- Ethereum ETFs logged $10M, bringing whole outflows prior to now two days to $100M

- Is the declining CME ETH yield behind the continued outflows?

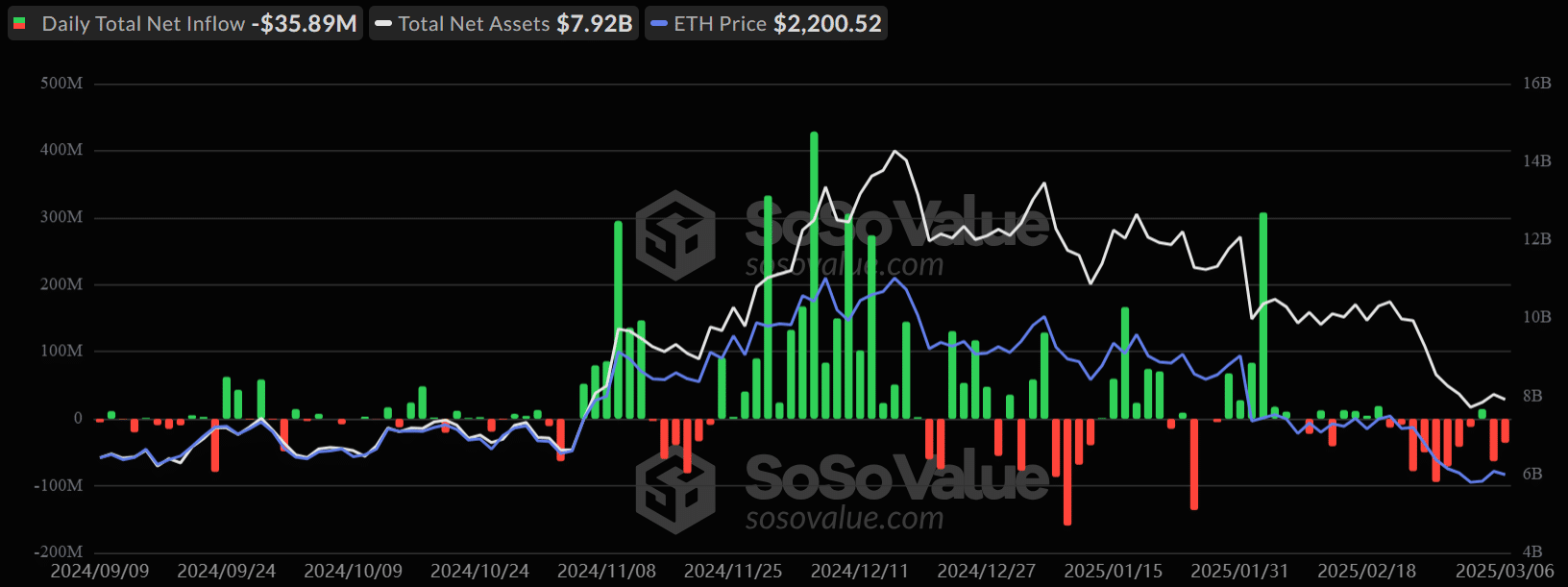

The U.S. Ethereum [ETH] ETFs logged one other $35.89M day by day outflow on 6 March, marking the second day of bleed-out. The renewed risk-off sentiment adopted a short pause on Tuesday, after 8-day consecutive outflows.

General, ETH ETF buyers have withdrawn over $400M from the product within the final two weeks.

This starkly differed from the steady inflows seen in early February. Particularly because the market rout deepened amid the continuing Trump tariff wars.

ETH CME yield drops

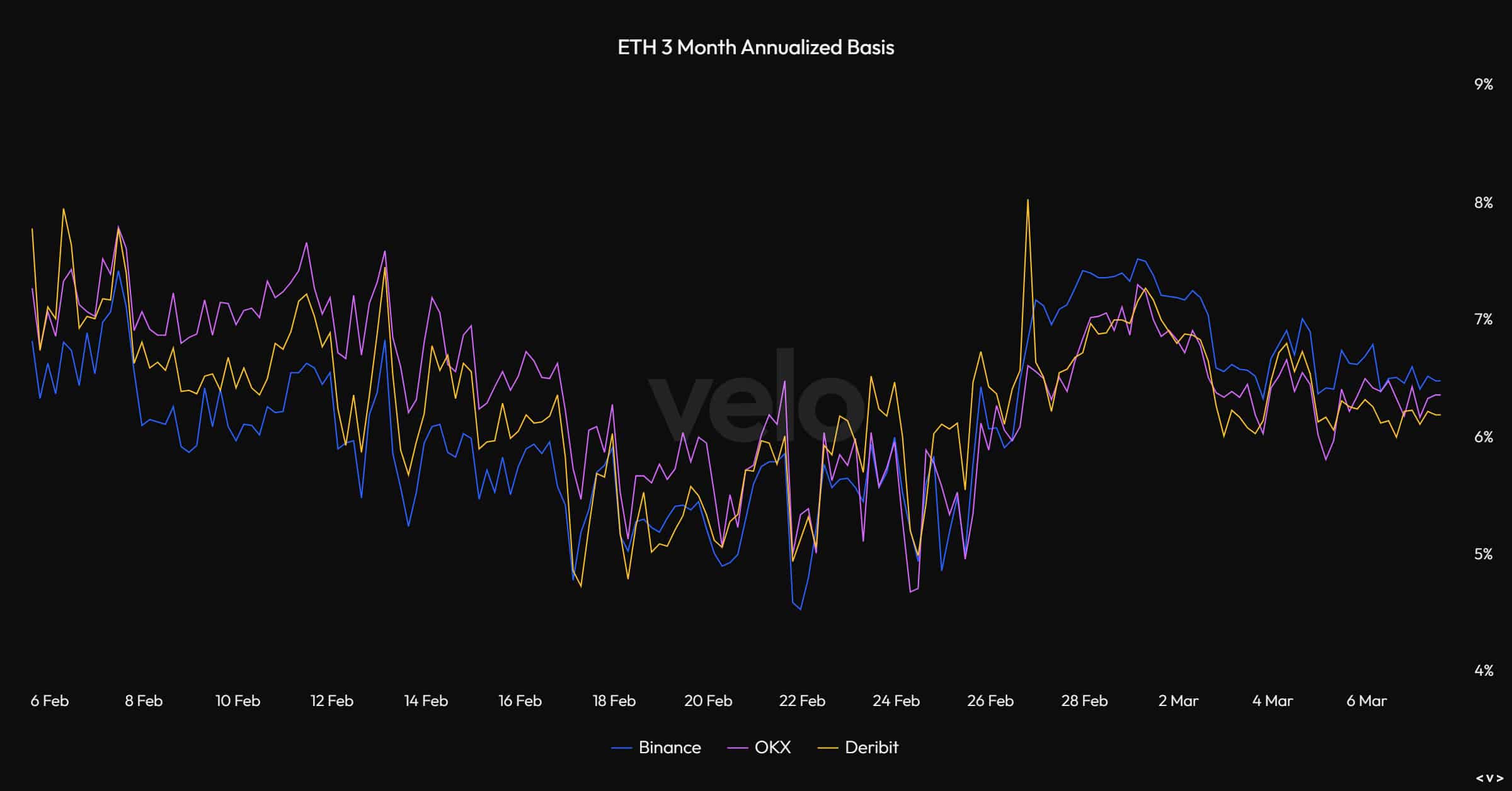

In February, ETH ETFs noticed comparatively increased inflows than BTC ETFs – A pattern Coinbase analysts linked to irresistible excessive yield from CME ETH foundation commerce.

For the unfamiliar, the commerce includes establishments shopping for spot ETH ETF and opening a corresponding brief on CME Futures to pocket the worth distinction (yield).

In keeping with Velo, the ETH yield surged to eight% in the direction of the top of February and was marked by robust ETH ETF flows.

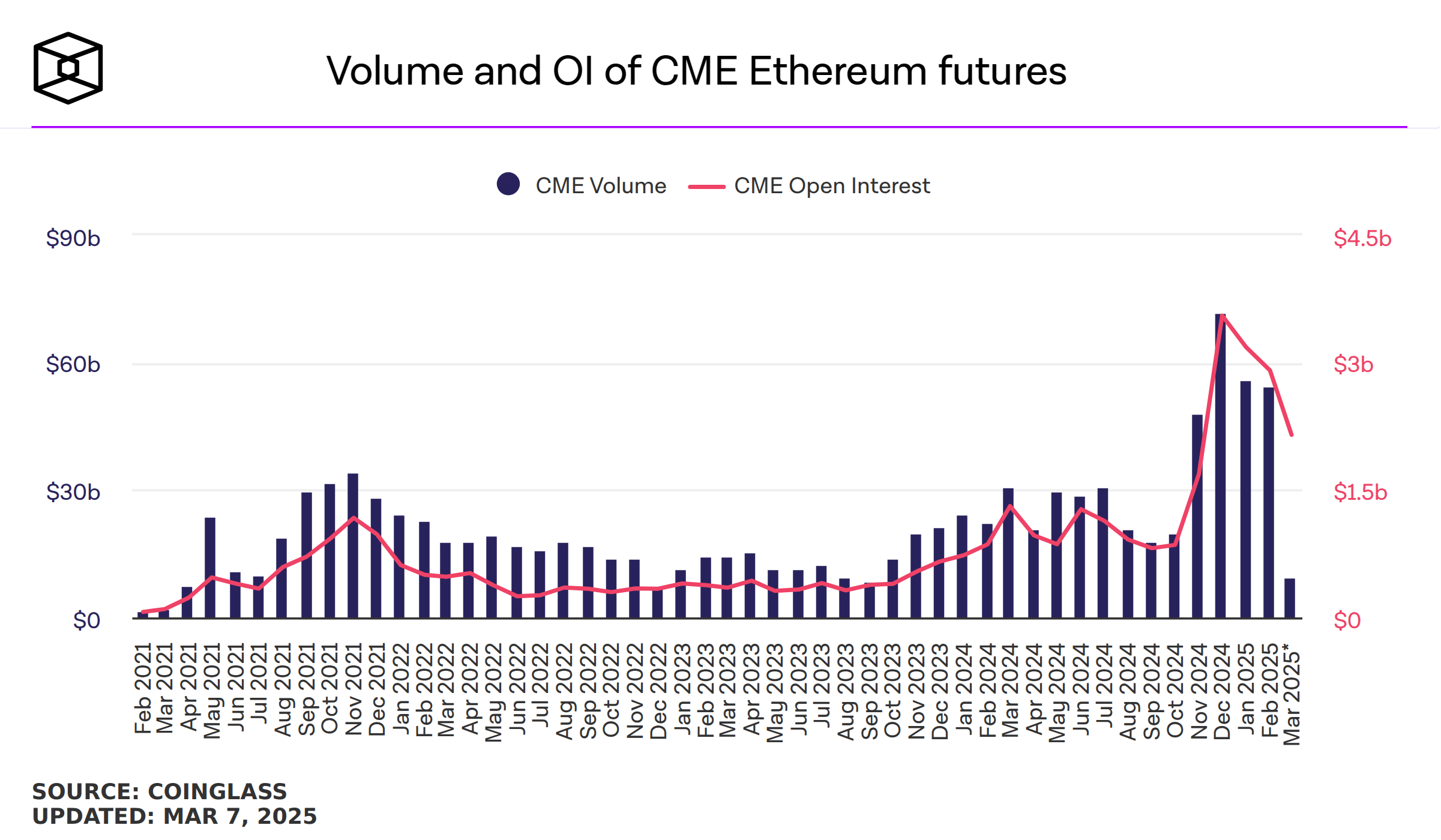

In March, nevertheless, the yield dropped to six%. This might dent urge for food for carry commerce and ETH ETFs. In truth, the concept was strengthened by the CME Futures Open Curiosity (OI) price too.

The OI has been steadily declining in 2025, slipping from $3.18 billion in January to $2.15 billion in March, suggesting slight unwinding or carry-trade gamers closing positions.

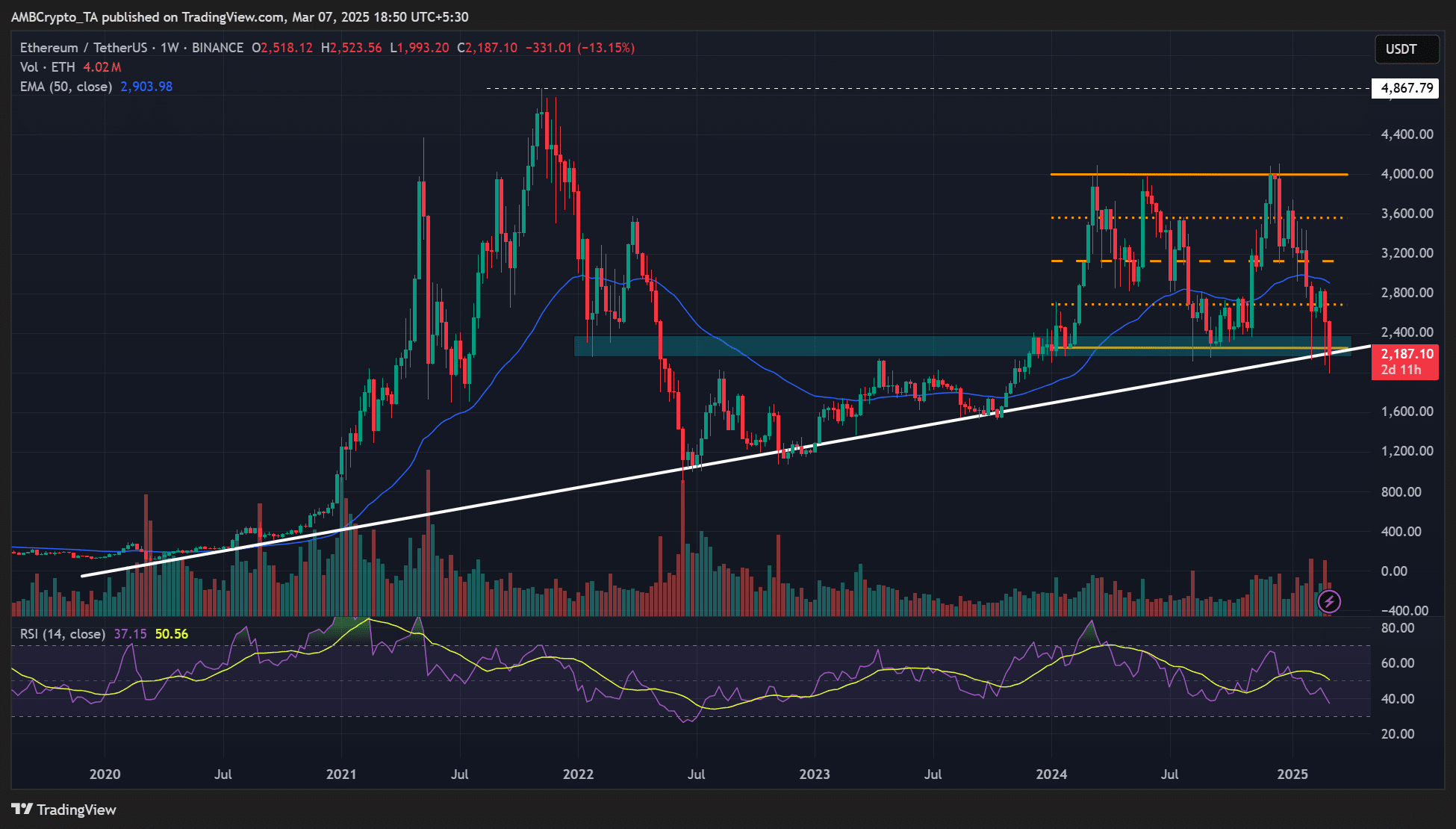

Nonetheless, the broader weak market sentiment hasn’t made issues higher for the king altcoin. As such, the altcoin’s draw back threat may stay at giant.

From a technical perspective, ETH appeared to be at a pivotal intersection of range-low and long-term trendline help above $2000. A breach under the extent may alter the upper timeframe market construction and merchants’ curiosity within the altcoin.