- ETH has surged by 9.03% during the last seven days.

- An analyst eyes additional good points if $2200 assist degree holds.

Ethereum [ETH] has not too long ago skilled a robust restoration in its value, buying and selling at $2553 at press time.

This marked a 5.25% enhance over the previous 24 hours, thus finishing a week-long upsurge. As such, on weekly charts, the altcoin has surged by 9.03%.

Prior to those good points, Ethereum had been on a downtrend, reaching a low of $2251 final week.

Regardless of the current surge, Ethereum’s value has remained significantly beneath its March excessive of $4070. Equally, it nonetheless stays down by 47.9% from its all-time excessive of $4878.

Subsequently, the present market circumstances elevate questions in regards to the sustainability of the restoration. Inasmuch, fashionable crypto analyst Ali Martinez advised a possible rebound if the $2200 assist degree holds

What market sentiment says

In response to Martinez, the TD Sequential was flashing “purchase” on Ethereum’s weekly charts at press time.

This advised that markets have a robust potential for a robust rebound if ETH’s costs maintain above the $2200 assist degree.

In context, TD Sequential helps to establish development exhaustion and Potential reversal factors. Thus, a purchase sign on the TD Sequential means that the downtrend is dropping energy, indicating a possible reversal to the upside.

Subsequently, primarily based on weekly charts, ETH might even see a sustained rally relatively than a short-term bounce.

ETH appears favorable

In response to AMBCrypto’s evaluation, ETH was experiencing a robust upward momentum on weekly charts. This was a results of favorable market circumstances that positioned the altcoin for additional good points.

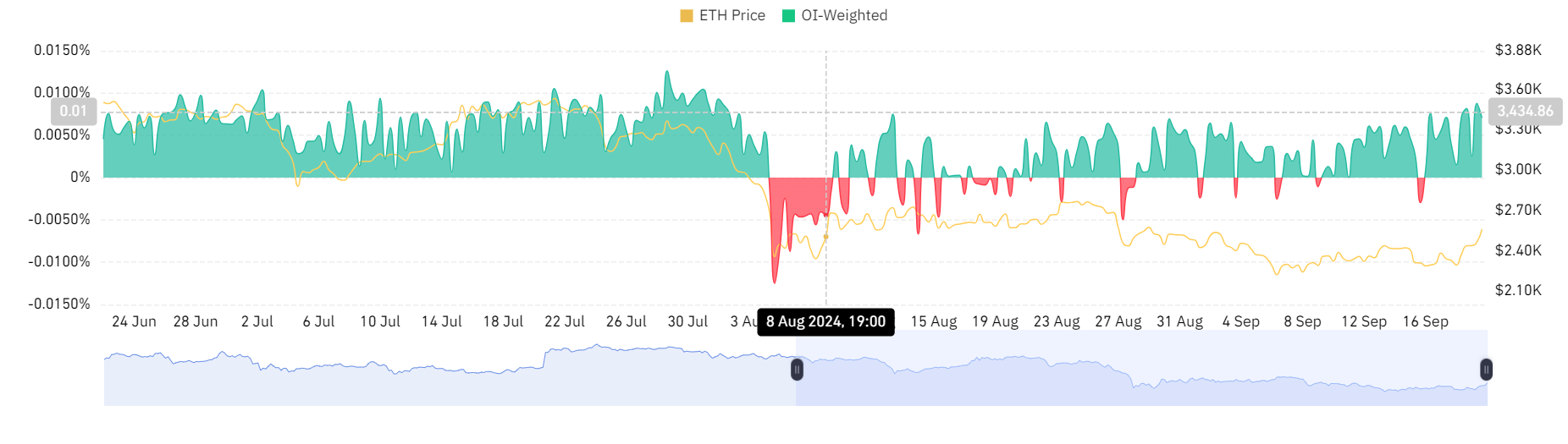

For starters, Ethereum’s OI-Weighted Funding Price has remained for the previous 4 days.

Normally, a constructive OI-Weighted Funding Price signifies a big quantity of open curiosity is related to buyers taking lengthy positions.

A excessive Open Curiosity mixed with a constructive Funding Price means that buyers are utilizing leverage to wager on value will increase, thus indicating confidence in upward motion.

It is a bullish sentiment, with lengthy place holders paying quick place holders.

Moreover, Ethereum’s Funding Price Aggregated by Change has been constructive for the final three days. This additional supported AMBCrypto’s earlier remark relating to a better demand for lengthy positions than quick.

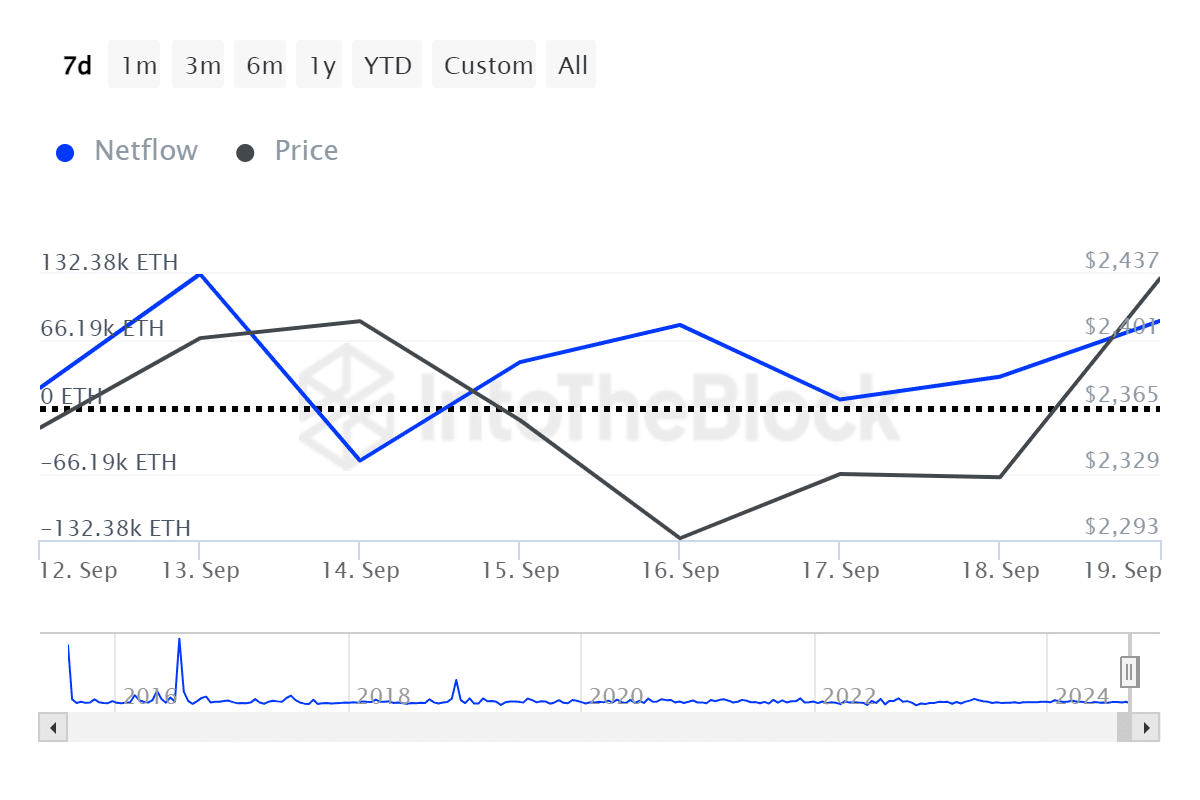

Lastly, Ethereum’s giant holder netflow has remained constructive a lot of the week, solely turning unfavourable as soon as on the 14th of September.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Thus, for the final six days, ETH has loved extra influx from giant holders than outflow. This indicated that enormous holders have been accumulating, signaling confidence within the asset’s future worth.

To sum up, Ethereum is having fun with constructive market sentiment. If these circumstances are maintained, ETH will problem the subsequent resistance degree round $2810 that has confirmed cussed up to now.