- ETH appeared bearish because it skilled a value drop of over 4% within the final 24 hours.

- Practically $163 million value of quick positions will likely be liquidated if ETH falls beneath $2,596.

Within the final 24 hours, the general cryptocurrency market has skilled a notable decline, together with Bitcoin [BTC] and Ethereum [ETH].

Amid the market downturn, on the fifteenth of August, on-chain analytic agency Spot On Chain made a put up on X (previously Twitter) that the Ethereum’s co-founder Vitalik Buterin has moved a notable quantity of ETH to Kraken.

Notably, Vitalik deposited a considerable 200 ETH value $530,000 to the Kraken cryptocurrency change. Additionally, that is the primary time in 2024 that Vitalik has deposited to any centralized change (CEX).

Crypto giants like Vitalik have a big affect on the general market, and such deposits can impression the business.

Nevertheless, the Ether quantity was comparatively low, and additionally it is not specified whether or not it was for donation, staking, or promoting.

In any other case, Vitalik has just lately moved over 3,200 ETH value $8.32 million to 2 new multisig wallets, that are probably for donation.

Ethereum’s value efficiency

At press time, ETH was buying and selling close to $2,620 and had skilled a value drop of over 4% within the final 24 hours. Regardless of this, its Open Curiosity dropped by 4%, indicating decrease curiosity from traders and merchants.

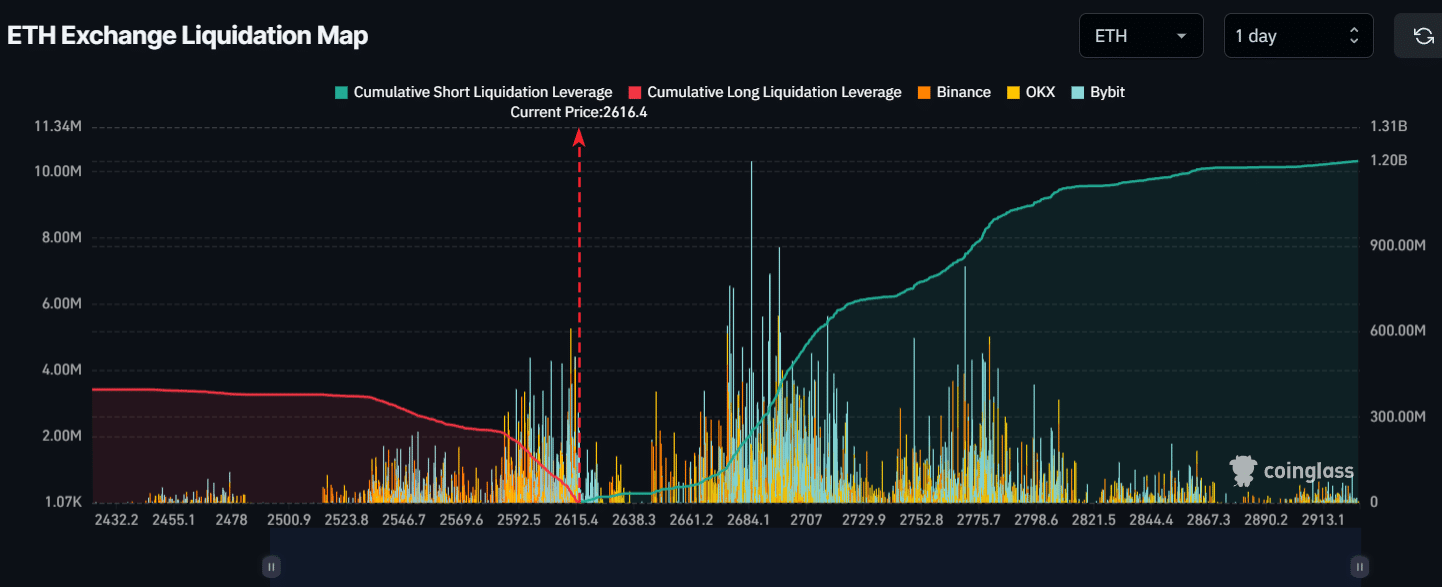

As of press time, the ETH’s main liquidation ranges had been at almost $2,596 on the decrease aspect and $2,686 on the upper aspect, in keeping with the on-chain analytic agency Coinglass.

If the sentiment stays the identical and ETH falls to the $2,596 degree, almost $163 million value of quick positions will likely be liquidated.

Conversely, if the sentiment adjustments and the worth rises to the $2,686 degree, almost $240 million value of lengthy positions will likely be liquidated.

Wanting on the present state of affairs, it appears to be like like ETH is bearish. Whereas, on the 14th of August, veteran dealer Peter Brandt shared a bearish outlook for ETH, utilizing technical evaluation on each larger and intraday ranges.

Is your portfolio inexperienced? Try the ETH Profit Calculator

In a put up on X, Peter hinted at a bearish commerce with a $1,651 goal and $2,961 as a stop-loss.

This put up has gained important consideration from the crypto neighborhood throughout this ongoing bearish market sentiment.