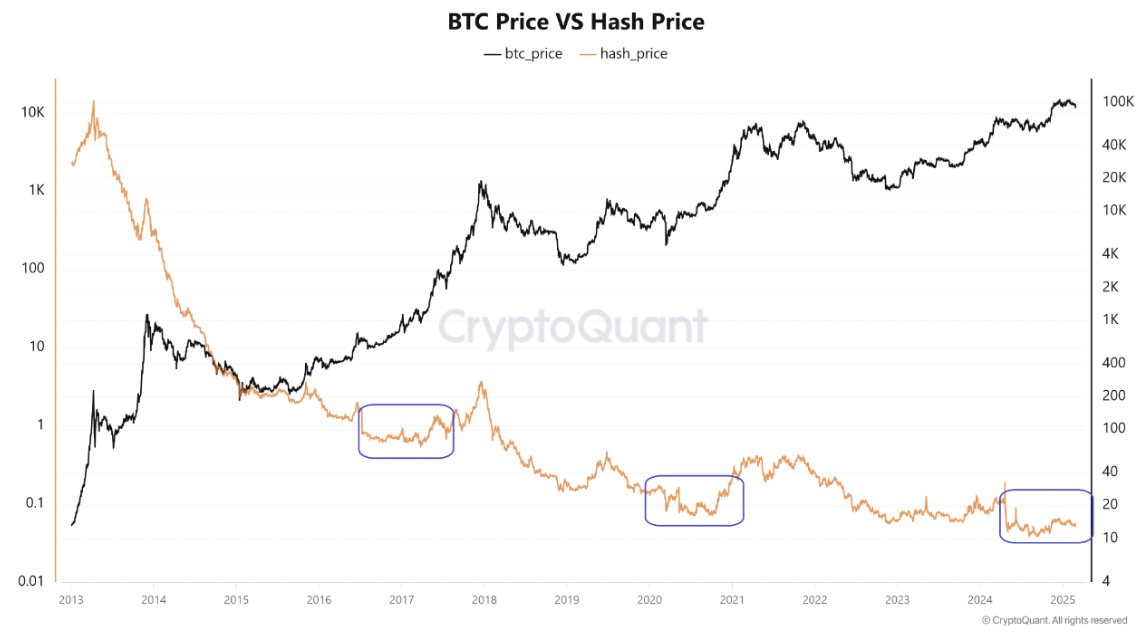

Bitcoin [BTC]’s latest actions in Hash Value aligned with previous patterns, suggesting the cryptocurrency could possibly be approaching a backside. At press time, Bitcoin was buying and selling at $80,101.35, down by 7.67% within the final 24 hours.

Traditionally, decrease Hash Value intervals have marked Bitcoin’s worth bottoming out, signaling {that a} potential rebound could possibly be on the horizon.

As BTC assessments these key ranges, it raises the query—might this be an excellent accumulation section earlier than the subsequent bull run?

Bitcoin’s in/out of the cash chart reveals attention-grabbing insights into the present market sentiment. A big portion of BTC, roughly 75.30% (14.95 million BTC), stays “within the cash,” exhibiting most buyers are nonetheless in revenue.

Nonetheless, 23.23% (4.61 million BTC) of Bitcoin addresses are “out of the cash.” This reveals that whereas most Bitcoin holders stay worthwhile, the market will not be with out its challenges.

BTC: The rising exercise on the blockchain suggests…

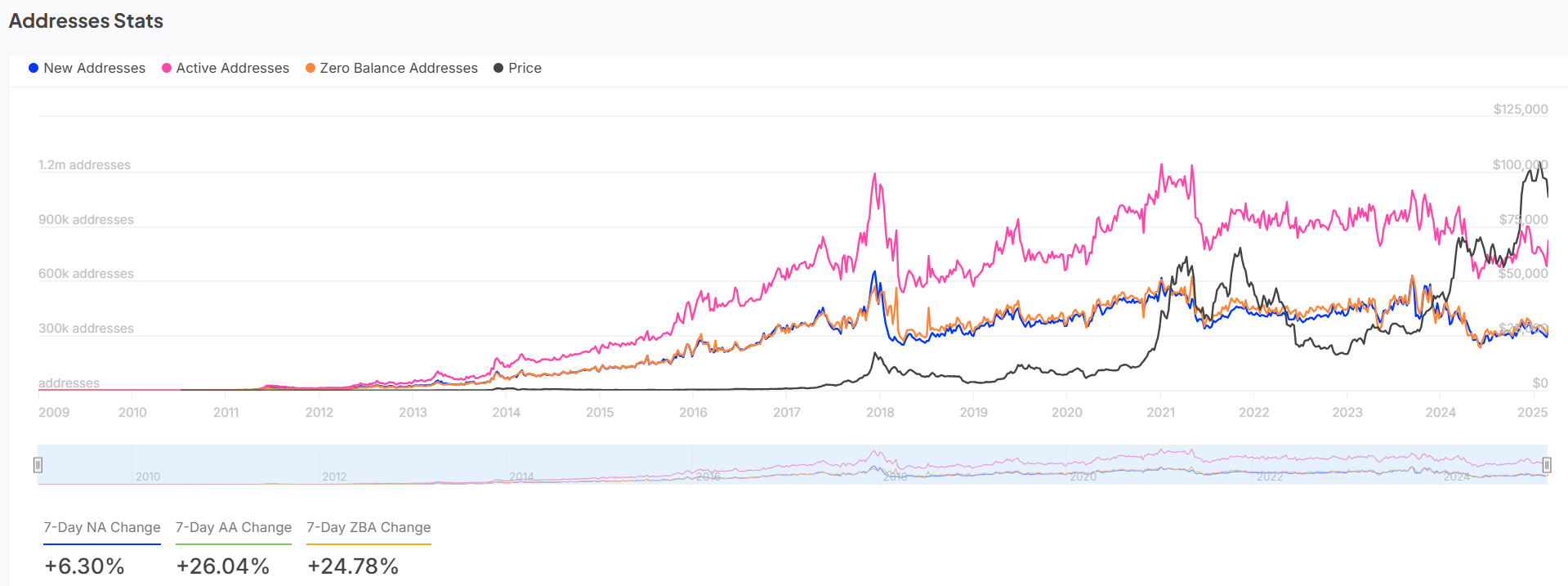

Bitcoin’s deal with statistics supply additional insights into the market’s course. Energetic addresses have elevated by 6.30% during the last 7 days, reflecting rising participation within the Bitcoin community.

The pink line, representing lively addresses, reveals a gradual rise, intently mirroring Bitcoin’s worth actions. In the meantime, the variety of zero-balance addresses has risen by 24.78%, signaling that many new customers are actively holding or buying and selling Bitcoin somewhat than abandoning their wallets.

This surge in exercise, particularly with the rise in new addresses (26.04% over the previous week), means that market confidence is rising. This might result in a worth rebound if BTC continues to achieve momentum.

Breakout forward? Technical indicators present…

Bitcoin’s technical evaluation reveals essential assist and resistance ranges.

On the time of writing, BTC was testing assist at round $80,216, a stage that has seen earlier worth reactions. Nonetheless, the downward trendline and the breakdown of key assist ranges counsel BTC is underneath strain.

Moreover, the Stochastic RSI studying of two.23 alerts an oversold situation, which regularly precedes a worth reversal. The Bollinger Bands additionally level to a tightening sample, indicating that volatility might enhance quickly.

These technical indicators counsel BTC might both bounce from this assist stage or break down additional, relying on future market developments.

BTC stock-to-flow ratio: Rising shortage fuels…

Bitcoin’s Inventory-to-Move ratio has surged by 100% within the final 24 hours, reaching 2.1152M. This means a rise in Bitcoin’s shortage, as the speed of recent provide continues to lower.

The rising Inventory-to-Move ratio means that, whereas BTC faces short-term worth volatility, its long-term worth proposition stays intact.

As fewer BTC cash are launched to circulation over time, shortage will drive up demand, doubtlessly pushing costs increased.

Is Bitcoin making ready for a rebound?

Primarily based on present evaluation, Bitcoin is approaching a possible backside. The decrease Hash Value, mixed with growing lively addresses, alerts a possible worth reversal.

Though technical indicators just like the Stochastic RSI level to an oversold situation, Bitcoin is prone to expertise elevated shopping for exercise. Shortage continues to drive worth.