Portugal joins growing list of countries restricting the prediction market platform amid regulatory scrutiny and insider trading concerns

Portugal’s gaming regulators are moving forward with plans to order the country’s internet service providers to block access to crypto-native prediction market platform Polymarket. The order came following reports of large trading volume in Polymarket’s Portuguese presidential election markets.

Two days before the Jan. 18 election, Portugal’s gambling regulatory body, Serviço de Regulação e Inspeção de Jogos (SRIJ), gave Polymarket 48 hours to voluntarily block access to the platform in the country. On Jan. 19, the SRIJ said it was proceeding with its ISP blocking order, according to reporting from Rádio Renascença.

The Portuguese news outlet confirmed with SRIJ officials that they became aware of Polymarket “very recently” and consider it illegal in Portugal. Portuguese law only allows for online and retail sports betting, online and brick-and-mortar casino gambling, and betting on horse races. All gaming operators must be licensed by the SRIJ.

“The site does not have any authorization to make bets available in Portugal, and in the national legal order is not allowed the exploitation of bets on events or political events, whether national or international,” SRIJ told Radio Renascença.

Polymarket was still widely accessible in the country on Jan. 20, but on Jan. 21, Portuguese business and financial news outlet ECO confirmed that telecommunications company Vodafone Portugal had blocked access to the prediction market platform in response to the SRIJ order. ECO’s report also said that Polymarket’s top competitor, Kalshi, which also had markets for the Portuguese presidential election (albeit with far less trading volume), remains accessible in the country.

Presidential trades raise ‘insider trading’ suspicions

Radio Renascença’s reporting on the Polymarket restrictions also raised suspicions of possible “insider trading,” indicating someone with early, non-public information could have tilted the odds in the Portuguese election market with especially large trades.

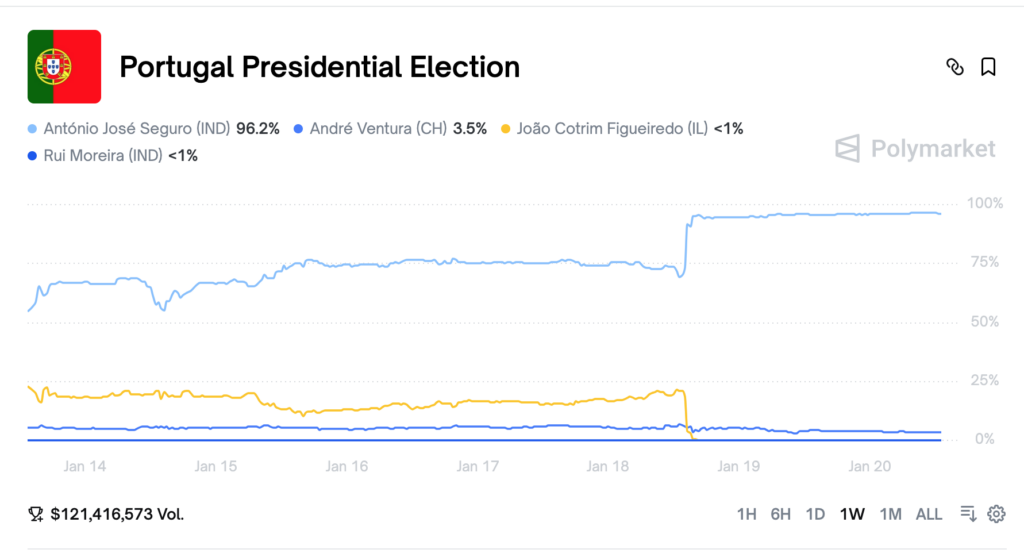

The day before the election, Polymarket traders gave Socialist Party candidate António José Seguro roughly 75% odds of winning, while João Cotrim de Figueiredo, leader of the Iniciativa Liberal party, had around a 16% chance. Hours before the results were made public, Cotrim de Figueiredo’s chances collapsed to 2.5% and Seguro’s rose to around 95% with over €4 million in last-minute trades, according to Radio Renascença.

The first-round results mean a runoff is required, as no candidate in the crowded field received the required 50% of the vote. Seguro led with 31% of the vote, while far-right candidate André Ventura (whose Polymarket odds of winning were at around 5% the day before the election) secured around 23.5%. The two will face off in another round of voting on Feb. 8 to determine the winner. Cotrim, who finished third with around 16% of the vote, will not move forward.

Polymarket’s Portugal Presidential Election market remains open, pending the results of the next voting round. The market shows that there has been more than $121 million traded, which is relatively substantial. It’s unclear how many of the trades originated in Portugal because Polymarket records wallet activity on a pseudonymous blockchain and does not publicly provide geolocation data.

Political event contracts have raised concerns in U.S.

Polymarket has faced similar accusations of suspicious trading activity before. Most recently, in early January, one anonymous account on the platform made more than $400,000 betting on Venezuelan President Nicolás Maduro’s removal hours before a U.S. military operation resulted in his capture. The trades sparked widespread scrutiny over the possibility of inside information being used.

In response to the Maduro trades, U.S. Rep. Ritchie Torres introduced the Public Integrity in Financial Prediction Markets Act of 2026, legislation aimed at preventing government officials and staff from using material non‑public information to trade on prediction markets. The bill would bar federally elected officials, political appointees, and executive branch employees from buying, selling, or trading prediction market contracts linked to government policy or political outcomes.

Notably, the Portugal election and Maduro capture trades occurred on Polymarket’s international platform, which is not accessible to U.S. traders. Polymarket’s U.S. platform, which operates under Commodity Futures Trading Commission (CFTC) oversight, soft-launched late last year and still only offers sports event contract trading.

Election prediction markets have come under fire previously in the U.S. Under the Biden‑era CFTC, regulators initially pushed back on event contracts tied to U.S. political outcomes. Kalshi sued after the agency moved to block election‑related contracts and a federal judge ruled in Kalshi’s favor in late 2024. The CFTC appealed, but in May 2025 the agency abruptly dropped the case, effectively conceding that election outcome contracts could be offered under federal oversight and ending nearly two years of legal conflict over whether the regulator had authority to prohibit them.

Polymarket has faced other international geoblocks in past year

Polymarket has repeatedly drawn regulatory scrutiny around the world, with several countries either formally ordering ISPs to block the platform or requesting that Polymarket restrict access, primarily due to alleged violations of national gambling laws or concerns over unlicensed trading activity.

Countries that have sought to restrict access to Polymarket in just the past year include:

- Belgium’s gambling regulator formally blacklisted Polymarket as an illegal gambling website after warnings over non‑compliance, which led to ISPs blocking the site in the country.

- Poland’s Ministry of Finance added Polymarket to its register of illegal gambling domains, moving to geoblock access on the basis that the platform operates unlicensed gambling activities.

- The Gambling Regulatory Authority of Singapore ordered local ISPs to block access to Polymarket, citing its operation as an unlicensed gambling platform under the national Gambling Control Act.

- Thailand’s authorities moved to restrict Polymarket as part of broader anti‑gambling and cryptocurrency regulatory enforcement.

- Romania’s National Office for Gambling blacklisted Polymarket as a prohibited operator, citing unlicensed gambling operations after a review of heavy election‑related trading volume.

- Ukraine’s National Commission for the Regulation of Electronic Communications issued a formal resolution ordering ISPs to block access to Polymarket, treating the platform as an unlicensed gambling operator under national law.

Polymarket maintains a global geoblocking list that shows jurisdictions where access is restricted due to gambling law compliance, international sanctions, or other regulatory concerns. Prior to 2025, countries like Germany, Italy, France, and the U.K. were included on Polymarket’s excluded countries list.

DeFi Rate requested comment from Polymarket on the Portuguese decision and the company’s standard policy when receiving such requests from national authorities, but we did not receive a response prior to publication.

Liquidity and access at risk as restrictions spread

Even for traders outside of restricted countries, the growing list of national blocks can have implications. Each new geoblock can reduce overall liquidity on Polymarket, making markets thinner and potentially more volatile, while also increasing uncertainty about where the platform can legally operate. For Polymarket, the expanding patchwork of restrictions complicates growth, compliance, and user acquisition, even as international interest in election and political markets continues to surge.

As prediction markets gain visibility, Polymarket’s continuing access removals in various countries underscore the tension between decentralized, global trading platforms and national regulations (particularly around politically sensitive events), raising questions about how far governments will go to protect their existing regulatory infrastructure and prevent perceived market manipulation.