Bitcoin slipped beneath $90,000 this week, a degree it had not touched in seven months, in keeping with information. Merchants watched nervously because the flagship token moved round $90,700, leaving it roughly 25% beneath its latest all-time excessive of simply over $126,000 reached on Oct. 6. Markets famous {that a} massive liquidation occasion on Oct. 10 nonetheless echoes by means of buying and selling desks.

Analysts See A Close to-Time period Backside

In accordance with an interview on CNBC, BitMine chairman Tom Lee mentioned the Oct. 10 liquidations and ongoing uncertainty about whether or not the US Federal Reserve will lower charges in December have saved pressure on crypto.

He described indicators of exhaustion amongst sellers and cited technical work suggesting a backside may seem quickly.

Bitwise Asset Administration chief funding officer Matt Hougan shared an identical line of considering, calling present pricing a “generational alternative” and urging longer-term traders to take discover. He added that merchants are jittery in regards to the economic system, excessive AI valuations, and US President Donald Trump’s tariffs, which can have added to promoting.

Promoting Fueled Largely By Quick-Time period Holders

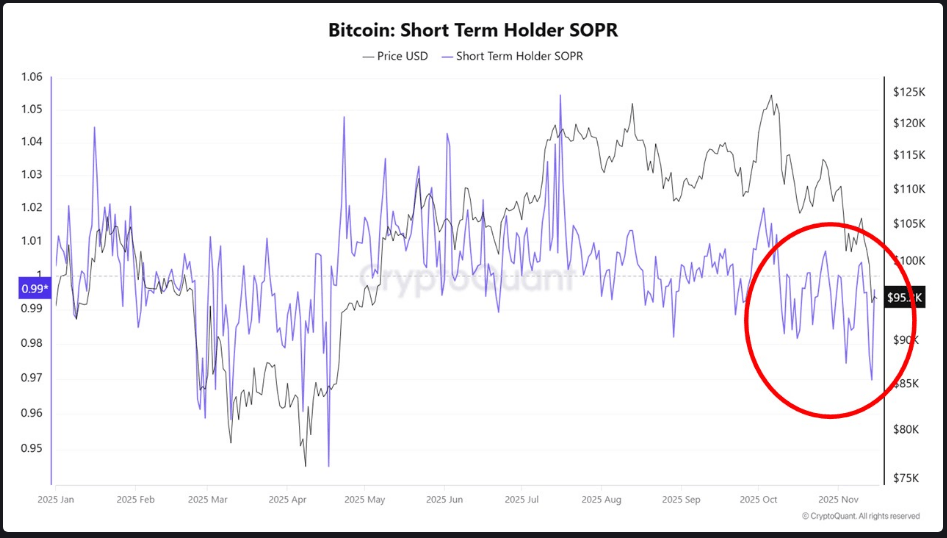

In accordance To XWIN Research, a overview of on-chain measures confirmed short-term holders did a lot of the heavy lifting within the latest decline.

The Quick-Time period Holder Spent Output Revenue Ratio fell beneath 1 on a number of events, which alerts many short-term homeowners bought at a loss. XWIN additionally mentioned cash youthful than three months made up a lot of the spent quantity in the course of the worst of the drop.

That sample factors to panic-driven exits by latest patrons moderately than mass, late-cycle distribution by longtime holders.

On the similar time, metrics equivalent to Coin Days Destroyed, Realized Revenue, and Lengthy-Time period Holder Web Place Change registered elevated distribution by long-term holders since September, however XWIN argued this habits matches routine profit-taking throughout a bull run moderately than blow-off prime promoting.

Movement From ETFs And Whales Provides Strain

Studies have disclosed that exchange-traded fund outflows and enormous gross sales by whales additionally contributed to the weak point, whereas rising geopolitical tensions added an additional layer of threat.

Market contributors described Bitcoin as an early mover that began to weaken earlier than different threat belongings, which some traders took as a warning sign for broader markets.

Outlook Hinges On Shares And Coverage

Lee expects a rebound if equities rally later this 12 months, saying a stronger inventory market would probably carry Bitcoin again to contemporary highs earlier than year-end.

Hougan agreed {that a} restoration may come shortly and that the present window affords a gorgeous entry for traders planning to carry for 12 months or extra.

But merchants stay break up; a couple of see the latest information as clear exhaustion, whereas others warn macro occasions and coverage selections may push costs decrease earlier than confidence returns.

Featured picture from Unsplash, chart from TradingView