- A have a look at how Bitcoin is faring in an excessive concern setting.

- Why liquidations might have performed a task in pushing BTC under $60k.

Bitcoin [BTC] has as soon as once more pulled again under the $60,000 value vary after a quick restoration final week. This comes simply days after the market began to regain optimism for a restoration.

The present Bitcoin value efficiency is a mirrored image of the prevailing sentiment. The Bitcoin/crypto concern and greed sentiment dropped from concern to excessive concern within the final 24 hours.

This has subsequently resulted within the move of liquidity from the cryptocurrency.

This end result means that the market is probably not out of the woods but after final week’s crash. BTC’s short-lived rally noticed it push as excessive as $62,754 throughout Thursday’s buying and selling session. It had a press time value of $58,172, a 7.58% drop from its weekly excessive.

The newest retracement occurred on the RSI mid-point. That is necessary as a result of it alerts an elevated give attention to short-term profit-taking amongst Bitcoin merchants. In spite of everything, the market is at the moment going by a section of heightened uncertainty.

There have been rising considerations in regards to the state of the worldwide financial markets after the latest unwind of the Japanese Yen carry commerce.

Some analysts concern that extra financial fallout is perhaps on the way in which. This additionally comes amid rising FUD relating to a recession.

Extra gasoline for the bears?

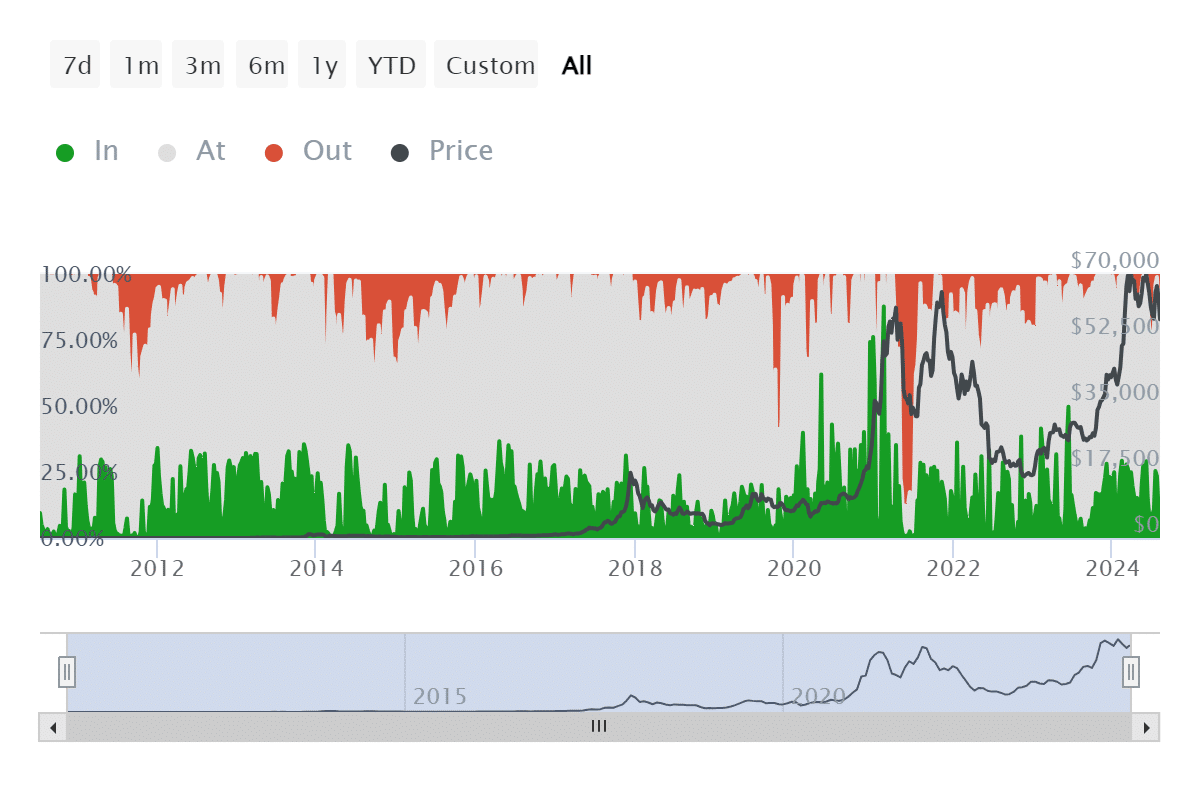

An evaluation of Bitcoin from a liquidity perspective reveals potential publicity to liquidations. Our evaluation revealed that addresses out of the cash peaked at 20.3% which is roughly 10.84 million addresses on the top of the latest dip on fifth August.

The variety of addresses out of the cash as of eleventh August was 7.14 million (13.38%).

Roughly 3.7 million addresses had injected liquidity into Bitcoin close to latest lows. In the meantime, the latest hype that rapidly pushed BTC might have inspired extra hype and urge for food for leverage.

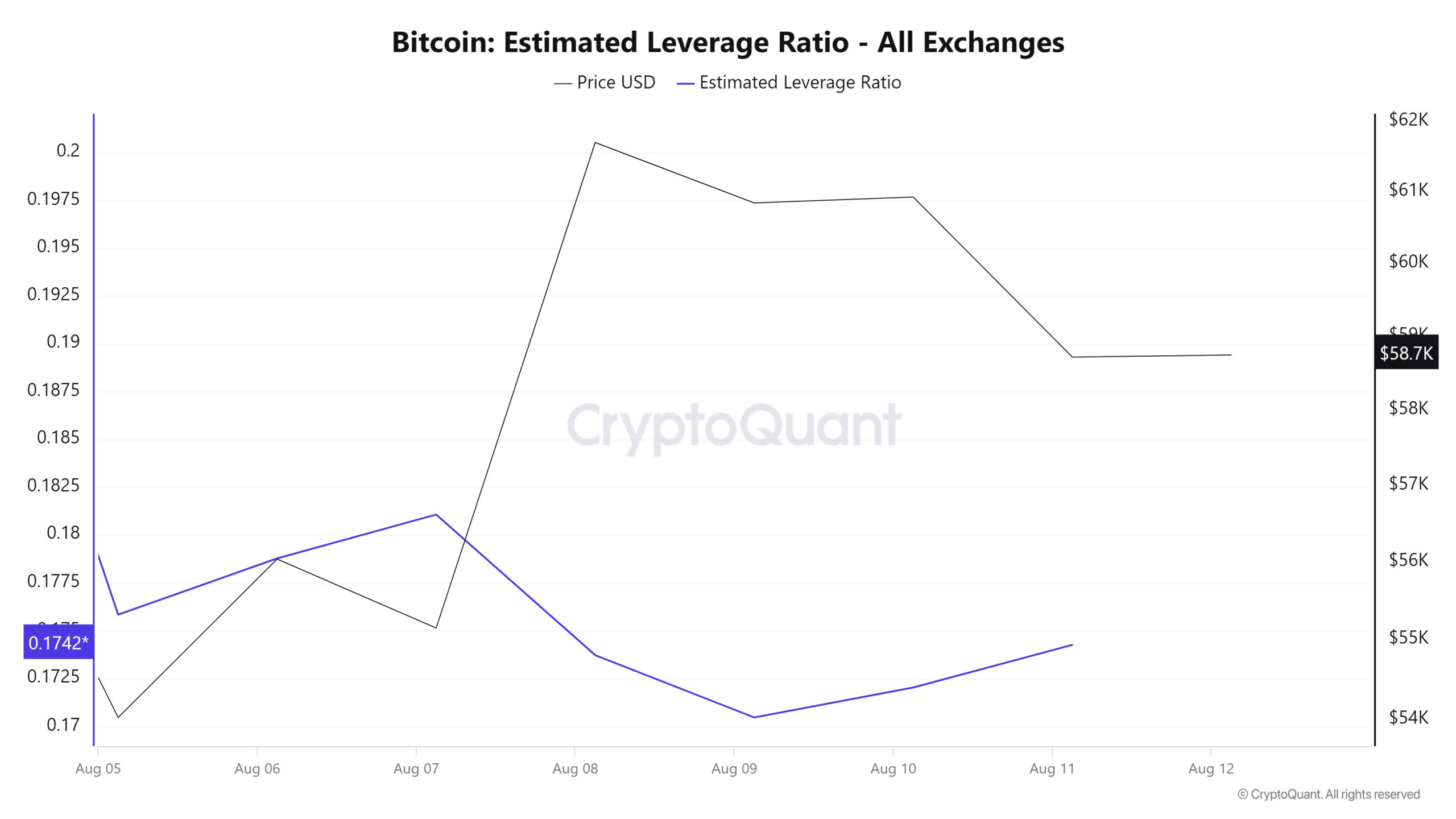

BTC’s estimated leverage ratio registered an uptick between ninth and eleventh August.

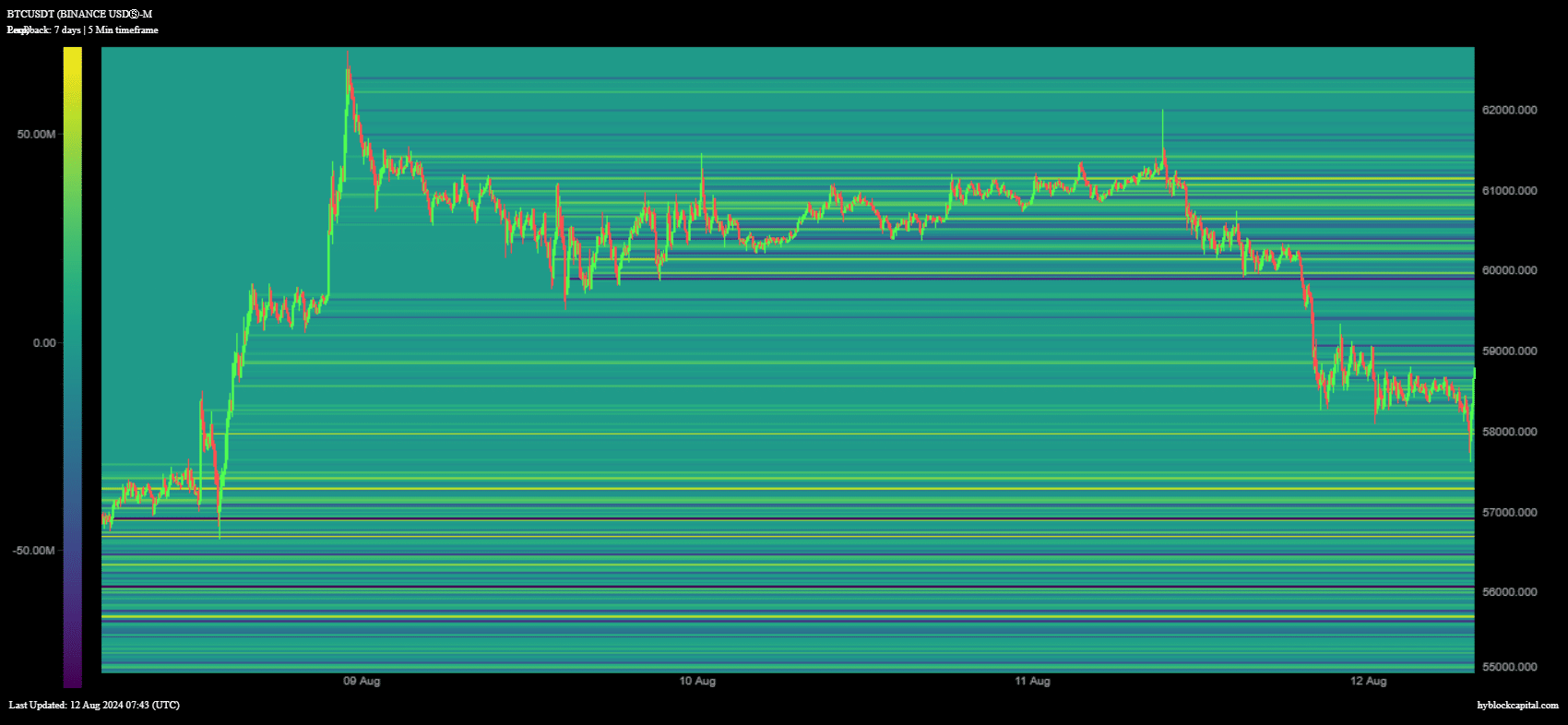

Bullish expectations and leverage might have created a conducive setting for one more wave of liquidations. BTC web longs peaked at $53.92 million on eleventh August at across the $61,129 value vary.

This was simply earlier than a robust bearish transfer that pushed the value under $60,000.

Supply: HyblockCapital

Is your portfolio inexperienced? Try the BTC Profit Calculator

These findings point out that leveraged longs liquidations might need closely influenced BTC’s value motion within the final 2 days.

Whereas liquidations might have performed into Bitcoin’s present dip under the $60,000 value, there isn’t any doubt that the market dangers extra draw back if sentiment stays weak.