- ETH witnessed a slight rise in promoting stress as most traders had been “in cash.”

- Technical indicators prompt a breakout above the $3.6k resistance.

Ethereum [ETH] just lately managed to hit the $3.6k mark, due to the weekly value pump. This pump allowed a considerable chunk of ETH addresses to be in revenue. Nonetheless, it witnessed a slight pullback up to now 24 hours. Will this pattern final or, will ETH reverse and transfer in direction of $3,900 subsequent?

Ethereum faces correction

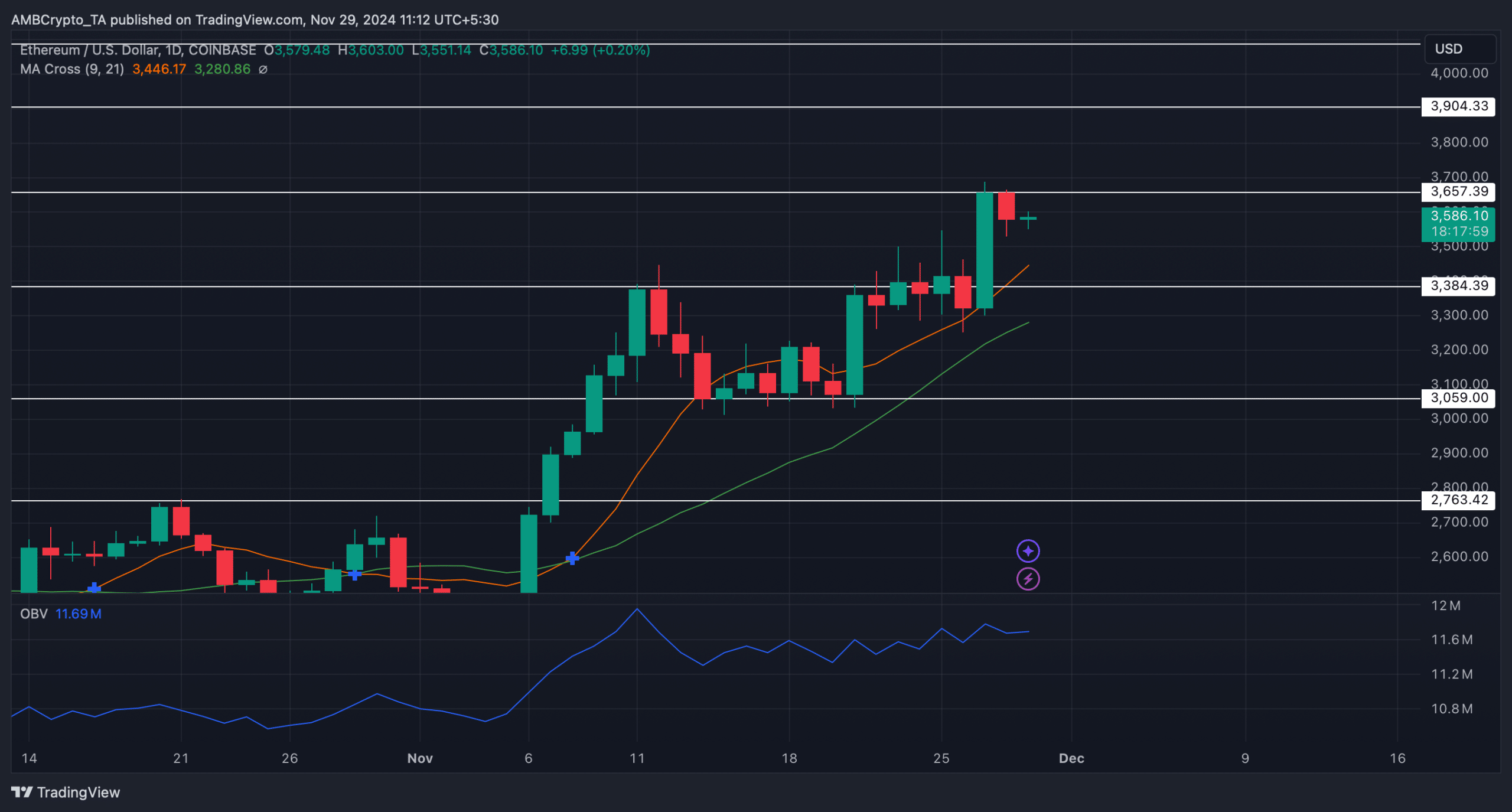

AMBCrypto reported earlier the occasion of ETH touching its resistance at $3.6k. If ETH turned that resistance into help, it might subsequent goal $3.9k. Nonetheless, that didn’t occur as at press time it was buying and selling at $3,577.87.

In the meantime, IntoTheBlock’s information revealed that over 90% of ETH traders had been “in cash”. Typically, every time such huge variety of traders get in revenue, it ends in revenue taking exercise, inflicting an increase in promoting stress.

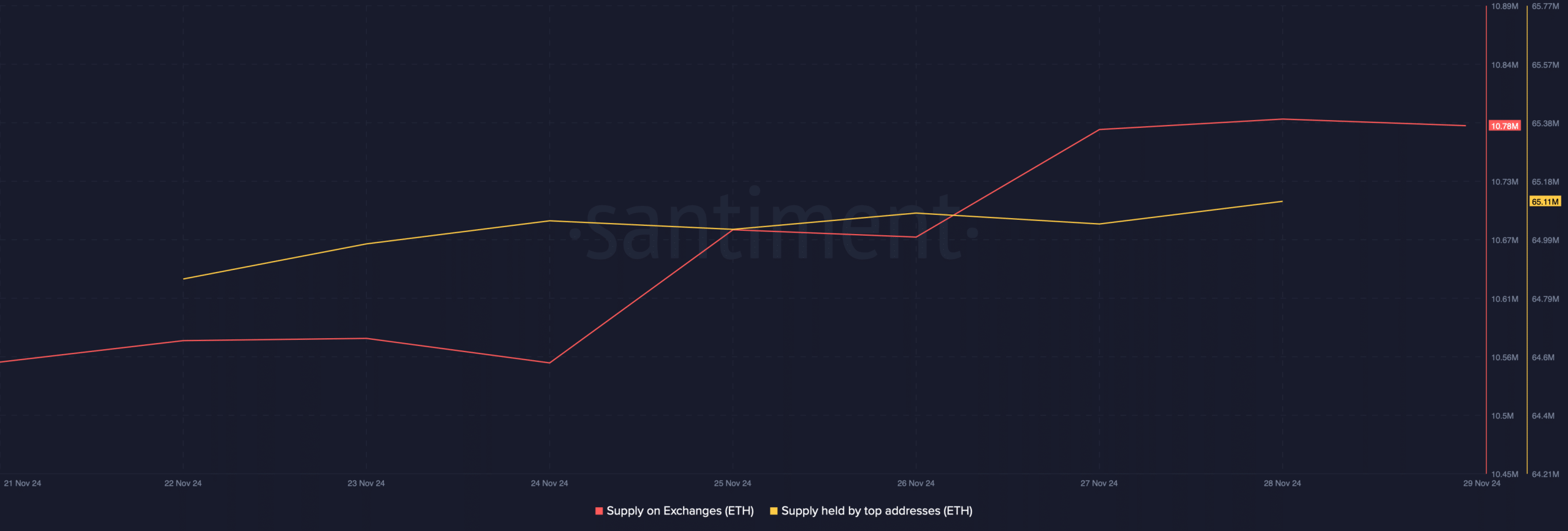

In reality, that appeared to be occurring on this event. As per Santiment’s information, ETH’s provide on exchanges registered an uptick, indicating that traders had been promoting their holdings.

Nonetheless, whales had been displaying confidence in Ethereum, as evident from the rise in its provide held by prime addresses.

Will ETH’s downtrend proceed?

To seek out whether or not whale confidence be sufficient to propel ETH above $3.6k in direction of $3.9k, we checked different datasets. Ethereum’s open interest elevated sharply final week whereas its value surged.

This prompt that the most recent correction is likely to be short-lived and ETH may simply be retesting its resistance.

Moreover, its funding fee additionally remained excessive, that means that that lengthy positions are dominant, which suggests bullish sentiment as merchants had been keen to pay additional to carry their lengthy positions.

Each these metrics hinted at a value leap above the $3.6k resistance, which might set off volatility and permit ETH to succeed in $3.9k within the coming days. As talked about above, Ethereum’s day by day chart additionally confirmed that ETH was constantly testing its $3.6k resistance.

Each time that occurs, it signifies that the possibilities of a breakout are excessive. This chance was additional help by the technical indicator MA Cross. ETH’s 9-day MA was resting properly above its 21-day MA, hinting at a bullish higher hand out there.

On prime of that, whereas ETH examined its resistance, its On Steadiness Quantity (OBV) remained excessive.

Learn Ethereum [ETH] Price Prediction 2024-2025

A rise in OBV signifies that the buying and selling quantity on days with constructive value actions is bigger than the amount on days with detrimental value actions—signaling a bullish pattern out there.

Subsequently, as prompt by the aforementioned indicators, if ETH crosses $3.6k, its street to $3.9k can be intelligent. Nonetheless, in case ETH fails to take action, it’d fall to its help close to $3.3k.