Key Takeaways

Why did Arthur Hayes make such a giant sale?

He lower danger throughout a downturn that liquidated over $620 million in positions.

Why is Hayes abruptly bullish on ZEC?

Rising liquidity stress and rising curiosity in privateness cash pushed him to purchase extra ZEC.

The market’s taken a tough flip, and Arthur Hayes is trimming his sails.

The BitMEX Co-Founder offloaded almost $5 million price of tokens in a single day, chopping down his positions throughout a number of main altcoins. His strikes got here because the market slipped to multi-month lows, including to an already uneasy week for merchants.

Arthur Hayes lets go of main altcoins

Knowledge from Lookonchain showed Arthur Hayes transferring rapidly to chop danger after the market’s downturn, routing a number of transactions via FalconX and Wintermute. His largest sale was roughly $2.48 million in Ethereum [ETH], adopted by $1.38 million in Ethena [ENA] and about $480,000 in Lido DAO [LDO].

He additionally lowered positions in Aave [AAVE], Uniswap [UNI], and ether.fi, sending a mixed few hundred thousand {dollars}’ price of tokens to OTC desks. The switch historical past exhibits a transparent unwind of publicity inside hours.

The speedy exits have brought on dialog about Hayes doubtlessly rotating into Zcash [ZEC]. The narrative is gaining traction throughout X and Reddit.

Extra lately, Lookonchain reported that Hayes has offered 1,480 ETH price $4.7 million over the previous two days. Nevertheless, his timing hasn’t been robust. The final time he offered ETH on the first of August, it was the native backside.

He ended up shopping for again at the next value simply 9 days later.

A market shaken

Hayes’ speedy sell-off occurred throughout a interval of deep market stress.

Over the previous 24 hours, 152,035 merchants were liquidated, wiping out almost $620 million in positions, in keeping with CoinMarketCap.

Bitcoin [BTC] accounted for the biggest share with $243.5 million in liquidations, adopted by Ethereum at about $170 million. The Heatmap confirmed pockets of stress throughout main altcoins as nicely, together with ZEC, Solana [SOL], and Ripple [XRP].

The largest single liquidation hit Hyperliquid’s BTC-USD pair for $30.6 million. With leveraged trades unwinding at this scale, sentiment has modified. This creates an setting the place giant holders like Hayes can transfer defensively.

Hayes backs ZEC

Constructing on that, Hayes’ newest public name might have added to ZEC’s surge.

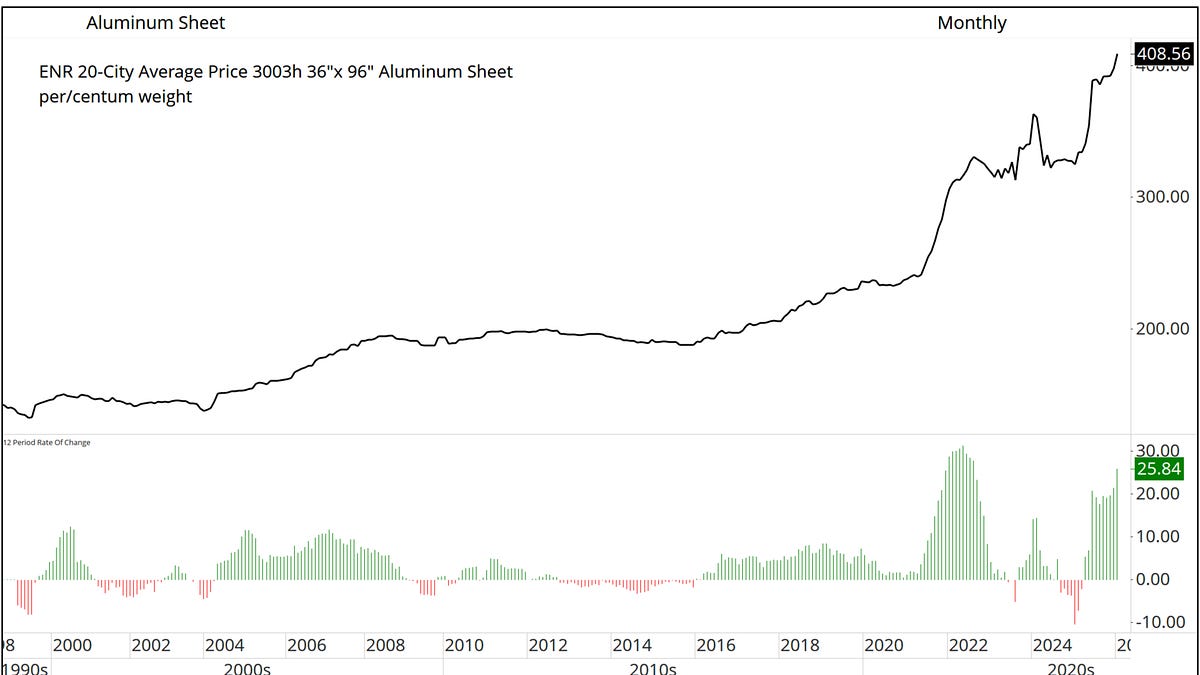

After posting a ZEC/BTC chart and saying he had “aped extra,” merchants rapidly took discover. The pair has been climbing steadily from round 0.0045 BTC and lately pushed via 0.0068 BTC.

A transparent sample of upper highs and better lows. The chart additionally confirmed stronger quantity.

With rising curiosity and tighter liquidity, Hayes’s shopping for confirmed the sentiment shift in direction of ZEC.

AMBCrypto previously reported that Hayes nonetheless sees room for the crypto market to develop.

He famous that previous Bitcoin cycles peaked in This autumn after the halving and mentioned this one might do the identical in 2025. It might even stretch into 2026 if Trump boosts spending and retains markets risk-on.