The Next Chapter of Synthetix Begins Now

In 2022, Synthetix left Ethereum Mainnet, lured by the low fees and abundant blockspace of Optimism. But we quickly (slowly) learned that the layer two scaling roadmap had some harsh trade-offs for applications.

On December 17, Synthetix is coming home. We are excited to announce the official launch of Synthetix’s canonical perp DEX on the one true blockchain: Ethereum.

We’re Just Getting Started

The last few months have been electrifying.

Synthetix has successfully executed Season 1 of the Synthetix Mainnet trading competition, handing out over $1,000,000 in prizes to the top 10 traders from a roster of 100 of X’s best and most influential voices, as well as the core, historical power users of Synthetix and Kwenta.

With hundreds of traders still competing in Season 2 for a share in a $1,000,000+ prize pool, we are putting the finishing touches on our brand new, lightning-fast, gasless perp DEX. Here’s what to expect on day one.

At launch, Synthetix will be limited to a maximum of 500 users. These 500 users will consist of historical Synthetix/Kwenta power users, sUSD and 420 pool stakers, trading competition participants, and a select few Synthetix Teams depositors.

Initially, we will launch with support for three markets: Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), with up to 100X leverage. Deposits on Synthetix will be capped at $100,000 per user.

The number of users allowed, the number of markets offered, and deposit and OI limits will all rapidly increase as the exchange matures.

Note: Withdrawals will not be enabled on day one, so you won’t be able to immediately withdraw funds from the exchange. This is a precautionary measure to monitor the on-chain deposit contract. We will look to enable withdrawals within approximately one week following launch.

Synthetix Liquidity Provider (SLP), our community-owned market-making engine, will also be live on launch; however, access to SLP will be whitelisted, with plans for public access to our community market-making vault (so you can earn real yield) as soon as possible.

This is just the beginning for Synthetix, with so much more to come in 2026.

Over the coming weeks and months, we will be rolling out an incredible pipeline of new products and features: multicollateral margin, more markets every week, RWAs, deep composability with DeFi, partnerships with leading protocols on Ethereum, optimistic and trust-minimized orderbooks, and more.

Feature Highlights

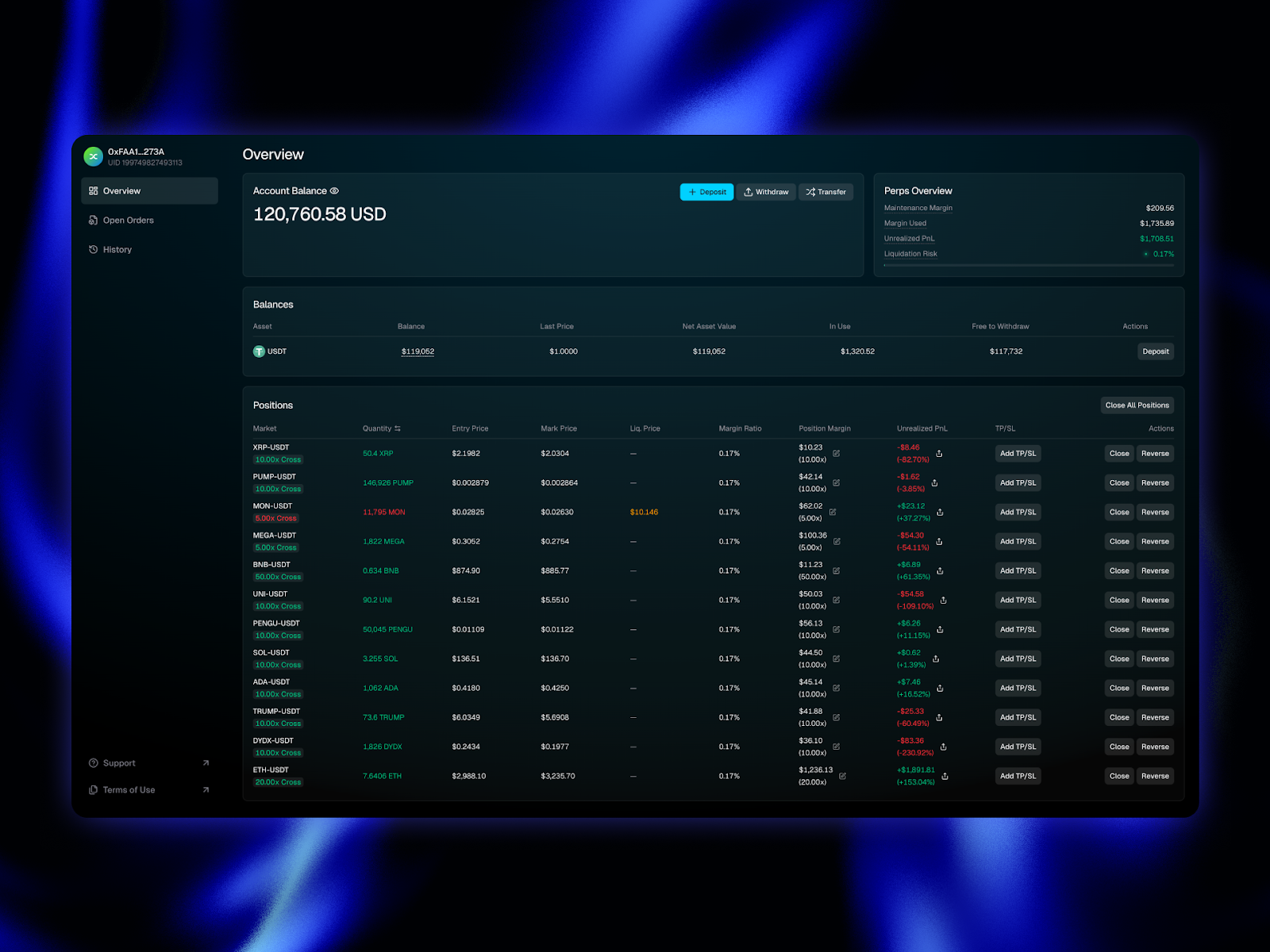

Portfolio

Synthetix Portfolio allows you to manage all your positions, view all of your balances, and active orders in one central hub. You can also view all of your open/closed orders, order/trade history, funding payments, and more.

The portfolio page is so nice that several traders who competed in Seasons 1 & 2 of our trading competition said their liquidations hurt less than usual because the UX is just that clean.

Markets Dashboard

The markets dashboard is the only dashboard you’ll need to view top-line price action and identify the markets others are trading most. You can easily see the total open interest and 24-hour trading volume at the top of the page, as well as the top assets by volume, best performance, and worst performance assets in three clean sections.

A blue fire icon will appear next to the most-traded / high volume assets to let you know what other market participants are trading.

You can also list your favorite assets, so it’s easy and intuitive to jump right to the markets you love to trade.

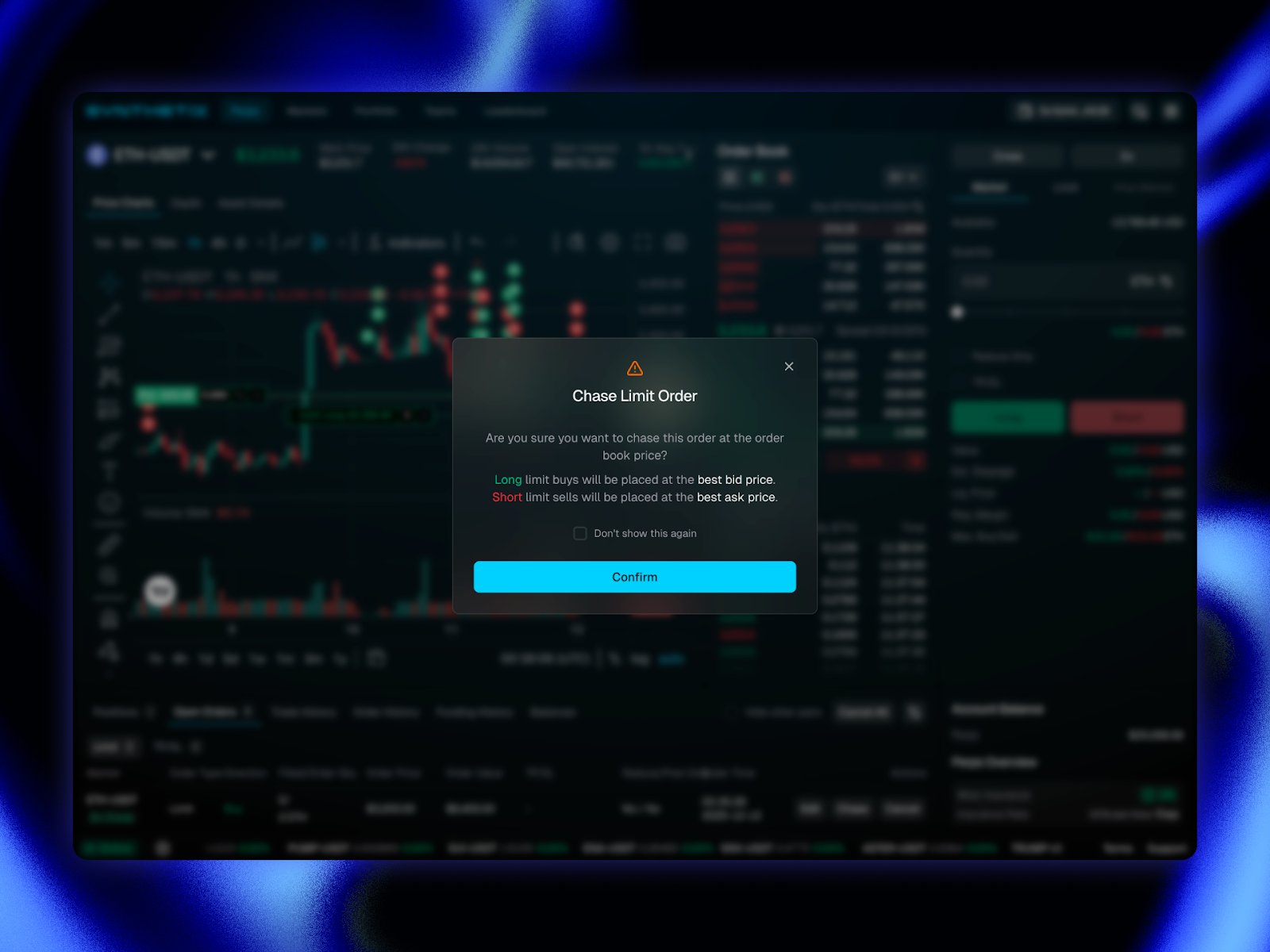

Chase Orders

Tired of seeing the book run away from your limit orders? You can now ‘chase' the book with your orders. In the order entry panel, you'll now notice a ‘chase' option on the far right. This will position your limit order at the top of the book (best bid or ask).

Front-run The Competition With Synthetix Teams

If you’d like to trade on Ethereum’s canonical perp DEX on day one (before the masses come flooding in) and unlock elite trading perks and potentially share in a staggering 500,000 SNX prize pool. Head to Synthetix Teams and deposit USDT under your favourite trader's team code.

The more USDT you deposit and the longer you hold, the larger your share. Deposits are prorated by size and duration; $1 locked for 7 days is equivalent to $7 for 1 day. If your team leader wins, the 500,000 SNX prize pool is distributed to the winning Team's members.

Note: To claim your share, you'll need to trade 10X the volume of your final deposit amount and execute over 10 trades within the first 3 months of launch.

Don’t worry, even if you don’t pick the winning trader, the first 100 depositors with over $5k will get whitelist access to Synthetix for day one of launch.

New Market Mondays

Every Monday, we’ll add new markets to the exchange (and sneak in some new features and quality of life upgrades as well).

These markets will be selected based on broad-scope trader appetite for assets, which will ensure that you’re able to trade the most popular, volatile or best-performing tokens as soon as physically possible.

Keep an eye on the official Synthetix X page and our blog to stay up to date with all upcoming updates and new releases.

Expect to see some incredible new incentives as we plug into Infinex in the very near future as well…

Revitalizing SNX and sUSD in the Synthetix Ecosystem

Over the last year, the SNX token has reclaimed its place at the heart of the Synthetix ecosystem as a source of yield, liquidity, and governance alignment. We’ve overhauled SNX staking to be intuitive: stake SNX, earn protocol fees. No PhD in DeFi required. The staking offering is simple, with no need for hedging, active debt management, or complex onboarding.

Synthetix also has the 3rd longest living stablecoin, sUSD. While Synthetix v3 experimented with external collateral, other protocols followed the Synthetix example and launched their own stablecoins. Synthetix Mainnet restores the critical function of sUSD, unlocking millions in staked SNX liquidity to supercharge the exchange.

Stakers no longer mint sUSD; that role now sits with the Treasury Market, which dynamically mints, burns, and deploys sUSD to maintain the peg and fuel trading liquidity in the orderbook. sUSD will be the deposit asset for AMMs to market-make on the exchange, generating yield from trading activity, from sharing fees, and from liquidations.

Synthetix has been a DeFi pioneer since its inception. With >50% of SNX now staked, Treasury-funded buybacks, and a Mainnet launch coming in just 5 days, SNX is poised for a renewed role in DeFi.

Follow Synthetix as we usher in perps on Ethereum Mainnet.

Join the conversation: discord.gg/synthetix

Subscribe to Telegram: t.me/+v80TVt0BJN80Y2Yx

Follow on X: x.com/synthetix