- Bitcoin’s volatility intensifies as liquidations set off sharp worth swings, with $337 million worn out.

- Liquidations amplify Bitcoin’s volatility, creating alternatives and dangers as the value exams key ranges.

Bitcoin’s [BTC] current surge in direction of $100,000 has sparked large market volatility, with over $337 million in lengthy liquidations inside 24 hours.

As the value dips under $93,000, the specter of additional sell-offs stays excessive, particularly with $772 million in brief positions in danger. With a possible rebound to $98,000 on the horizon, merchants should be alert to the potential of a liquidation cascade driving costs even greater.

Right here’s a have a look at the elements behind Bitcoin’s wild worth swings.

Testing the $100,000 Threshold

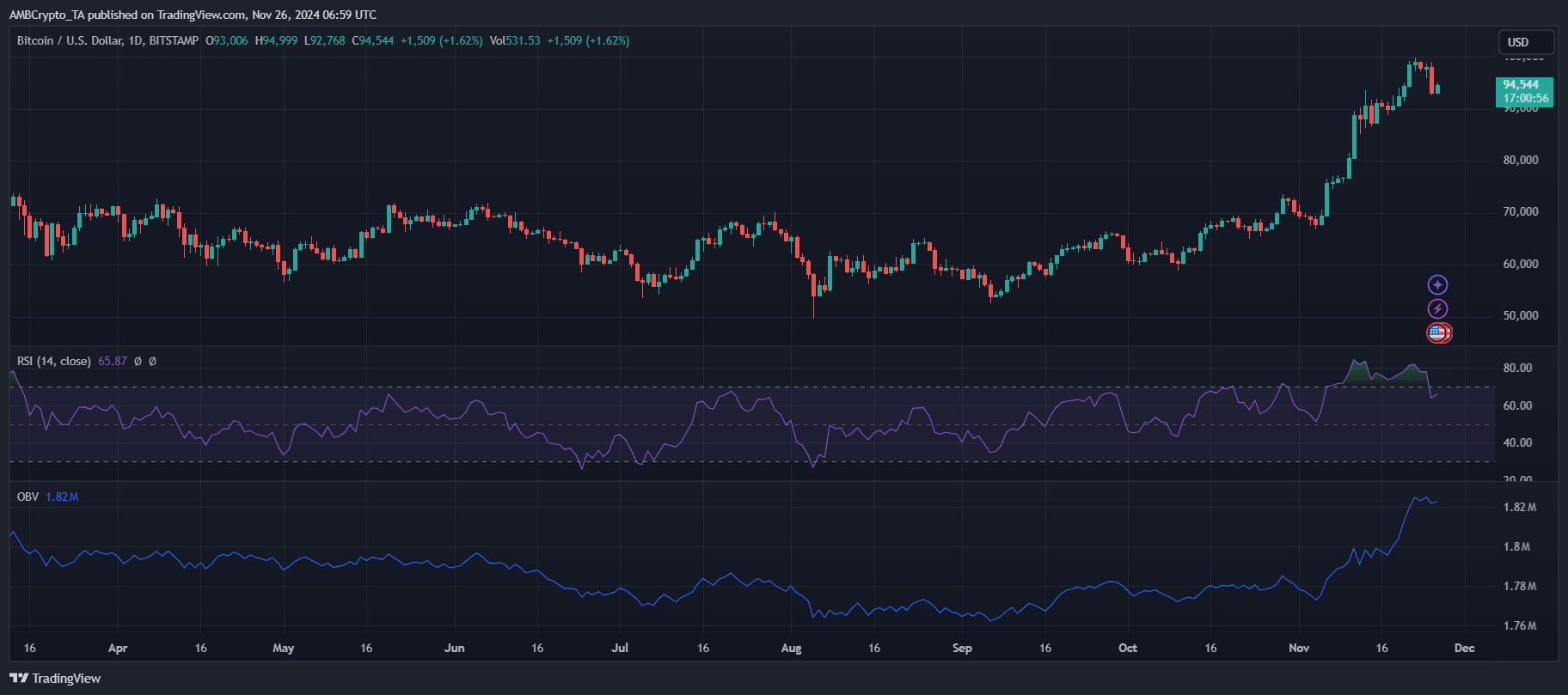

Bitcoin’s ascent towards the $100,000 milestone has dominated market conversations, with its current worth motion highlighting each bullish momentum and growing warning. The cryptocurrency briefly touched $94,999 earlier than retreating to $94,577.

The RSI at 65.91 signifies Bitcoin stays in a bullish zone, however simply shy of overbought circumstances. OBV, presently at 1.82 million, displays sturdy shopping for curiosity however hints at slowing momentum in comparison with earlier spikes.

Volatility persists as Bitcoin’s buying and selling vary narrows, suggesting a possible consolidation section earlier than one other breakout try.

Whereas the bullish pattern stays intact, a failure to keep up help above $93,000 may set off sell-offs, particularly with the elevated threat of liquidation-driven worth shifts.

Conversely, sustained shopping for stress could push BTC towards $98,000 or greater, retaining merchants on edge on this pivotal section.

The function of liquidation in market volatility

Liquidations are a key driver of Bitcoin’s current market volatility, amplifying worth actions as positions are forcibly closed. Prior to now 24 hours, greater than $337 million in lengthy positions have been liquidated, triggering sharp downward worth actions.

As Bitcoin’s worth dips under $93,000, the danger of additional sell-offs intensifies, with $772 million in brief positions at stake.

If Bitcoin rebounds towards $98,000, it may spark a cascade of liquidations, additional driving the value upward.

This liquidation cycle creates heightened volatility, making it essential for merchants to stay vigilant and monitor key worth ranges to keep away from being caught in a sudden market shift.

Robust bullish momentum for BTC

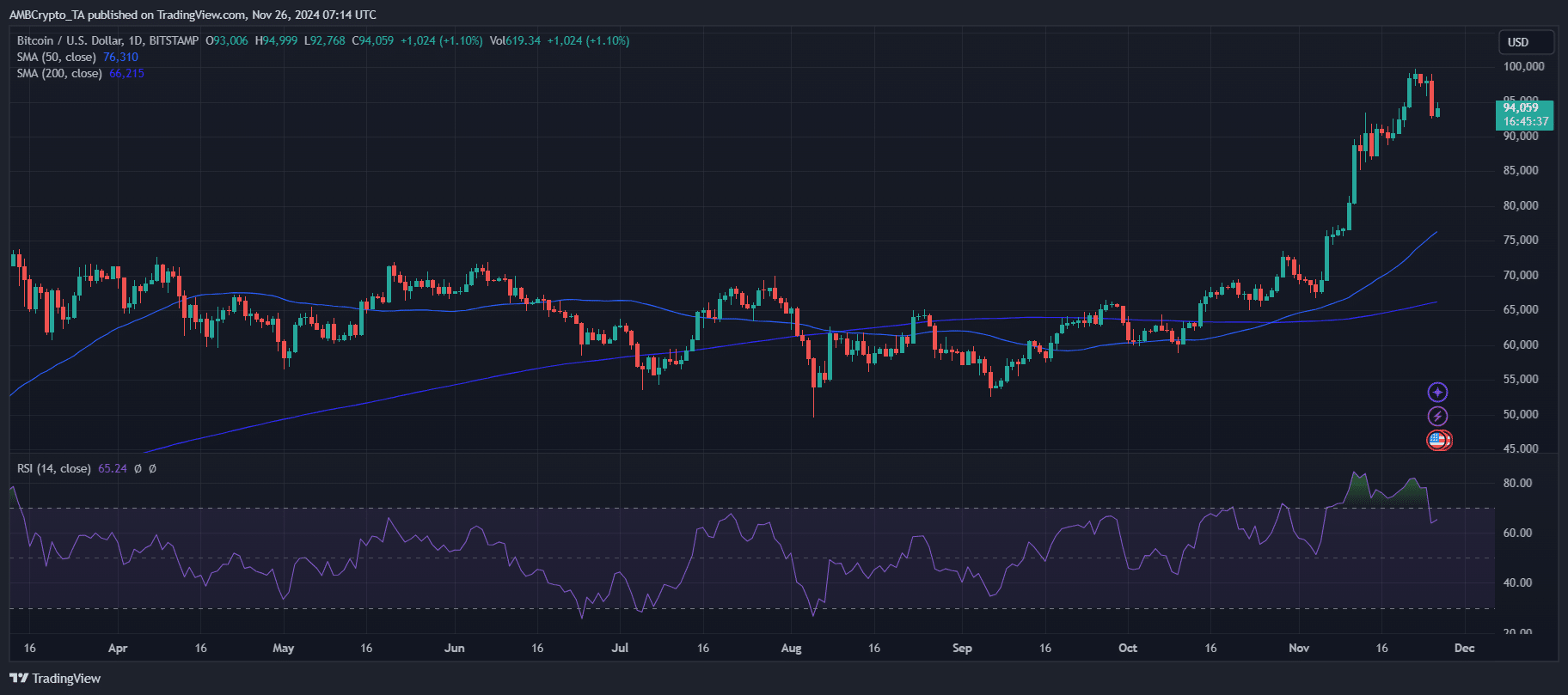

Bitcoin’s worth stays nicely above the 50-day SMA ($76,311) and 200-day SMA ($66,215), reinforcing the long-term bullish pattern. The huge hole between these transferring averages underscores sturdy upward momentum, with the 50-day SMA performing as a key help degree.

Buying and selling quantity exhibits constant exercise, however a decline from current peaks suggests a cooling section in shopping for stress. RSI at 65.29 maintains a bullish posture, aligning with present worth motion.

These indicators level to a market nonetheless primed for upward strikes, however warning is warranted as decreased quantity may restrict quick breakouts or amplify volatility on retracements.

Quick-term predictions

As Bitcoin navigates this risky section, short-term predictions hinge on key help and resistance ranges. If the cryptocurrency can preserve help above $93,000, a rebound towards $98,000 appears possible, probably triggering a liquidation cascade that might propel costs even greater.

A break under $93,000, nevertheless, could result in additional sell-offs, with $88,000 or decrease turning into the following crucial help zone.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

Merchants ought to look ahead to indicators of sustained shopping for stress or a shift in quantity, as these may sign the following route.

Whereas the long-term bullish outlook stays intact, the short-term worth motion may very well be unpredictable, and warning is suggested for these seeking to enter positions.