- Ethereum’s day by day lively addresses have decreased to round 395,000.

- An tackle moved over 19,500 ETH to Binance within the final 48 hours.

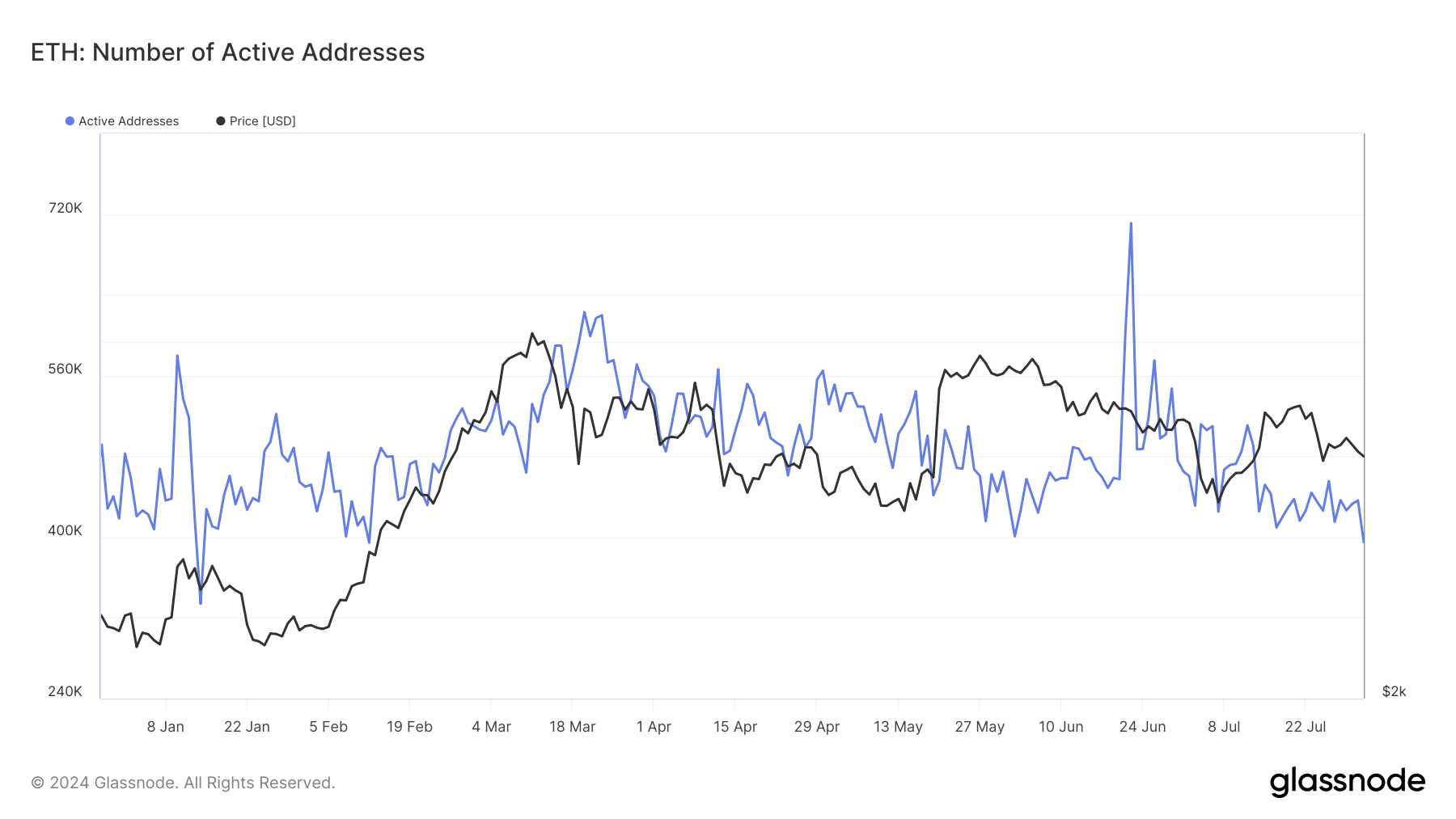

Ethereum [ETH] has skilled important progress in its day by day lively addresses over the 12 months, indicating elevated use and engagement inside its community.

Nevertheless, current traits have confirmed a decline in these lively addresses, suggesting a potential slowdown in exercise.

Alongside this lower, there was a noticeable shift in market dynamics, with sellers starting to dominate buying and selling actions.

Ethereum’s unstable lively addresses

In keeping with knowledge from Glassnode, Ethereum’s day by day lively tackle metric has skilled a outstanding enhance all year long, surging by 127%.

This substantial progress has primarily been pushed by heightened exercise on Layer 2 (L2) platforms, per the report.

An in-depth evaluation of the lively addresses metric on Glassnode highlighted a peak in day by day lively addresses, reaching over 700,000 in June.

Nevertheless, current weeks have witnessed a downward pattern on this metric. After a major rise to over 510,000 in July, the variety of lively addresses started to taper off.

By the tip of July, this determine had decreased to roughly 436,000. As of the newest knowledge, it has additional decreased to round 395,000.

Ethereum sellers seem extra lively

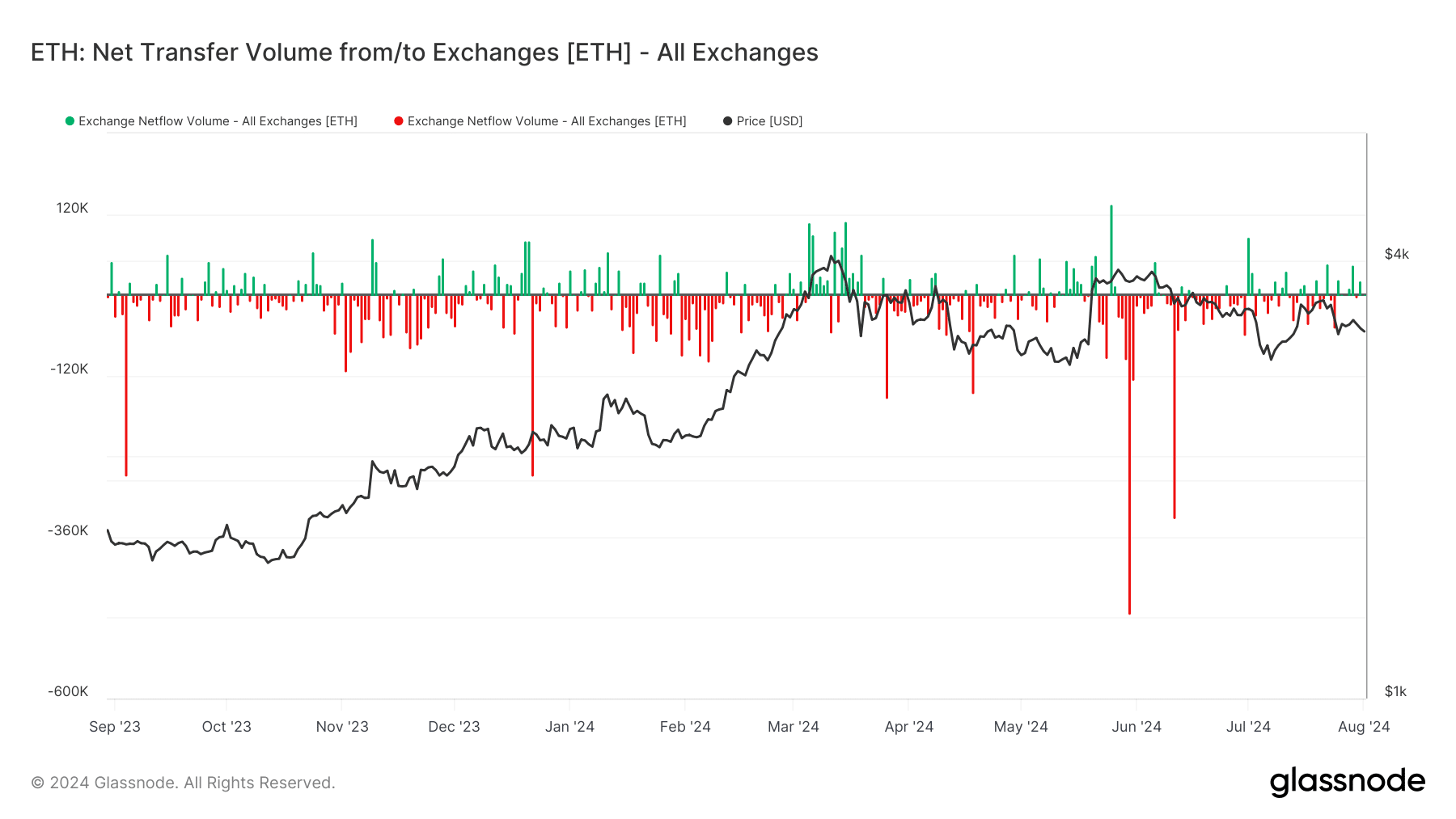

The current evaluation of Ethereum’s netflow on Glassnode has highlighted a notable pattern. It confirmed extra ETH was being moved into exchanges than was being withdrawn.

The transfer steered a predominance of promoting exercise amongst holders. Over the previous month, this pattern culminated with a major inflow of over 22,000 ETH into exchanges.

Additional intensifying this pattern, knowledge from Lookonchain revealed that particular accounts have been significantly lively in transferring ETH to exchanges.

Within the final 48 hours alone, these accounts despatched a complete of 19,500 ETH, valued at almost $64 million, to the Binance alternate.

Such large-scale actions to exchanges typically point out a readiness to promote, contributing to elevated provide in the marketplace.

This inflow of ETH to exchanges has coincided with and sure contributed to the current decline in Ethereum’s value.

As extra ETH turns into accessible in the marketplace by these exchanges, the elevated promoting stress can result in a downward pattern in value, particularly if demand doesn’t hold tempo with the brand new provide.

Is your portfolio inexperienced? Take a look at the ETH Profit Calculator

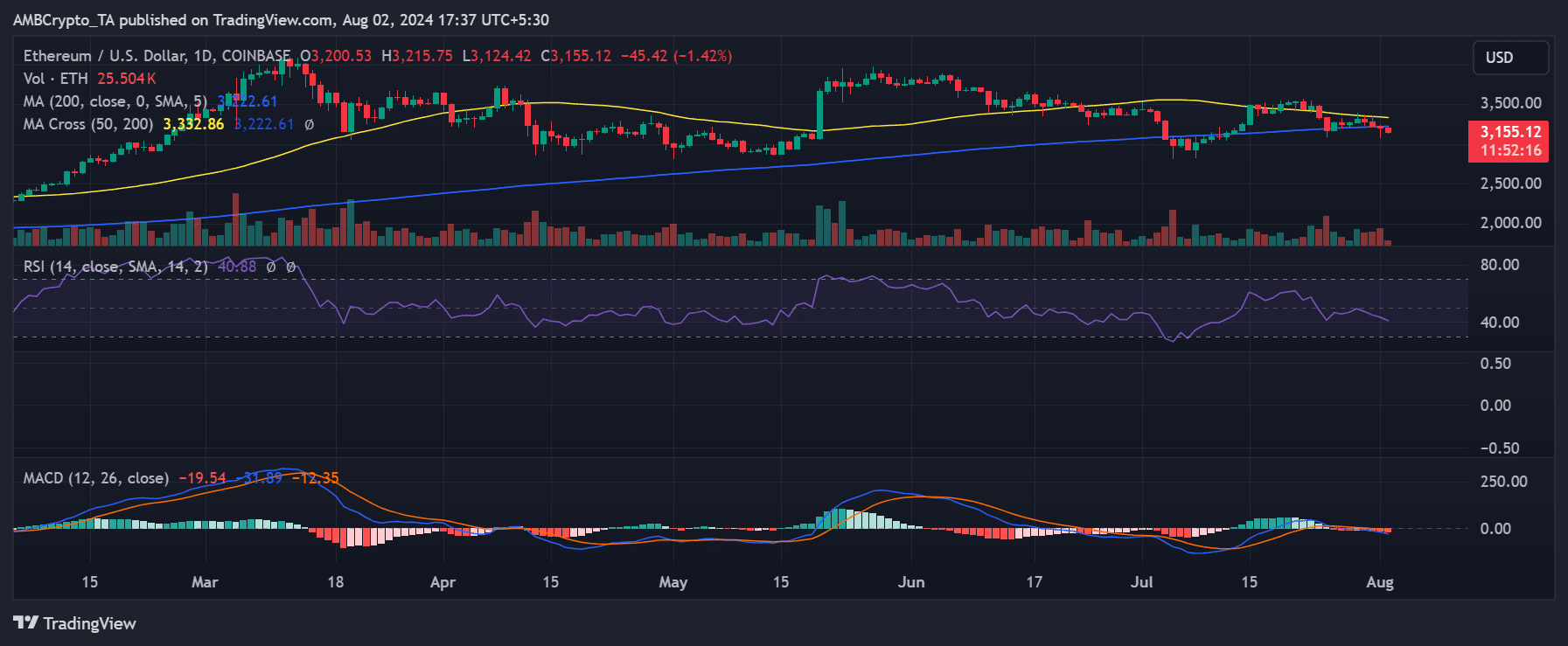

RSI reveals rising bear pattern

An evaluation of Ethereum’s day by day value pattern revealed a decline of over 1.4% on the time of writing. The worth was roughly $3,154, marking the fourth consecutive day of decreases.

In keeping with AMBCrypto, the decline started across the thirtieth of July, and Ethereum has been on a downward pattern ever since. The Relative Power Index (RSI) is about 41, indicating a strengthening bearish pattern.