- Bitcoin discussions appear to be slipping, with merchants now extra centered on altcoins

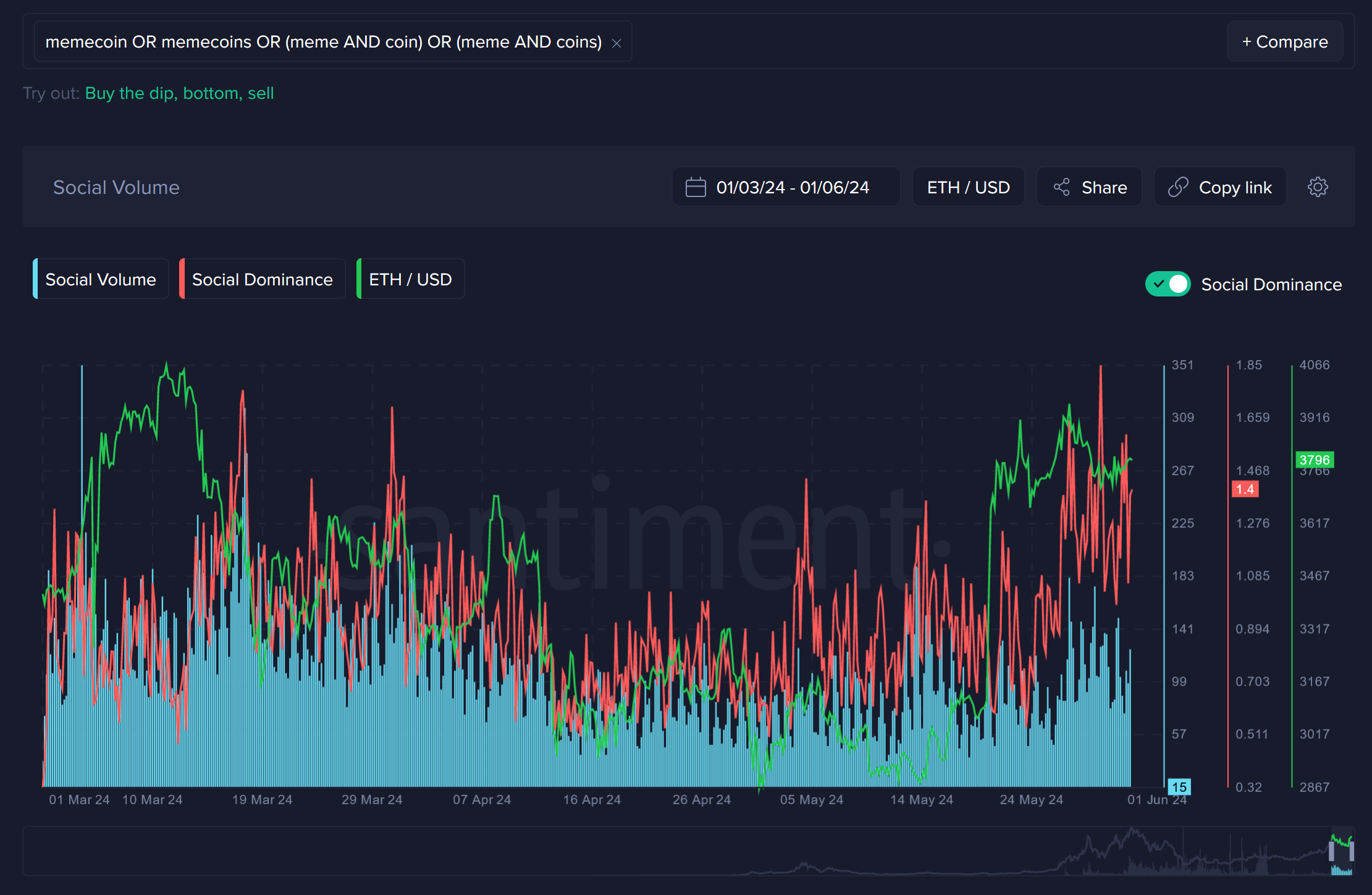

- Memecoin mania going robust, however this may very well be a warning for merchants

Bitcoin [BTC] has retraced virtually all of its features after breaking out previous the $67k resistance stage on 20 Could. It prolonged upwards to $71.9k, however fell to check $67k once more on 23 Could.

This consolidation implies that Bitcoin’s bullish energy shouldn’t be as excessive as buyers would have hoped. The truth is, a current AMBCrypto report explored some related Bitcoin metrics, discovering that lots of them remained bearish.

Memecoins have succeeded in capturing the general public curiosity

Supply: Santiment Insights

In a post on X (previously Twitter), Santiment shared some insights into the crypto tendencies on social media. Memecoins have captured extra of the general public’s consideration since mid-April resulting from their superior efficiency as a sector.

Tokens like dogwifhat [WIF], FLOKI [FLOKI], and Shiba Inu [SHIB] registered good performances over the previous week. Pepe [PEPE] additionally noticed outstanding features over the previous two weeks, with the altcoin up by 63% since 20 April. This got here at a time when Bitcoin tried to interrupt previous $67k, however didn’t see a strongly bullish consequence.

The heavy engagement with memecoins may very well be an indication that the market is grasping and speculative and never in a part of natural improvement, one the place the general public pursues tokens with good tech and utility.

Now, the Bitcoin ETF inflows have been optimistic recently and the month of Could ended properly too. Nevertheless, it stays to be seen if that is sufficient to start one other rally this week.

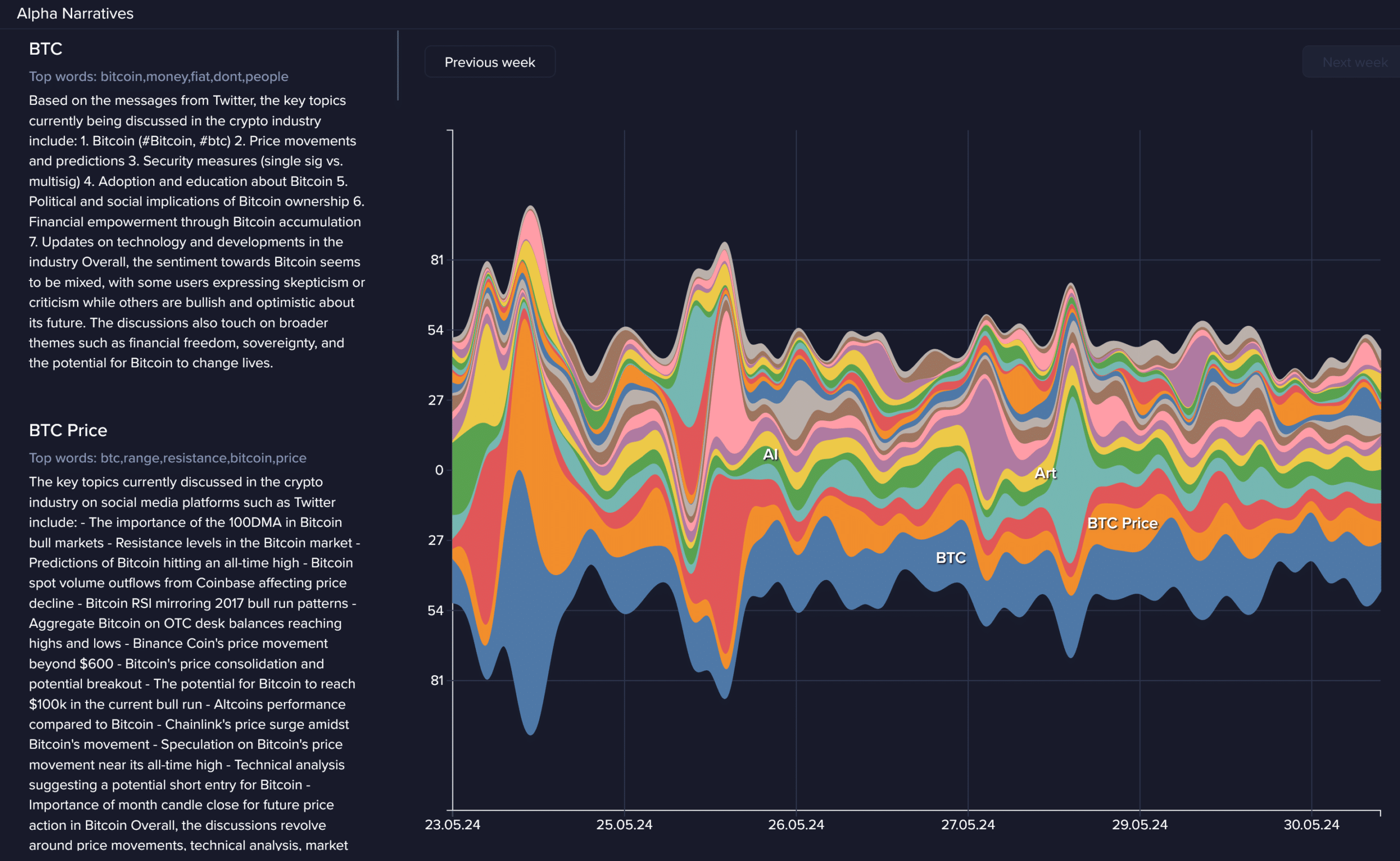

Supply: Santiment Insights

The info additionally confirmed that Bitcoin discussions have been sliding downward. In keeping with Santiment, this was as a result of merchants have been more and more fixated on altcoins for potential features whereas Bitcoin dithered under the $70k resistance.

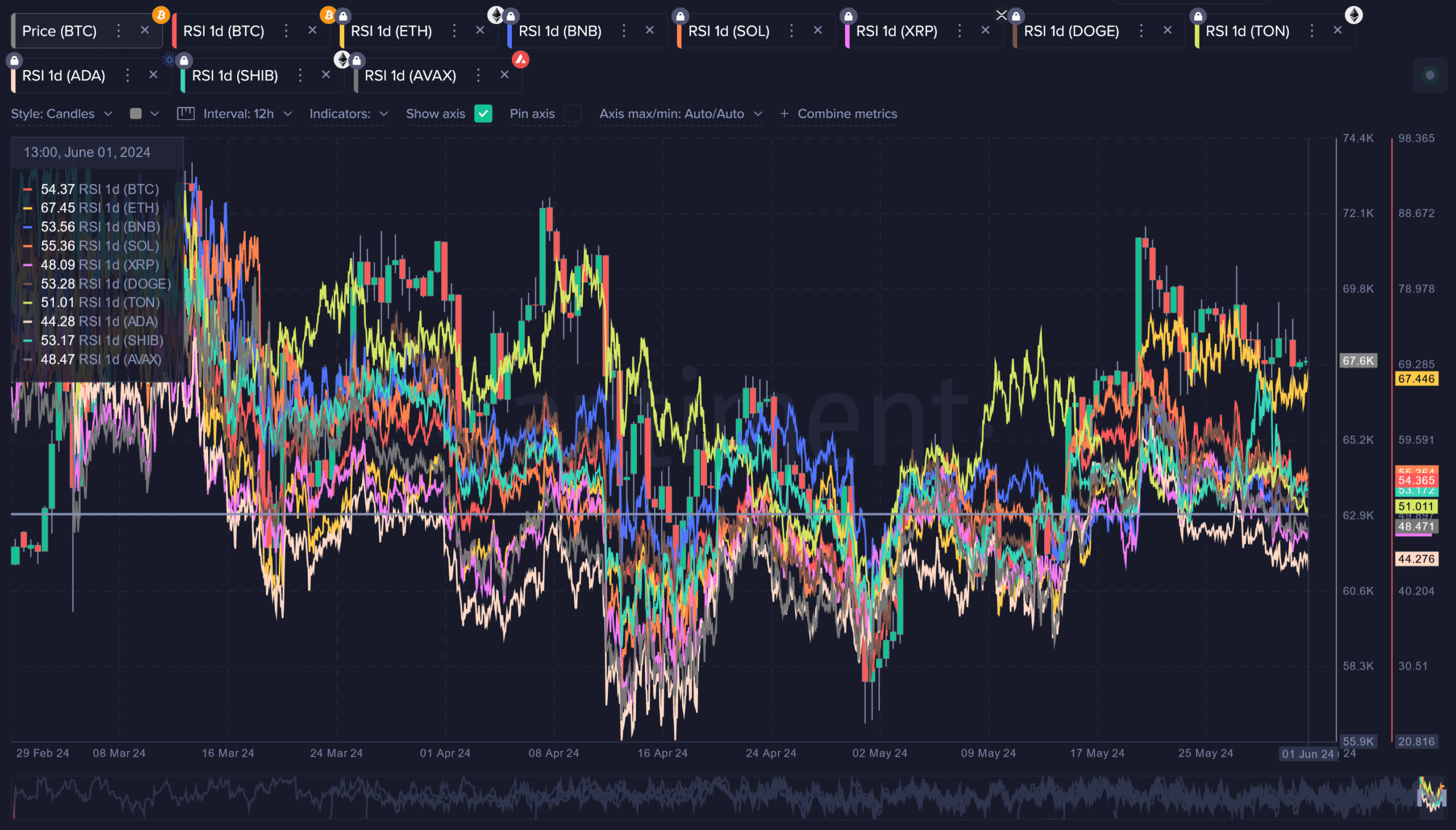

Giant-cap momentum was bullish for probably the most half

Supply: Santiment Insights

The RSI on the 1-day interval revealed that a lot of the main tokens have been close to or above the impartial 50-mark, signaling bullishness. Ethereum [ETH] and Solana [SOL] have been the strongest with readings of 67 and 55, respectively.

In the meantime, Cardano [ADA], XRP, and Avalanche [AVAX] struggled to realize bullish traction on the charts.

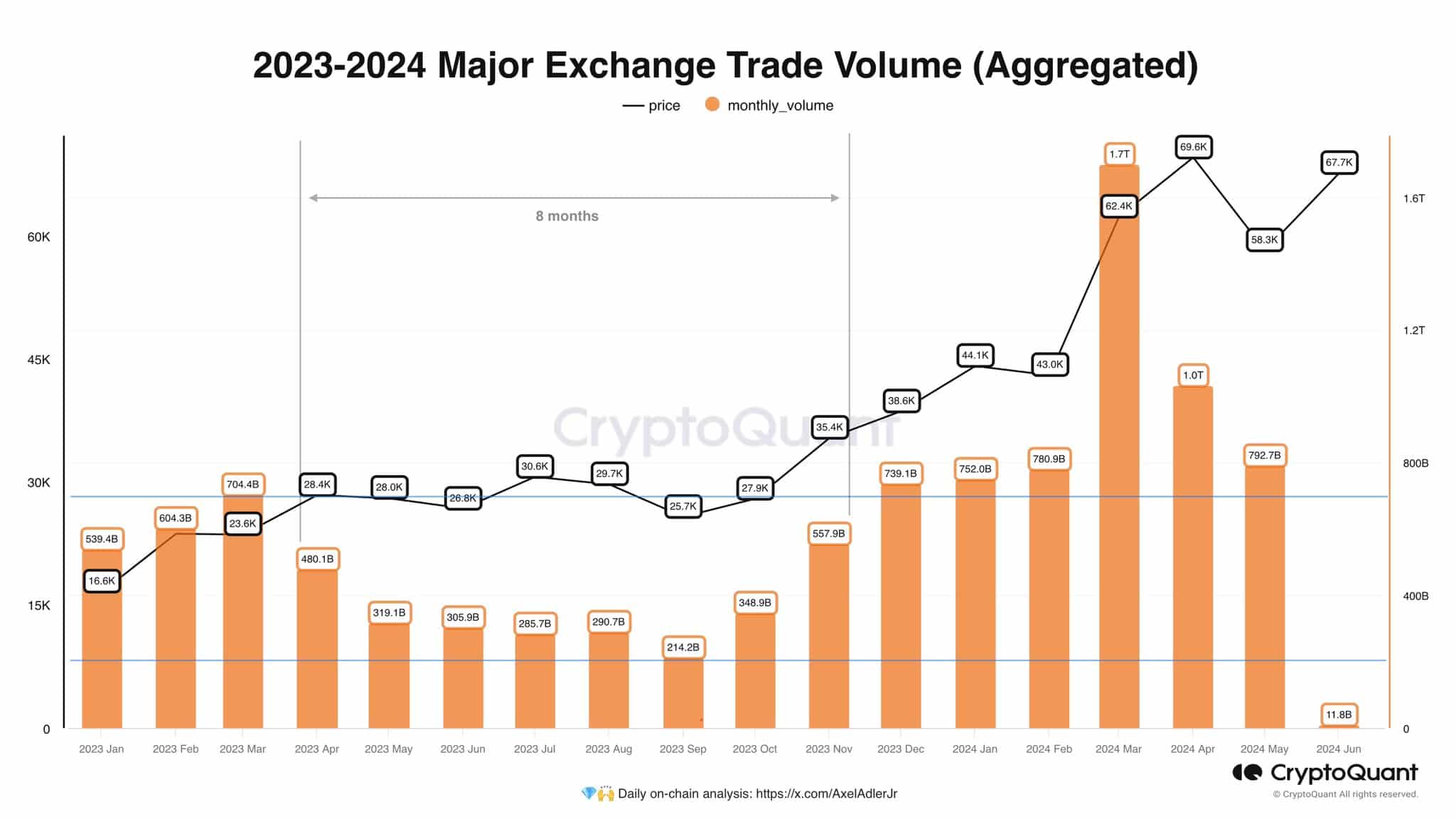

Supply: Axel Adler on X

Right here, it is usually value noting that the buying and selling quantity of main altcoins has fallen dramatically, when in comparison with March. Crypto analyst Axel Adler pointed this out in a publish on X, claiming that Bitcoin’s lack of momentum has been affecting sentiment throughout the market.

Is your portfolio inexperienced? Test the Bitcoin Profit Calculator

The volatility and buying and selling quantity behind Bitcoin has declined since March, and the value continues to commerce throughout the vary of $60k-$72k. Buyers must be affected person, whereas merchants must be careful for vary formations and never get caught out by false breakouts.