- Ethereum faces heightened volatility following the most recent CPI information, sparking market hypothesis

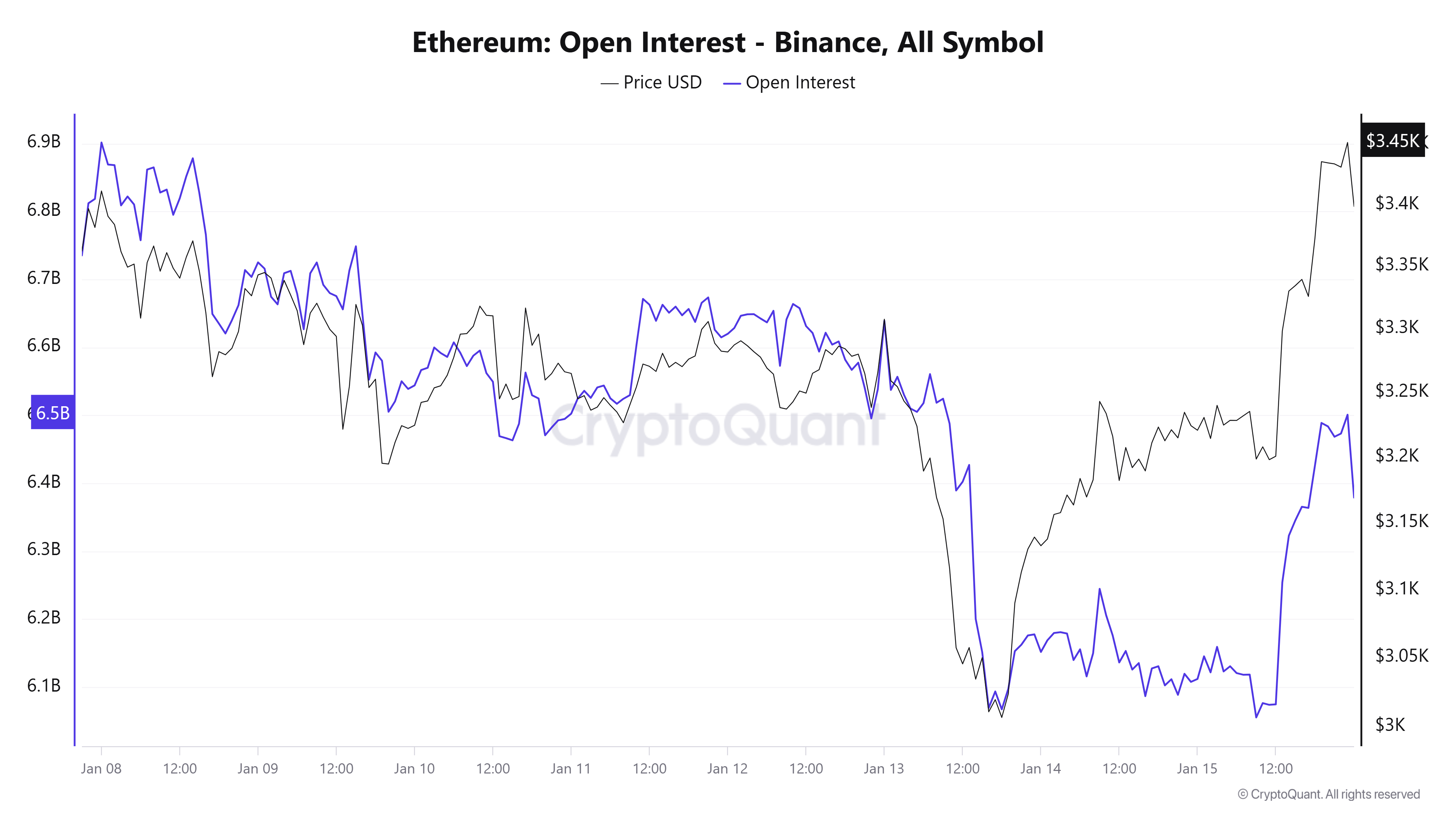

- In gentle of the CPI information announcement, ETH Open Curiosity spiked to over $6 billion

The most recent U.S. Consumer Price Index (CPI) report indicated a 0.4% hike in December, bringing the annual inflation price to 2.9%. This uptick, primarily pushed by rising vitality prices, has vital implications for monetary markets, together with cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

Market reactions to CPI information

Following the CPI launch, Bitcoin’s worth rose by 4.12% to roughly $100,510, reflecting investor optimism about potential Federal Reserve rate of interest cuts. Ethereum additionally noticed positive factors within the final buying and selling session, with its worth appreciating by over 7% to round $3,451.

These actions recommended that cryptocurrencies are responding positively to inflation information resulting from their attraction as different belongings in inflationary environments.

Liquidation dynamics post-CPI launch

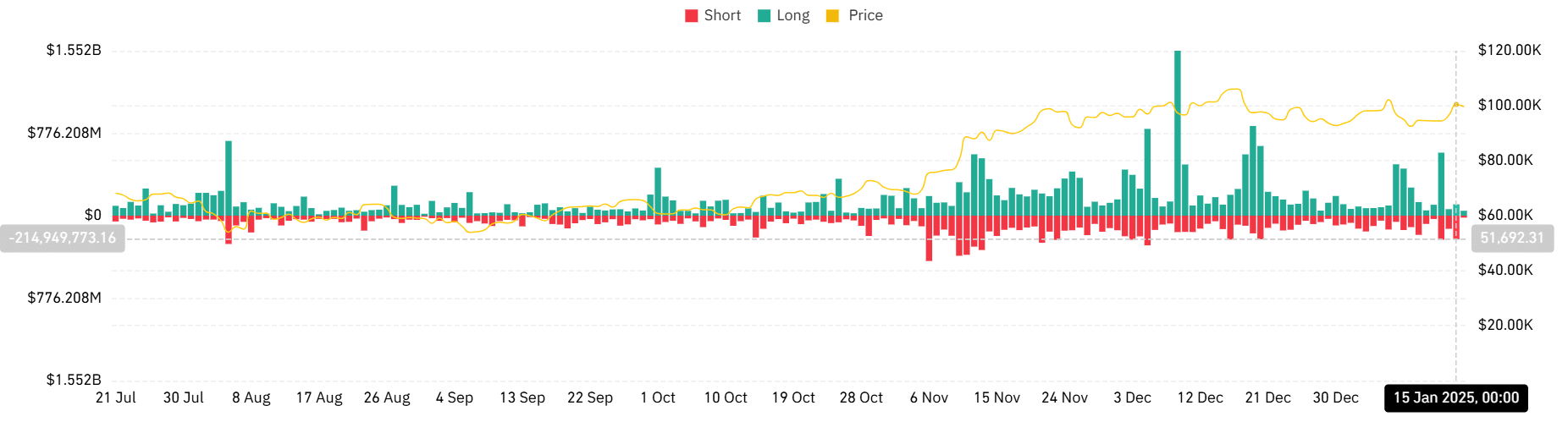

The overall liquidation chart from the final buying and selling session revealed a liquidation surge following the CPI announcement. An evaluation of the chart confirmed that liquidations had been nearly $330 million.

Ethereum, particularly, noticed vital liquidation exercise – An indication of heightened market volatility and fast shifts in investor positions. Actually, liquidations had been value over $67 million.

Moreover, the market noticed extra quick liquidations, with over $223 million in recorded quantity.

This development underscores the sensitivity of those belongings to macroeconomic indicators and the speculative nature of its market.

Ethereum Open Curiosity evaluation

Ethereum‘s Open Curiosity (OI) chart highlighted a notable hike in OI following the CPI information launch. Evaluation of the OI information confirmed that it spiked to round $6.5 billion within the final buying and selling session.

This uptick recommended that extra capital has been coming into ETH’s Futures markets, reflecting rising investor curiosity and potential expectations of future worth actions. Value noting, nonetheless, {that a} excessive OI may also point out greater leverage. This may increasingly result in better volatility.

Ethereum’s worth outlook

Ethereum’s worth motion revealed a compelling technical setup, with the 50-day shifting common at $3,562.47 sustaining a wholesome hole above the 200-day MA at $2,980.39. The MACD indicator readings (0.53, -55.72, -56.25) recommended that momentum is trying to shift, regardless that the present construction stays fairly delicate.

The altcoin’s newest worth motion, influenced by CPI information exhibiting a 0.4% December enhance, has pushed ETH to check vital resistance ranges. The important thing help zone at $3,200 is now essential for sustaining the prevailing market construction, whereas the $3,500 zone represents fast resistance.

– Learn Ethereum (ETH) Price Prediction 2025-26

Ethereum’s response to those macro catalysts might set the tone for its near-term worth motion. Whereas the derivatives market has been exhibiting indicators of elevated curiosity, the balanced liquidation patterns counsel a extra mature market response to financial information, when in comparison with earlier cycles.