- Polygon community has seen a surge in RWA curiosity, together with a current ECB trial.

- MATIC traction on the value charts has slowed barely, with $0.51 as a key value stage.

Polygon [MATIC] founder Sandeep Nailwal has acknowledged rising Actual World Asset (RWA) curiosity within the Ethereum [ETH] L2 community. His remarks adopted the European Central Financial institution’s (ECB) current bond issuance trial.

‘So many RWA’s launching on Polygon organically could be very encouraging…Polygon POS is already second solely to Ethereum mainnet when it comes to the RWA worth created.’

Nevertheless, based on RWA.xyz data, the assertion was overstated. The platform confirmed that Polygon was the fifth-largest community primarily based on whole market cap, particularly within the US tokenized securities market.

Will the RWA curiosity enhance MATIC value?

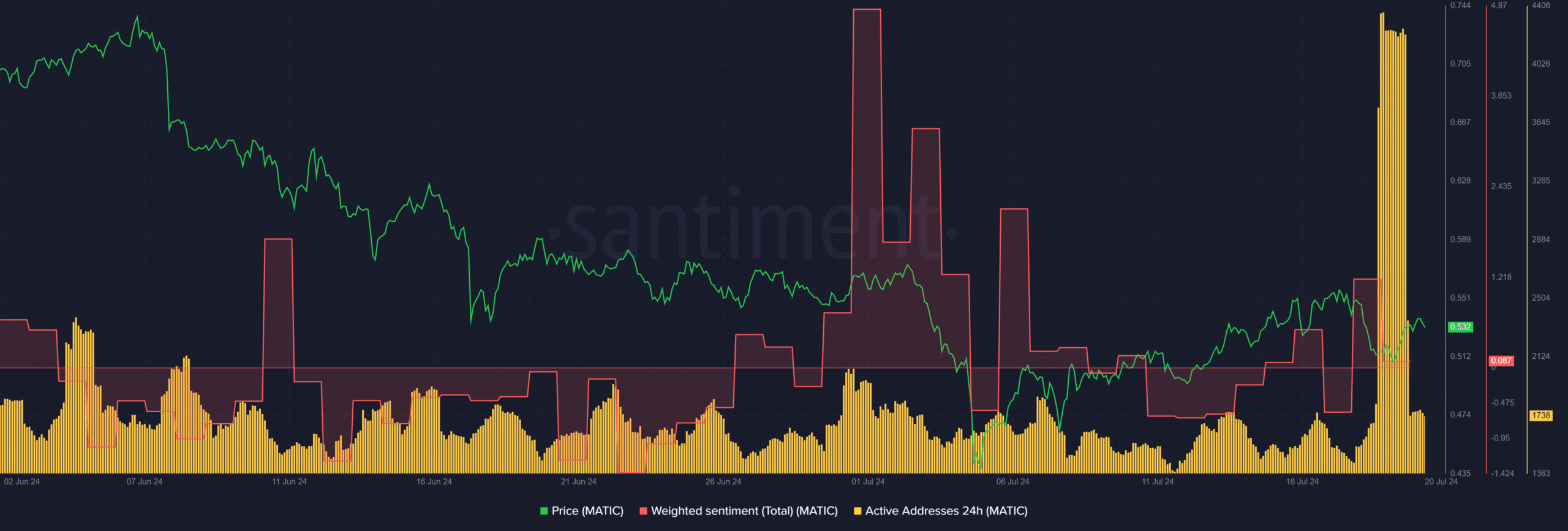

The rising RWA curiosity revealed some constructive community results, as denoted by a surge in MATIC’s every day energetic addresses, per Sentiment knowledge.

Moreover, the information replace on the ECB trial on the community flipped MATIC’s Weighted Sentiment to constructive. Nevertheless, the metric dropped in the direction of the impartial stage as of press time, which might dent market sentiment on MATIC.

On the time of writing, the every day energetic deal with additionally tanked, which might derail additional value upside with fewer customers partaking with the altcoin.

MATIC restoration cooled off

On the value entrance, MATIC surged 3% on nineteenth July after Nailwal’s remarks. Nevertheless, MATIC’s total restoration in July stalled above $0.55 and retraced to $0.51. The blended studying on key value chart indicators signaled merchants’ warning.

Notably, the RSI (Relative Energy Index) recovered however remained muted under the common stage (50). It meant that the current restoration didn’t collect sufficient shopping for stress to ensure a stronger upside.

Moreover, CMF (Chaikin Cash Movement) was above common however hovered close to the equilibrium stage, denoting inflows surged however stagnated prior to now few days.

The above readings instructed that MATIC might wrestle to interrupt the overhead hurdle and every day order block above $0.55 (crimson).

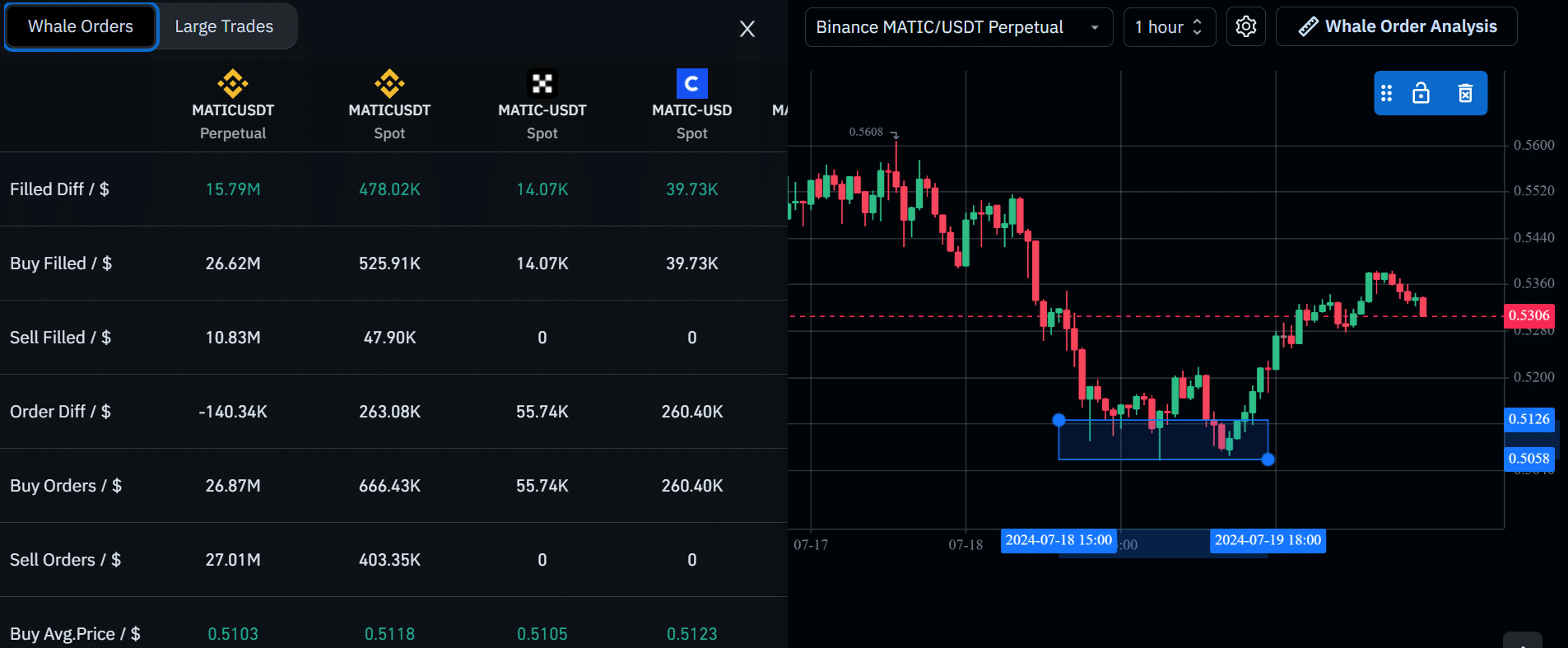

Nevertheless, the $0.51 stage was additionally a vital demand curiosity stage, as proven by the chart and whale order data.

The bounce at $0.51 was marked by about $26 million in purchase orders within the derivatives market on Binance change. Moreover, demand surged within the MATIC spot market, with over $500K in bids on the stage.

Therefore, given the whale curiosity and big quantity at $0.51, it was a vital stage for any MATIC speculator searching for market entry into the altcoin.

![Polygon [MATIC]](https://ambcrypto.com/wp-content/uploads/2024/07/MATICUSDT_2024-07-20_14-29-39.png)