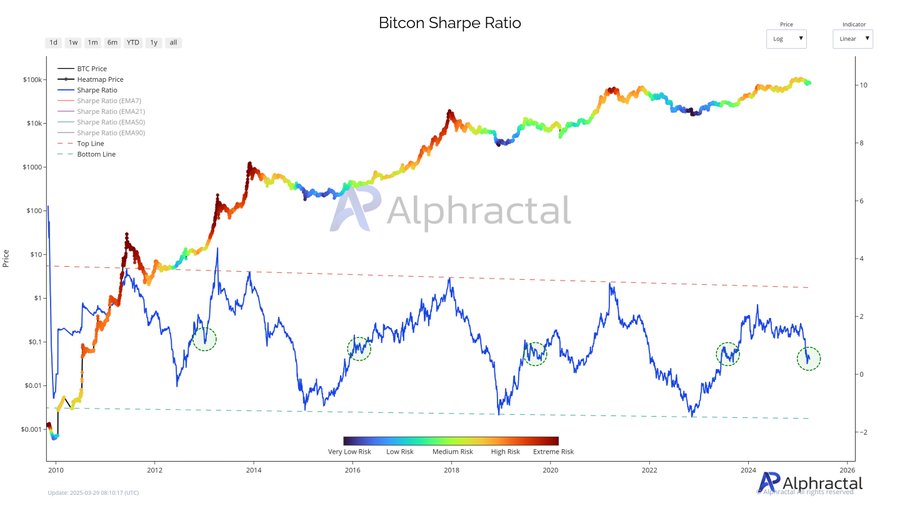

- Bitcoin’s Sharpe Ratio dips to impartial, hinting at consolidation amid waning risk-adjusted returns.

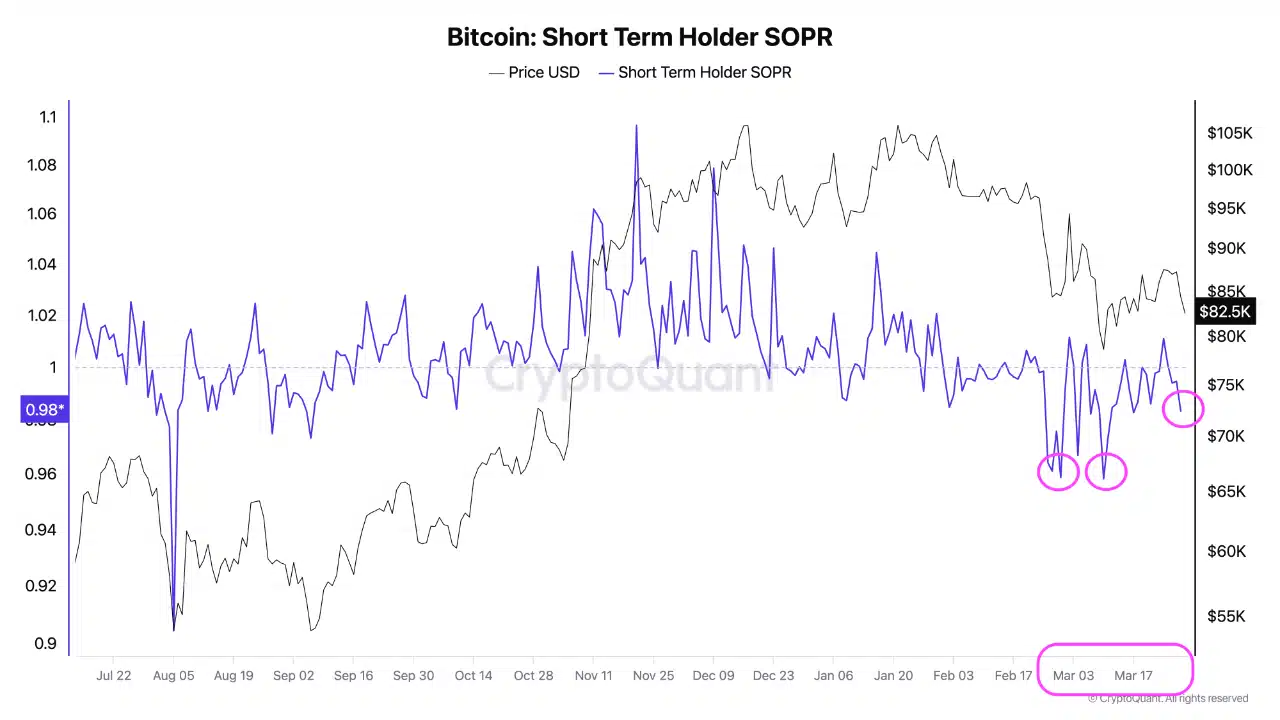

- STH SOPR beneath 1 signifies losses for short-term holders, including to market uncertainty.

Bitcoin’s [BTC] market dynamics are displaying indicators of a shift, with the annualized Sharpe Ratio dipping to impartial ranges — a sample seen in earlier years.

On the similar time, the STH SOPR has slipped beneath 1, hinting at mounting losses amongst short-term merchants and fueling a wave of panic and uncertainty throughout the market.

As sentiment wavers, merchants are left grappling with uncertainty, weighing whether or not the latest alerts level to consolidation or one thing extra.

Bitcoin’s Sharpe Ratio alerts market pause

The chart exhibits that Bitcoin’s present Sharpe Ratio has retreated from earlier highs, with the latest downturn marked by a notable dip into the impartial zone.

This decline mirrors previous patterns the place impartial or near-zero ranges preceded durations of value stability or delicate correction earlier than resuming upward motion.

Because the ratio continues to hover close to neutrality, consolidation within the coming weeks appears more and more seemingly.

Brief-term holders beneath strain

Bitcoin’s STH SOPR has remained beneath 1, signaling that many short-term buyers are promoting at a loss.

As seen within the chart, notable dips in early and mid-March coincide with value declines, indicating heightened panic amongst merchants.

Traditionally, such drops in STH SOPR mirror moments of capitulation, the place weak fingers exit the market.

Nonetheless, previous cycles counsel that extended durations beneath 1 usually precede restoration phases as promoting strain subsides.

With Bitcoin’s value hovering between the 80k-85k vary, buyers are carefully expecting a rebound.

A sustained transfer above 1 in STH SOPR would point out renewed profitability amongst short-term holders, probably strengthening market sentiment.

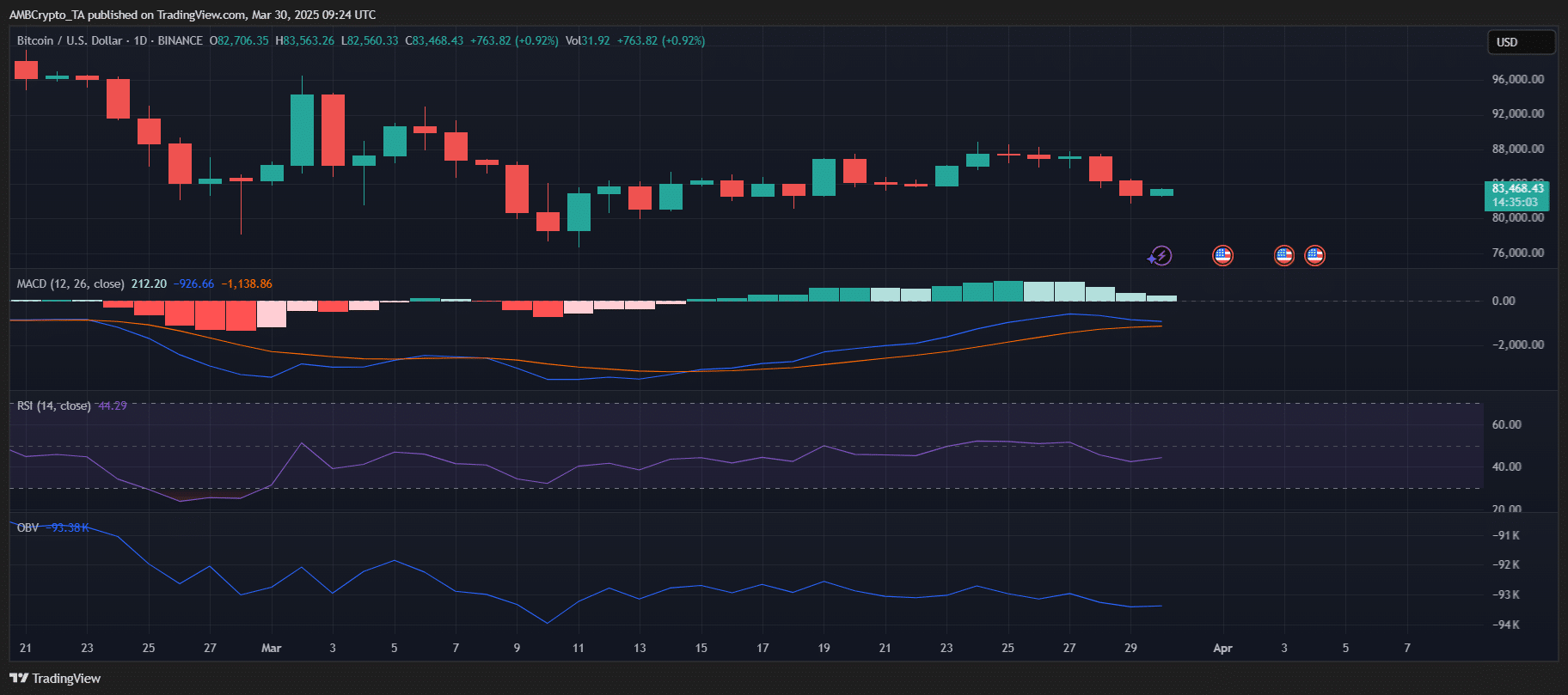

Bitcoin value outlook

Bitcoin is in a section of cooling momentum, with latest day by day candles displaying indicators of promoting strain. The MACD indicator stays optimistic however reveals waning bullish momentum, hinting at doable consolidation.

RSI at 44.29 suggests neutral-to-slightly bearish sentiment, indicating that Bitcoin is neither oversold nor overbought.

In the meantime, the OBV declining barely reinforces lowered shopping for strain. If the $83,000 help holds, Bitcoin might consolidate earlier than making an attempt one other transfer upward.

Nonetheless, additional weak point might see a take a look at of decrease help close to $80,000. A possible MACD bearish crossover and RSI dipping beneath 40 might sign additional draw back.

A breakout above $85,000, nevertheless, may reignite bullish momentum.