- Bitcoin worth surged to $102K as shopping for strain elevated, signaling sustained upward momentum

- Robust market participation and constructive sentiment steered Bitcoin might problem new resistance ranges quickly

Bitcoin worth: Latest efficiency and market dynamics

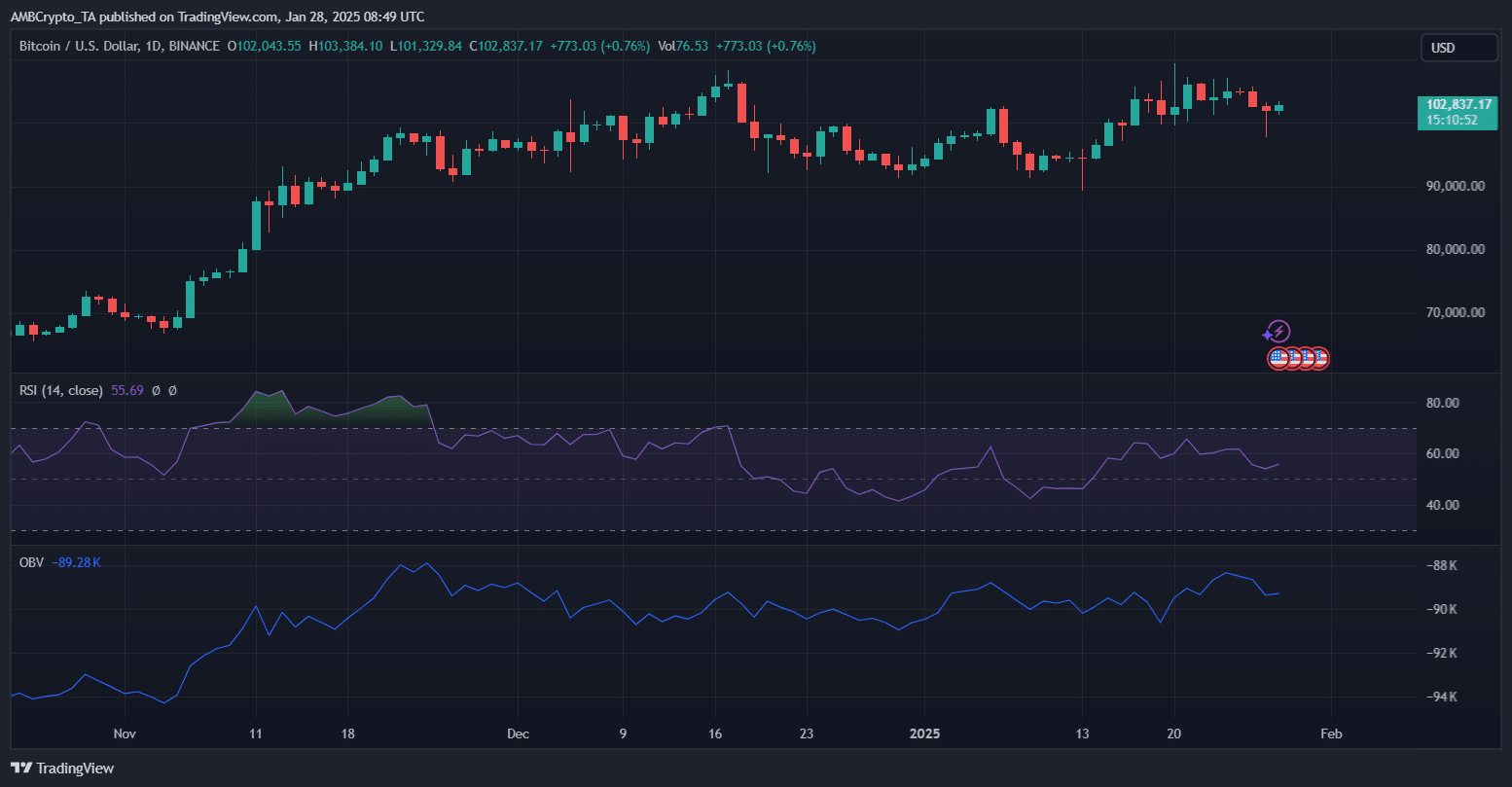

Bitcoin has proven resilience, with its worth climbing to $102,837. There was a gradual uptrend since November, marked by persistently larger lows. The RSI is at the moment at 55.69, indicating impartial momentum with room for progress.

OBV tendencies counsel rising accumulation, presumably fueling shopping for strain.

The latest surge will be attributed to the brand new pro-crypto U.S. administration, sparking renewed curiosity amongst buyers.

Traditionally, January usually acts as a basis month for bull runs, setting the stage for potential rallies.

Coupled with constructive sentiment and historic patterns, Bitcoin’s upward trajectory might quickly face exams round psychological resistance ranges.

Shopping for strain rebounds

The Purchase/Promote Stress Delta chart reveals important fluctuations in market sentiment over the previous few days.

Notably, there was a pointy improve in purchase strain across the twenty fourth of January, coinciding with a worth surge towards $106K.

Nevertheless, this momentum was short-lived as promote strain intensified, resulting in a pointy decline beneath $100K on the twenty seventh of January. This drop was accompanied by excessive buying and selling quantity, suggesting heavy liquidation and potential stop-loss triggers.

As Bitcoin approached $98K, purchase strain rebounded considerably, aligning with the present restoration to $102K. This means consumers are stepping in at key help ranges, reinforcing market confidence.

If this pattern continues, Bitcoin might stabilize above $102K and try one other breakout towards the earlier resistance stage of $106K.

The buying and selling quantity aligns with these shifts, indicating robust market participation throughout each rallies and corrections. This hints at heightened investor exercise.

Learn Bitcoin’s [BTC] Price Prediction 2025–2026

Market sentiment evaluation

Bitcoin’s change inflows present invaluable perception into investor sentiment. Latest information suggests a comparatively steady pattern.

Traditionally, giant spikes in change inflows usually precede sell-offs, as buyers transfer BTC to exchanges for potential liquidation.

Nevertheless, the present inflows stay average regardless of Bitcoin’s rally previous $102K, indicating that holders should not speeding to promote, reinforcing bullish sentiment.

On the time of writing, the Worry & Greed Index stood at 72, putting the market firmly within the “Greed” zone.

This means robust investor confidence but in addition raises warning, as excessive greed ranges can precede corrections.

If inflows stay regular and greed doesn’t overextend, Bitcoin might maintain its momentum, with the potential to problem new highs.