The winds of change are blowing within the Bitcoin market, bringing a contemporary wave of short-term merchants whereas veteran holders stay steadfast of their convictions.

A current report by Bitfinex Alpha reveals an enchanting dichotomy in investor conduct, with new gamers chasing fast earnings and seasoned hodlers (maintain on for expensive life) accumulating for the lengthy haul.

Associated Studying

Quick-Time period Surge Fueled By ETF Frenzy

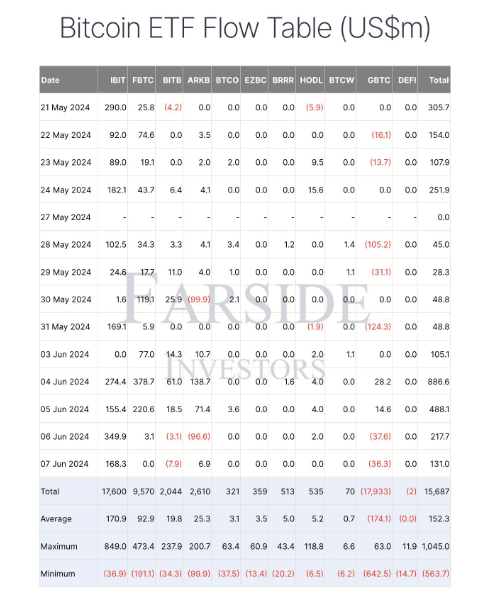

Spot Bitcoin ETFs, monetary devices that mirror Bitcoin’s worth, have emerged as a game-changer. These simply accessible choices are attracting a brand new breed of investor, one with a eager eye for short-term good points.

This inflow is clear within the vital rise of short-term holders (these holding Bitcoin for lower than 155 days). Their holdings have skyrocketed by practically 55% since January, indicating a surge in speculative exercise.

It appears to be like like we nonetheless have overhang from final cycle.

Quick time period holders realized worth is steadily rising as new gamers enter the market and Purchase #Bitcoin. Hedge funds, Pension Funds, Banks and so on.

However the worth isn’t taking off as a result of older cash are being distributed.

We… pic.twitter.com/VxaXozgANT

— Thomas | heyapollo.com (@thomas_fahrer) June 12, 2024

Nevertheless, this newfound enthusiasm comes with a caveat. Quick-term traders, by their very nature, are usually extra reactive to cost fluctuations. A sudden market correction might set off a sell-off, inflicting worth volatility. The report highlights this vulnerability, emphasizing the necessity for warning amidst the present “greed” sentiment available in the market (as measured by the Concern & Greed Index).

Lengthy-Time period Holders: Diamonds In The Tough

Whereas the short-term scene buzzes with exercise, long-term holders proceed to show unwavering religion in Bitcoin’s potential. These digital veterans, who weathered earlier market cycles, have proven a exceptional shopping for spree after initially offloading some holdings at Bitcoin’s all-time high in March.

The report additional underscores this bullish sentiment by stating the minimal quantity of Bitcoin held by long-term traders that was bought above the present worth level. This signifies a “hodling” mentality, the place traders are assured that the present worth represents entry level for future good points.

Moreover, Bitcoin whales (massive traders holding vital quantities) are mirroring their pre-2020 bull run conduct by aggressively accumulating Bitcoin, indicating a possible repeat of the earlier market upswing.

Navigating The Crosscurrents

The present Bitcoin market presents a singular state of affairs. On one hand, the inflow of short-term traders injects contemporary power and liquidity. Nevertheless, their presence additionally introduces the danger of elevated volatility. Alternatively, long-term holders proceed to be the bedrock of the market, offering stability and confidence.

Associated Studying

Bitcoin Worth Forecast

The Bitfinex Alpha report coincides with a technical analysis-based prediction, forecasting a potential rise in Bitcoin’s price by 29.51%, reaching $87,897 by July 13, 2024.

Nevertheless, the report additionally acknowledges the combined sentiment available in the market, with a Concern & Greed Index hovering at “Greed” territory. This means a necessity for warning, as investor optimism can generally precede worth corrections.

Featured picture from VOI, chart from TradingView