- Ethereum’s threat urge for food drops, indicating warning available in the market and slower development forward.

- The Bybit hack appears to have had a comparatively gentle influence, overshadowed by broader market shifts.

Ethereum’s [ETH] resilience is being examined as latest occasions, together with the rumored Bybit hack, shift market sentiment.

Surprisingly, the sell-off following the potential safety breach had much less influence than the third of February market downturn, which stays extra influential regardless of unclear causes.

Beneath these short-term fluctuations, a deeper concern emerges: Ethereum’s threat urge for food has been steadily declining since March 2024.

Whereas decreased risk-taking might scale back liquidations and foster accumulation, it additionally alerts a sluggish market. With ETH hovering round key ranges, the query is whether or not it might keep its place or face extended uncertainty.

The Bybit hack: A minor occasion within the bigger image?

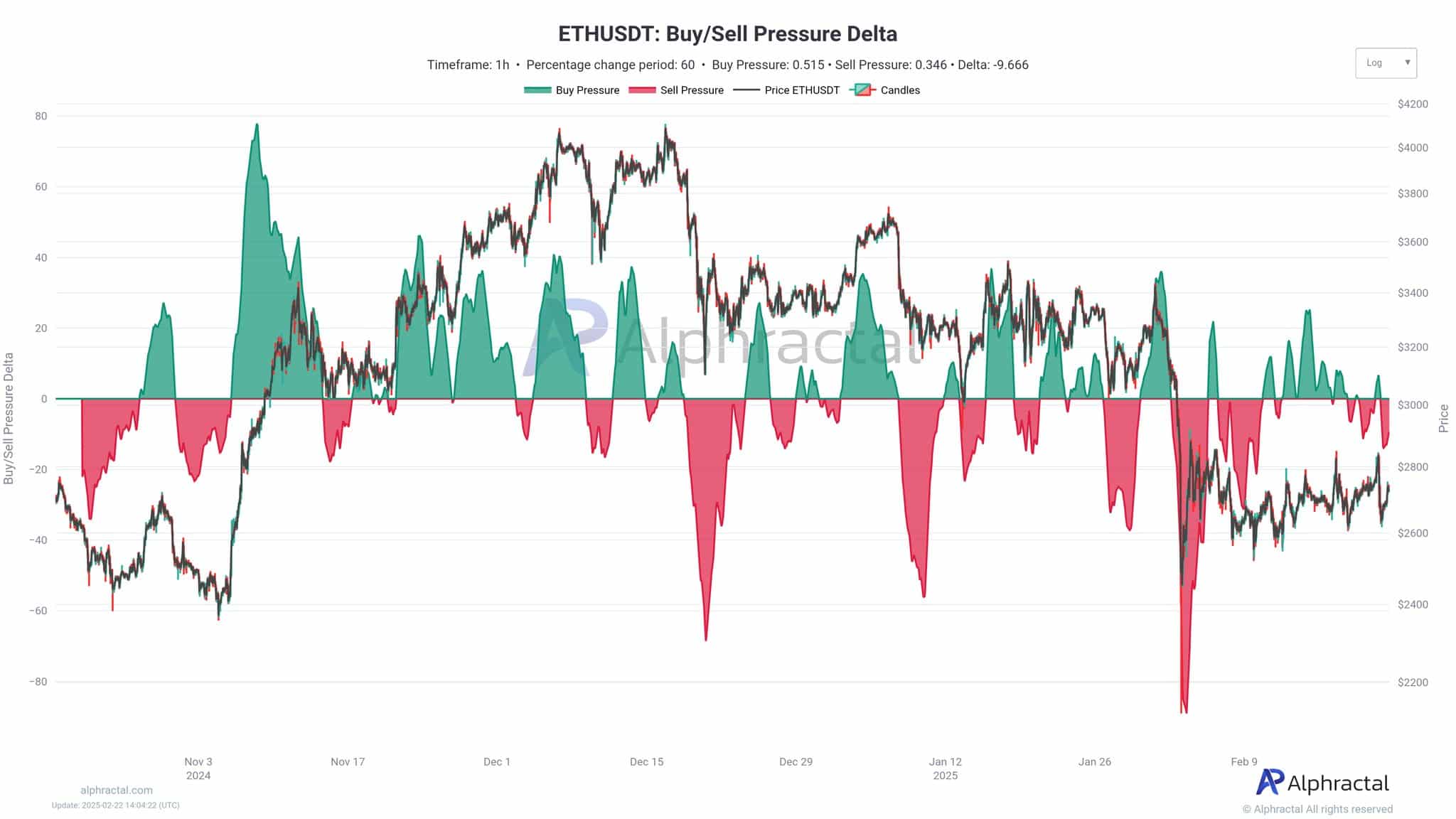

Regardless of issues over the potential Bybit hack, information suggests ETH’s sharpest declines in latest months had been tied to broader risk-off strikes, not remoted occasions.

There was a notable worth drop in late January and early February, properly earlier than information of the hack emerged.

The sell-off on the third of February, which was extra extreme than the hack’s influence, is indicative of deeper liquidity points and shifting sentiment.

With threat urge for food declining since March 2024, Ethereum faces decreased participation from leveraged merchants. Whereas this will result in fewer liquidations, ETH’s sluggish restoration alerts ongoing market uncertainty.

Ethereum: Is the declining threat a trigger for concern?

Ethereum’s threat urge for food has steadily declined since March 2024, reflecting a broader shift in sentiment. The NRM chart exhibits a transparent downtrend — buyers have gotten extra risk-averse.

Traditionally, larger threat urge for food drove speculative surges, however the present market feels extra cautious.

Regulatory uncertainty and decreased leveraged participation have contributed to this development.

Whereas decrease threat metrics scale back volatility and create a extra secure surroundings, additionally they dampen the potential for explosive worth actions.

Until threat urge for food recovers, Ethereum might proceed to commerce in a extra managed and fewer speculative method.

The danger-reward paradox

As Ethereum’s threat urge for food wanes, the market enters a section of decreased volatility and fewer liquidations.

This stability may encourage long-term accumulation however might also lead to stagnation, as worth appreciation slows with out speculative momentum.

Traditionally, decrease Sharpe Ratios have coincided with sideways motion, requiring endurance from buyers.

If Ethereum’s risk-adjusted returns stay subdued, the market may face an prolonged accumulation section as an alternative of an imminent breakout.

Ethereum: The battle of provide and demand

Ethereum’s worth is more and more influenced by institutional inflows, retail sentiment, and regulatory developments.

BlackRock’s latest $3.6 billion funding alerts institutional confidence, probably stabilizing costs and boosting adoption.

In the meantime, retail sentiment stays divided, with some accumulating on dips and others cautious on account of market uncertainty.

The doable approval of Ethereum staking ETFs in 2025 may reignite retail curiosity, whereas bettering regulatory readability within the U.S. might scale back investor uncertainty.

In the end, Ethereum’s future will depend upon balancing institutional backing with sustained retail participation and favorable regulatory situation